What is the perfect order?

The perfect order of moving averages is defined as a set of simple or exponential moving averages that are aligned consecutively depending on the trend. For example, in the case of a bullish trend, a perfect order would be that a moving average of 10 periods were in a higher price level to a moving average of 20 periods which in turn would be higher than a moving average of 50 periods and so on. In other words, in an upward trend, moving averages are aligned from major to minor period upwards.

In the case of a downtrend, the opposite is true, ie that moving averages are lined up from smallest to largest period. For example, above the 10 period moving average would be the moving average of 20 periods which in turn would be below the moving average of 50 periods and so on. This alignment of moving averages is the basis of the perfect order trading strategy that we will describe below:

Example of a perfect order in an uptrend:

When a set of moving averages are aligned in a row, this is a clear indication that the market is under trending conditions. This not only indicates that price momentum is on the side of the trend, but also that moving averages act as multiple levels of support or resistance depending on the direction of the trend. In order to optimize this strategy, you can use the ADX indicator, in which case the trader should expect to have a value greater than 20, as this is an indication that the trend is gaining strength.

With the perfect order trading strategy, levels for opening and closing positions are difficult to determine, however, the trader should strive to maintain the position open as the perfect order is preserved and proceed to close once the order can not be sustained more.

Note that this phenomenon does not occur often and the basis of this methodology is to take advantage of this condition when first appears. Basically the strategy try to generate profit in trending markets near the beginning or a bullish/bearish trend.

Rules of the strategy

The rules to open buy/sales posiciones in the perfect order trading strategy are the following:

Buy position

- Look for a currency pair that is in an uptrend and with moving averages in a bullish perfect order. The trader can use a combination of simple moving averages with the following periods: 10, 20, 50, 100 and 200. However, each trader can use their own combination of moving averages.

- If you want to optimize the strategy, you should look for a currency pair that has a rising ADX with a value greater than 20.

- Open a buy position in the fifth bar or japanese candlestick after the formation of perfect order, as long as this continues holding.

- The stop loss is initially placed in the minimum of the day in which the perfect order was formed.

- Close the position when the perfect order ceases to hold.

Short position

- Look for a currency pair that is in an downtrend and with moving averages in a bearish perfect order. The trader can use a combination of simple moving averages with the following periods: 10, 20, 50, 100 and 200. However, each trader can use their own combination of moving averages.

- If you want to optimize the strategy, you should look for a currency pair that has a rising ADX with a value greater than 20.

- Open a short position in the fifth bar or japanese candlestick after the formation of perfect order, as long as this continues holding.

- The stop loss is initially placed in the maximum of the day in which the perfect order was formed.

- Close the position when the perfect order ceases to hold.

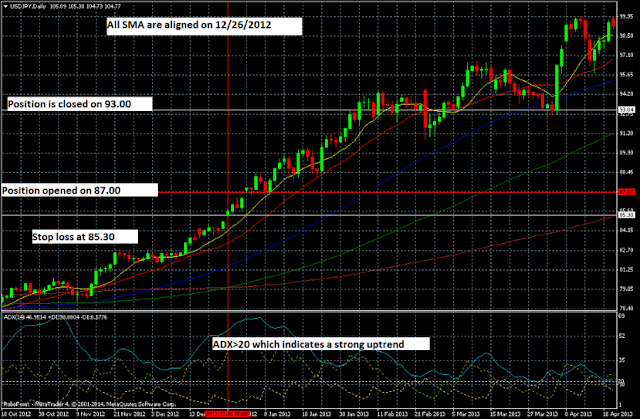

Example of Perfect Order Trading Strategy

The image above shows a daily chart of the USD / JPY which has a strong upward trend noted by the 5 simple moving averages of 10, 20, 50, 100 and 200 periods. On December 26, 2012 all moving averages were aligned sequentially and form a bullish perfect order. For this reason, we proceeded to wait the formation of five bars and open a buy position at 87.00 and place a stop loss in 85.30, ie the minimum reached by the price of the USD / JPY the day in which appear the perfect order.

In this case, the price continued its upward movement and we left the position open to earn more profits. At the same time we move the stop loss to follow the price and protect the gains made so far. Once the 10-period moving average crosses below the moving average of 20 periods, the position is closed because the perfect order no longer exis. This crossover occurs on February 26, 2013 and the closing of the position is performed around 93.00. At the end a gain of 600 pips is made with this transaction.