Candlestick Charts – Offering Best Information about Forex Trading!

- In this case, this sort of chart is the combination of bar-chart and line chart and each is representing the range of price changes, so it offers the best of both types of charts. For this reason it is commonly used by technical analysts to identify price patterns in the charts.

- A major advantage of the candlestick charts is that they are easy to read and interpret. So, these charts can be very useful for beginners traders in any financial market, including Forex. In this case, the trader can get more information about the price change, maximum and minimum prices reached, major and minor trend changes and other important data.

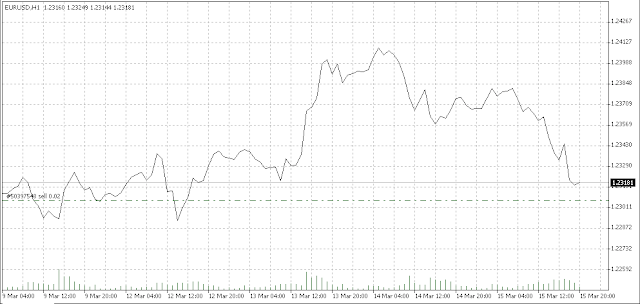

Each candlestick in the chart shows the following information: opening price, closing price, high price and low price over the predetermined period. The time span of each candle can also be adjusted to show any period of time that the trader wants. For example, it can show the longer time periods (long term trends) like weeks, months, and years as well shorter time periods (short term trends), like 4 hours, 1 hour, 30 minutes or even 1 minute.

Traditionally, if the candle is filled or colored, this means that the asset price closed at a lower price that opened. By contrast, if the candle has no color or is filled with a light color (green for example), this means that the asset price closed at a higher price that opened. See the following graphic example:

- Easy interpretation

- The candIestick charts are ideal for beginners to start their chart analysis.

- They are very easy to use.

- A candlestick chart is an excellent tool to identify key points where the financial asset´s price can change its trend.

How to read a Japanese candlestick chart?

- See the color of the body: The color of the candle body in any period of time, indicates whether the price has risen (High) or down (Low). In other words, if the difference between the opening and closing is positive or negative. Most online trading platforms allow to configure the colors of the bodies of the candles. However, the most popular colors are white/green for bullish candles and black/red for bearish candles, so most traders use these colors. Therefore, if a 5-minute chart, a candle is green, it means that in this period the closing price is higher than the opening, hence the price has risen.

- Review the length of the candle: The length of the candle tells us how much difference there was between the closing price and opening. If the difference was very strong, that tells us that the market in that period was bullish (if the candle is green) or bearish (if the candle is red). This helps us determine whether the market is moved or is quiet. If opening a graphic look great candles is a good time to trade. If instead they are all small-bodied candles, means the market is stagnant and we should think twice before trading. Recall that the gain of the Trader is in the market movement.

- Study the tails of the candlestick: Always consider the tails that occur in the candlestick, both above and below the body. The tails represent the most extreme prices of the period. The top line represents the highest price reached during that period, while the tail at the bottom represents the lowest price that was reached during the same period.

Thus, how can be used the candlestick charts for improving the trading performance?

Trading with candlestick patterns

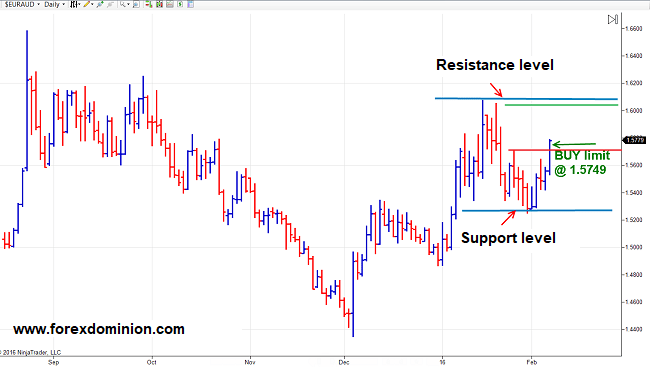

The candlestick patterns can provide the trader invaluable information on the price action with a simple glance. While common candlestick formations can provide important data about what is “thinking” the market, they can sometimes generate false signals precisely because they are frequent. Therefore, it is also important to know the more advanced patterns which have a high degree of reliability and their use in combination with other market analysis tools.

As with any other resource of technical analysis, the candlestick patterns should be used with other analysis tools to confirm their signals. In the following link we offer more information about the candlestick patterns and the most used and reliable patterns:

-Japanese candlestick patterns