ECN brokers are an intermediary class that is gaining a lot of popularity in Forex. Therefore, it is not surprising that new brokers of this type appear regularly.

What is an ECN broker?

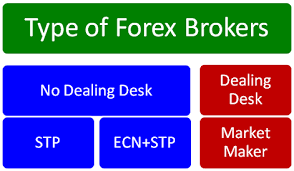

“ECN” means “electronic communication network” for its acronym in English. Sometimes, brokers of this type are also known as STP (direct processing) or NDD (non dealing desk brokers). All these terms basically mean the same thing: client transactions are matched with third-party orders that want to be part of the trade. In contrast, non-ECN brokers (with trading desk or market makers) look for a counterpart among their clients or act as counterparts in their clients’ transactions, which can create an obvious conflict of interest.

ECN brokers usually charge lower spreads than market makers, although they compensate this (at least in part) through commissions on the opening and closing of transactions. These commissions are a fixed percentage of the total trading volume, for example, $10 USD for each standard lot. Even so, the combination of spreads and commissions is generally a bit lower than the spreads of non-ECN brokers.

The union of transparency and low transaction costs make ECN brokers a good option for all types of traders. However, there are other factors that you should consider before choosing one of these brokers or an ECN account (some companies offer ECN and non-ECN accounts):

- Account size – ECN brokers generally have higher deposit requirements. In addition, some impose a minimum volume for each transaction of 1 mini lot, instead of 1 micro lot (one-tenth of a mini lot) which is the standard of the Forex industry.

- Execution – ECN brokers offer excellent execution speed and non-existent or negative spreads in some periods. Keep in mind that, during periods of very low liquidity, execution can be seriously affected because there are no counterparties to complete the trades. This phenomenon can cause very serious slippage events or prevent the trader from getting out of a bad trade; things that would not happen in a market maker broker. Such events usually occur during the publication of important market news, especially when the results differ from market expectations.

- Spreads – In fact, the spreads are the most attractive feature of ECN brokers, even when commissions are taken into account. However, spreads can vary considerably and even become higher than those of market makers brokers. As you can expect, spreads fluctuate because they are based on the law of supply and demand. Only market makers brokers can offer fixed spreads (although they are rarely the best option).

- Instrument catalog – Before offering quotes and transactions with an instrument, ECN brokers should ensure that they are connected to their liquidity providers. This does not happen with dealing desk brokers, so they can offer a broader portfolio of assets, especially stocks, commodities and various types of indexes. In addition, ECN brokers usually have higher volume requirements for transactions with instruments other than Forex. That means that, if you want to diversify your portfolio, it is a good idea to consider a market maker broker as a complement or replacement for an ECN broker.

- Maximum trading volume – ECN brokers allow their clients to carry out transactions with a much higher volume (at least in theory) since they do not have to worry about trading desks. For example, some brokers with a dealing desk set a maximum volume of 5 lots per transaction, which is not the case with ECN brokers.

- Minimum trading volume – ECN brokers generally require that the minimum trading volume for their customers’ transactions be 1 mini lot (0.1 of a standard lot), in contrast to 1 micro lot (0.01 of a standard lot) required by the dealing desk brokers (there are brokers with a minimum trading volume of 0.001 lots). Most ECN brokers do not allow micro lot transactions, although a few do. Keep this in mind if you are an investor who prefers to trade with micro lots.

What are the “True” ECN Forex Brokers?

We have seen the reasons that have popularized ECN Forex brokers in recent years. We have also noticed that more and more brokers announce that they are “ECN” or have ECN accounts. However, there is a lot of controversy around the subject, since many of these companies are not really ECN brokers. So how can you identify a “true” ECN broker?

A true ECN broker is simply a company that connects your transactions to a network, where those trades automatically match the orders of another trader or liquidity provider.

That is the textual definition. In this context, most brokers who claim to be ECN are probably telling the truth.

But if you see high or rarely changing spreads, and constantly slow execution, it is almost certainly not an ECN broker.

However, the real problem arises when trying to define the term “liquidity provider“. How can a broker be an ECN and have a dealing desk at the same time? The network is as good as its source. For a broker to be really ECN, the liquidity provider must be a first-level bank. However, we must ask ourselves if this is always the case, and why so many brokers who claim to be ECN refuse to publish their liquidity providers.

When the first ECN brokers began to appear, bank operators wondered how transactions of a few mini lots could have direct processing through first-tier banks, since at least 10 whole lots would normally be needed. This suggests that any broker with volume requirements of less than 10 lots is only “collecting” trades that will eventually require some kind of trading desk to process them.

But, the question is, does it matter?

If the broker at least tries to match orders directly and without interfering, there is not much conflict of interest. Also, if you can reduce your costs and execute your trades more quickly, why not accept it? Just don’t forget what is really behind the scenes.

How to Choose the Best ECN Forex Broker?

Choosing an ECN broker is not much different from selecting any other kind of broker. There are not many factors that are exclusive to this class of intermediaries.

To start, you must take into account the capital you want to invest, the instruments with which you want to trade, your trading schedule and your geographic location. With these 4 factors, you will discard a large number of companies. The good news is that brokers that do not meet the minimum standards in certain areas are generally not accepted anywhere, so they are easier to discard.

Broker Location

Starting with your location, you may feel more comfortable with a broker from your own country (or a nearby country), or from a nation with a language and legal system similar to yours. If you are a resident of the United States, there are certain special factors to consider. The United States is a country that greatly restricts Forex operations, which means that your options are limited to foreign companies (although that facilitates the entire process).

If you live in the United Kingdom, it is recommended that you select a broker based in that country that offers financial spread bets. That way, you won’t have to pay income taxes. Perhaps this is the easiest criterion to start, as you can significantly reduce your list of candidates in a single movement.

The next point to consider is the regulation and security of your money. If you are going to deposit a small amount, you may not mind. However, if you plan to invest large amounts of capital, it is a crucial factor. Some countries have well-established financial regulations that combat the presence of scammers.

Deposit Protection

Another important point is the protection of your money. At the time of this writing, the United Kingdom Government protects the deposits of all regulated broker customers up to a maximum of GBP 75,000. That means that if you deposit that amount or less in a regulated ECN broker in the UK, and the broker steals your money or goes bankrupt, the government will return the value of the deposit. Needless to say, it is a great advantage that provides a lot of peace of mind. If you are going to invest a large amount of money, you should seriously consider the financial protection of the government. That means you should opt for famous financial centers, and doubt small islands that you don’t even know!

Trading costs

The third factor is the cost of trading which is very important in ECN and no ECN brokers. If you are going to deposit a considerable amount, there is no reason for you to pay more than 1 pip in the EUR/USD pair, taking into account spreads and commissions. You can open demo accounts in all the brokers you consider to know their real spreads. However, keep in mind that some companies offer different conditions in their demo accounts, including significantly lower spreads than real accounts. Luckily, there are some websites that compare live spreads of several brokers live, so it’s a good idea to visit them.

Trading Style

Another factor to consider when choosing a broker is your trading style, that is, the number of trades you perform per day. Are you a scalper or an intraday trader? Do you prefer swing trading? Are you a positional trader? If you are one of those who open a few positions that remain open for several days, and even weeks or months, consider the rollover costs that are generated every day at 5 p.m. New York time. If that is your case, the rollover is more important than spreads to determine the difference between profits and losses (at least to some extent).

On the other hand, if you are going to open many positions that remain open for a few minutes or hours, you should pay more attention to the spread than to the rollover. That means that the same Forex broker maybe your best option if you are an intraday trader, while at the same time being a bad decision if you are a positional trader.

For traders with scalping strategies, ECN brokers are the best option since their spreads are lower and rather they want their clients to perform as many trades as possible.

Market makers brokers put more limitations on trading strategies. Some do not allow scalping.

Broker Trading Platform

The next thing you should consider is the broker’s trading platform. Does it work properly or freeze? Is it easy to use, intuitive and friendly? Does the execution suggest in any way that the broker is ECN, or at least something similar?

For the Forex market, the best ECN trading platform for retail traders is cTrader. Therefore, if you are looking for a real ECN broker, it is best to select a broker that offers this application.

Good reputation

The fact that so many STP brokers claim to be ECN brokers makes it even more important for the latter to enjoy a good reputation. A broker must have an excellent reputation among its clients and must have positive reports on the online customer forums. The ideal choice would be a well-established Forex broker with years of experience in the market that enjoys positive customer reviews. However, there may also be new Forex brokers willing to offer you good quality accounts, capable of adapting to modern requirements and earning a good reputation with new generations of traders.

Innovative and original trading services

It is best to select an ECN broker that offers original features and services and that highlights them from others. For example, there are brokers that offer some interesting features and resources for the trader, such as educational trading resources, real-time market news, market analysis, or trading signals, which substantially improve the customer experience. For example, some ECN brokers also offer trading tools such as VPS hosting, which allows the execution of trading robots 24/5 and improves the execution of trades.

To know which are the best ECN brokers we recommend you to visit our following comparative table and the analysis of each broker:

| Broker | Regulation | Minimum deposit | Broker Review |

|---|---|---|---|

| CySEC and FSCA | $5 | Review | |

| Axi | ASIC and FCA | $100 | Review |

| ThinkMarkets | ASIC and FCA | $200 | Review |

| FPMarkets | ASIC | $200 | Review |

| Valutrades | FCA | $100 |