What is Forex Dominion?

Do you want to have the best information about the Forex market and trading? Then you are in the right place.

At present, millions of people around the world invest in financial markets and this amount is growing day by day thanks to the many opportunities offered by these markets

Forex, stocks, indexes, commodities, ETFs, and other markets are the places where large and small traders earn and lose large fortunes on a daily basis.

However, trading is not easy. Trading in markets like Forex requires a lot of knowledge, experience, and proper psychology.

In Forexdominion we include abundant educational material about the market, including tutorials about the Forex market, technical analysis, fundamental analysis, trading psychology, and trading strategies.

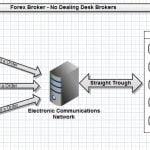

In the world, there are hundreds of stock, futures, Forex, and CFD brokers. Here we show the best brokers in the Forex and CFD sectors, grouped into lists where we classify them according to their main characteristics. For example, we show the best ECN, STP, Market Makers, and DMA Forex brokers.

Recommended brokers

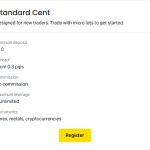

| Best Broker For Novice Traders

| Recommended ECN Broker

|

|---|---|

Best Multi-asset Broker

| Recommended ECN/STP Broker for Beginners

|

Recent articles of Forex Dominion

- What is an STP Broker? – (Straight Through Processing)In this article, we explain what an STP broker is, its characteristics, advantages and disadvantages, and how they work. STP brokers send orders directly to liquidity providers, offering transparency and avoiding conflicts of interest. Straight … Read more

- HF Markets Profit Leaders Trading Contest: Everything You Need to KnowThe Profit Leaders contest by HF Markets (HFM) is a competitive trading event designed for traders who want to test their skills in real market conditions while competing for cash prizes. In this article, we’ll … Read more

- Order Block Trading – Definition and FeaturesThe world of trading is full of tools and strategies that seek to offer the trader an advantage. One of the most advanced and lesser-known techniques is trading based on Order Blocks. This approach, often … Read more

- How to invest in palladiumWhen it comes to investing, we should think about diversifying our portfolio. For example, investing in palladium, one of the precious metals that is attracting the most attention, is one way to do so. Surprisingly, … Read more

- Markets4you “Profit Masters 2025 – Trading ContestThe brokerage firm Markets4you has officially launched its trading competition Profit Masters 2025, inviting traders from multiple regions to compete for prestige and cash prizes. The contest aims to reward both skill and discipline, offering … Read more

- Investment in cyclical companiesIf you’re interested in investing in the stock market, it’s essential that you understand the concept of cyclical stocks. These stocks are not simply financial assets; they are a fundamental part of your investment strategy. … Read more

- Exness Affiliate Program – Partners Program ReviewThe ECN Forex broker Exness currently has an affiliate program created with the objective of promoting its services and acquiring new clients who open an account and deposit funds through affiliates, who have at their … Read more

- Protect your savings with Gold ETFsDo you want to know why you should consider different ways to protect your money — such as gold ETFs or other precious metal ETFs? In this article, we give you the answer. Today we’re … Read more

Forex Education

Forex Guide

- Order Block Trading – Definition and Features

The world of trading is full of tools and strategies that seek to offer the trader an advantage. One of the most advanced and lesser-known techniques is trading based on Order Blocks. This approach, often used by institutional traders, focuses on identifying key areas where large transaction volumes influence market … Read more

The world of trading is full of tools and strategies that seek to offer the trader an advantage. One of the most advanced and lesser-known techniques is trading based on Order Blocks. This approach, often used by institutional traders, focuses on identifying key areas where large transaction volumes influence market … Read more - How to invest in palladium

When it comes to investing, we should think about diversifying our portfolio. For example, investing in palladium, one of the precious metals that is attracting the most attention, is one way to do so. Surprisingly, we look at the performance of stocks from companies like Amazon or Tesla and rarely … Read more

When it comes to investing, we should think about diversifying our portfolio. For example, investing in palladium, one of the precious metals that is attracting the most attention, is one way to do so. Surprisingly, we look at the performance of stocks from companies like Amazon or Tesla and rarely … Read more - Protect your savings with Gold ETFs

Do you want to know why you should consider different ways to protect your money — such as gold ETFs or other precious metal ETFs? In this article, we give you the answer. Today we’re going to talk about something that directly affects your wallet. Because let’s be honest — … Read more

Do you want to know why you should consider different ways to protect your money — such as gold ETFs or other precious metal ETFs? In this article, we give you the answer. Today we’re going to talk about something that directly affects your wallet. Because let’s be honest — … Read more - How to Start Investing in Platinum? – Step-by-Step Guide

Platinum, although less famous than gold and silver, is a highly valuable precious metal with great potential in the investment world. Its rarity and unique properties make it an attractive option for those investors interested in diversifying their portfolios. Here we will provide you with a comprehensive guide to investing … Read more

Platinum, although less famous than gold and silver, is a highly valuable precious metal with great potential in the investment world. Its rarity and unique properties make it an attractive option for those investors interested in diversifying their portfolios. Here we will provide you with a comprehensive guide to investing … Read more - Why invest in gold? Discover the advantages of this metal

Here we are going to see the main reasons why millions of people have wanted to buy this valuable metal throughout history. And why today it continues to be a very good option to consider. If we look at history, the monetary value of this precious metal has been recognized … Read more

Here we are going to see the main reasons why millions of people have wanted to buy this valuable metal throughout history. And why today it continues to be a very good option to consider. If we look at history, the monetary value of this precious metal has been recognized … Read more - How to Invest in Gold? Complete Guide 2025

Gold is one of the most coveted precious metals in the world since the origins of civilization. Moreover, today, its search and extraction forms part of a very important industry. Whether due to its scarcity, its use in jewelry, being considered a safe haven asset, or having been part of … Read more

Gold is one of the most coveted precious metals in the world since the origins of civilization. Moreover, today, its search and extraction forms part of a very important industry. Whether due to its scarcity, its use in jewelry, being considered a safe haven asset, or having been part of … Read more

Technical Analysis

- Center of Gravity Indicator (COG) of John Ehlers

Technical analysis offers traders numerous tools to decode market movements, and among the lesser-known but highly effective indicators is the Center of Gravity (COG). This unique oscillator, developed by renowned engineer and trader John Ehlers, brings a fresh perspective to momentum analysis by applying principles from physics to financial markets. … Read more

Technical analysis offers traders numerous tools to decode market movements, and among the lesser-known but highly effective indicators is the Center of Gravity (COG). This unique oscillator, developed by renowned engineer and trader John Ehlers, brings a fresh perspective to momentum analysis by applying principles from physics to financial markets. … Read more - Long Black Candlestick Pattern

The Big Black Candlestick is a confirmation pattern for downtrends and is noted for having a high reliability. Itis characterized by open near the maximum and close near the minimum, with a much larger real body than other Black Candlesticks that usually occur in the price charts. Because of this, to identify … Read more

The Big Black Candlestick is a confirmation pattern for downtrends and is noted for having a high reliability. Itis characterized by open near the maximum and close near the minimum, with a much larger real body than other Black Candlesticks that usually occur in the price charts. Because of this, to identify … Read more - Woodie’s Pivot Points – Definition and Formulas

Pivot points are a valuable tool for traders as they allow the calculation of support and resistance levels that can be used as a reference point to develop an entire methodology or approach to trading in the market. Another popular method for calculating pivot points is Woodie’s Pivot Points, which … Read more

Pivot points are a valuable tool for traders as they allow the calculation of support and resistance levels that can be used as a reference point to develop an entire methodology or approach to trading in the market. Another popular method for calculating pivot points is Woodie’s Pivot Points, which … Read more - Long White Candlestick Pattern

The Long White Candle candlestick pattern appears opening near the minimum and closing very near the maximum of the market session. Its figure is much larger than those produced by the normal White Candles that are formed in price charts. Therefore to differentiate the two candles the trader should analyze … Read more

The Long White Candle candlestick pattern appears opening near the minimum and closing very near the maximum of the market session. Its figure is much larger than those produced by the normal White Candles that are formed in price charts. Therefore to differentiate the two candles the trader should analyze … Read more - Oscillator of a Moving Average (OsMA) – Main Features

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more - Klinger oscillator in trading: how to take advantage of this indicator?

The Klinger oscillator in trading is one of many technical indicators used to find buying and selling opportunities in financial markets. The Klinger oscillator is unique in that it takes into account both price and volume data in its calculation. The theory behind the indicator is that strong price movements … Read more

The Klinger oscillator in trading is one of many technical indicators used to find buying and selling opportunities in financial markets. The Klinger oscillator is unique in that it takes into account both price and volume data in its calculation. The theory behind the indicator is that strong price movements … Read more