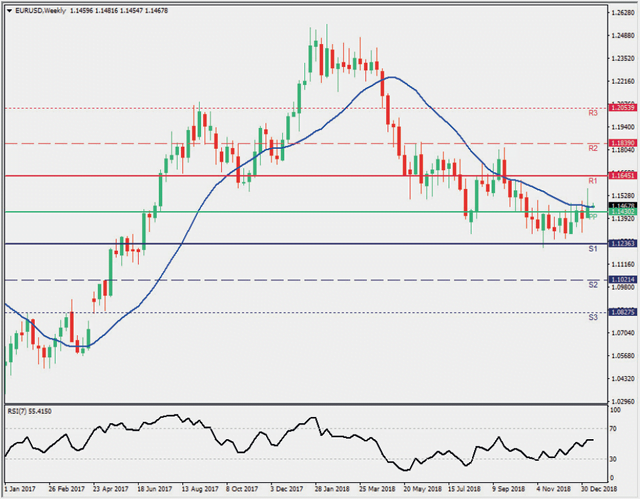

The Euro dropped from its top of 1.25 to 1.12 lows against the Dollar over 2018, and has been

trading at 1.14 in the early days of 2019. The drop in the Euro is directly associated with the

interest rate hikes by the Fed as the Euro Area interest rate has remained stable. Furthermore,

the exchange rate also reacted strongly on news regarding Brexit, with March 2019 fast

approaching and no deal reached yet.

On the macro side, the Euro Area has been quietly registering decent growth rates, estimated at around 2%, on a y/y basis. Inflation has been fluctuatingiii around the ECB target level of 2%. In 2019, growth is forecastediv to stand at 1.7%, down from the previous forecast of 1.8%, with a similar path for inflation. An increase in bond yields is expected, attributed to both the end of QE in December 2018 and the discounting of the effect of a possible ECB rate hike in late 2019. The hike, as communicatedv by the ECB in the last few meetings, is expected to take place in the third quarter of 2019.

The end of QE is expected to raise bond yields and provide a backstop for stock markets, even though it should not have any broader effects in the overall economy, given that interest rates will remain at mostly the same levels until the rate hike.

Risks remain at the aggregate, with Brexit posing the greatest threat and opportunity for the European economy, as the disruptions from the divorce can be easily reversed via the inflow of business activities in the mainland. The Italian economy still poses the greatest concern in the region, albeit the agreement to reduce the budget deficit to 2.04% shows positive momentum.

The US-China trade war could have a positive impact on the European economy as domestic products could become more price competitive. Still, a slowdown in the Chinese economy will hurt European businesses, given the lack of available alternative growth markets the world.

Outlook for the Euro and EURUSD

– Technically Neutral

– Pivot Point – 1.1430

– Support – 1.1235, 1.1020 and 1.0825

– Resistance – 1.1645, 1.1840 and 1.2100

Euro and EURUSD Review

– Political Risk – Parliamentary elections in Greece and Portugal could potentially harm economic growth in the countries if the incumbents do not continue for another term. EU Parliament elections in May could perhaps give way to the rise of EU-sceptic parties.

– Brexit – The departure is scheduled to take place on March 29 2019, after which the cliff-edge scenario will take place.

– Possibility of a rate hike in the third quarter of the year, while the question as to who will replace Mario Draghi as head of the ECB remains.

Source: