General definition

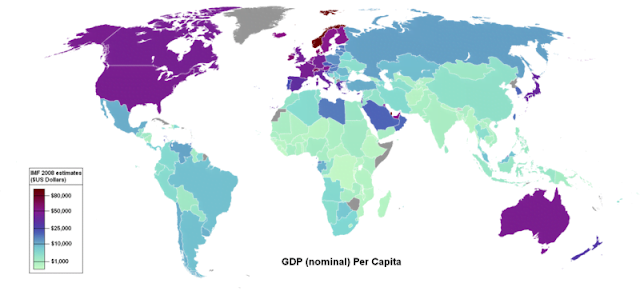

The GDP or Gross Domestic Product is a report that includes the total value of all goods and services produced within a country in a given year, which is equal to the total of consumption, investment and government spending, plus the value of exports, minus the value of imports. The GDP report is disclosed at 8:30 am EST on the last day of each quarter and reflects the previous quarter. The importance lies in seeing the GDP growth during that period. In the case of the U.S., GDP growth has historically had an average value of about 2.5-3% per year.

The GDP can be calculated by three methods:

- Expenditure method.

- Method of distribution or income.

- Method of supply or added value.

Relevance of the Gross Domestic Product

Effects of the Gross Domestic Product in the market

The GDP data has a great impact on the markets. Its value is taken into account by investors as it indicates whether an economy is growing, stagnant, or in recession. Sometimes, a figure that indicates a turning point, as a growth figure after several consecutive quarters of recession, which most likely indicates the beginning of the expansion trend may lead to strong market movements. As immediate consequences of this situation increases would occur in the securities markets, as investors will have positive economic expectations.

When the GDP is rising, investors can anticipate that the stock market will go up due to higher corporate profits. The revaluation of the equity markets and economic growth that shows this indicator implies a stronger currency. Consequently, many investors will be attracted to invest in a growing economy, so the expectations of the economy will improve, there will be more confidence, which at the same time will create new businesses, new jobs, etc.. Given this climate of economic prosperity, global investors have to buy the domestic currency to purchase shares of the stock market of the country or to invest in companies directly, which will cause the appreciation of the national currency.

Also, when this indicator rises, the counterpart is a declining bond market for fear of an increased inflation due to a probably economic overheating which may happen sooner or later. It is normal for an economy where activity grows and creates jobs, that wages tend to rise, and therefore the price of goods and services do the same. Thus it is easy to assume that economic growth will drive an increase in interest rates to curb rising inflation, and as a result, a depreciation of bond prices.