What is a Master candle?

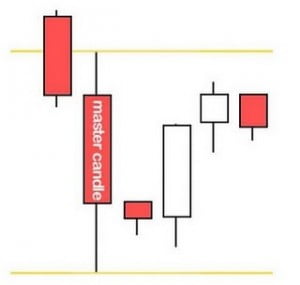

First at all we are going to describe what is a master candle. Basically these are candle with big bodies and wicks (the sticks over and under the bodie of the candle) marking a new high or a new low and whose extension or range covers out the following 4 or more candles. To better understand the concept of master candles we can observe the following image:

Usually if we observe the formation of a master candle we can determine a range between the maximum and minimum of that candle which will be stronger the more candles are within the range. It is therefore expected that in the event of rupture the prince will make a fairly strong movement in the direction in which the breakout occurs. For this reason it is recommended to apply this trading strategy in instruments and assets that are sufficiently volatile in order to capture a strong movement. For example, the creator of this strategy recommended to use this systems with currency pairs such as GBP/JPY and with 1H charts.

Introduction

This is basically a breakout trading technique. The trader must identify a master candle in the price chart and wait until the breakout occurs in one direction or another. When the breakout is confirmed, the trader can open a position in the direction on the movement, taking care of whether it is a false breakout and the price returns to the range of the master candle.

Trading instruments

This trading system can be used with every instrument or asset, but it is recommended for volatile instruments with strong movements. In the case of Forex market it can be used with volatile currency pairs such as GBP/JPY.

Indicators

This trading technique can be applied with almost every time frame but the creator recommend its use with the following chart configuration:

- 1 candlestick chart of 1 hour for volatile currency pairs like GBP/JPY.

Trading system rules

- Identify a master candle with at least 4 candles inside its range.

- Draw a line in the high and the low of the master candle (including the wicks) to stablish a range.

- Wait until there is a breakout in the range of the master candle and open a position in the direction of that rupture.

- Stop loss: The creator of this strategy sets a stop loss of 50 pips, however that can be adjusted depending on the market conditions and the instrument.

- Take profit: In this case the author recommends a take profit of 50 pips. But as in the case of the stop loss that can be adjusted depending on the instrument and the market conditions.

- The levels of the stop loss and take profit can be adjusted according of the number of accumulated candles inside the range. For example if there are 7 accumulated candles, the take profit and the stop loss can be set at 60 pips. If the number of accumutad candle is 10 or more, we can increase the stop loss and take profit up to 70 pips.

Strength of the signal generated by the master candle:

We can use the following criteria to determine the strength of the signal generated by the master candle:

- The master candle was formed near an important psychological level (for example .00, .25, .75, etc.).

- The longer the price has been within the range. At this point the author of this strategy suggests a filter of 24-hour, period after which if no break has occurred it is best to discard the pattern.

- The more times the price has bounced on the extremes of the range. For example, the more times the price has touched the maximum of the range and has been returned, when the upward breakout occurs, there are more probabilities that will be a strong movement in the direction of the breakout.

- Finally, if the maximum or minimum of the master candle touches a new minimum or maximum on a daily, weekly, monthly, yearly or even historic level (an important support and resistance), it is almost certainly that the breakout of the range of the Master candle will be an excellent signal to enter in the market.

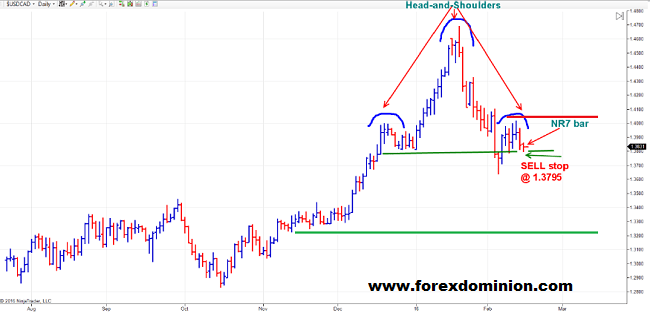

Example

The following chart is a perfect example of this trading technique used to trade in the GBP/JPY currency pair:

If you want to learn more about this trading technique you can download a free ebook that explain it deeper: