What is the recovery factor?

The recovery factor is an important indicator of the health of a trading system, which is calculated as the ratio of absolute profit to maximum drawdown. The recovery factor is usually measured in points or percentages.

This indicator gives the trader an idea of the extent to which the total profit of the strategy exceeds the level or depth of the maximum drawdown. In part, the recovery factor indicates the ability of a strategy to recover after a period of losses (drawdown) together with the reserves for the resumption of trades after drawdowns.

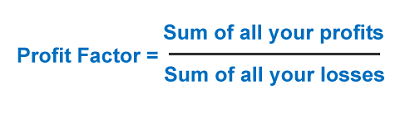

How is the profit factor of a strategy calculated?

The recovery factor can be calculated in two different ways that give two different results.

First method

The traditional (classical) method for calculating the recovery factor is expressed by a simple formula, as the ratio of net profit to maximum drawdown:

Recovery Factor = Net Profit/Maximum Drawdown

For example, suppose a trading strategy makes a net profit of $100,000 with a maximum drawdown of $12,500. This means that the recovery factor is 8:1 (100,000/12,500), which is a very favorable value. Based on this metric, we can say that this strategy is quite a bit better than another one that produces a profit of 120,000 with a maximum drawdown of 30,000 (profit factor of 4:1).

Although the second strategy generates more profit, it does so with a higher level of risk. For the level of risk you take, the first strategy produces a higher profit and has a better chance of recovering when a drawdown occurs.

Second method

Recovery Factor = Net Profit/Total Drawdown

The recovery factor value calculated in the second way provides a truly objective assessment of the stability/reliability of a trading system.

However, at the moment, on all major Internet sites, the recovery factor, including its application to PAMM accounts, is calculated in the first way.

Why is the recovery factor important in trading?

The recovery factor is an important indicator of the reliability of a trading system and should be carefully studied by the trader when evaluating different strategies. As already stated, it shows how quickly a system can return to profitability after drawdowns. Its calculation indicates how many times the current profitability of a strategy is greater than its historical maximum drawdown.

The attractiveness of the recovery factor is that it is an indicator that allows combining different criteria to evaluate the attractiveness of a strategy, such as profitability and possible drawdowns.

It often happens that a trader finds a strategy and sees that it has a return of several thousand percent. He then looks at the historical drawdowns of the strategy and understands that drawdowns of 80% to 90% are unlikely to suit him for obvious reasons.

This leads the trader to look for other strategies and he finds that they all have different combinations of profitability and maximum drawdown, making it difficult for him to make a good decision. As a result, the trader gets confused as he is not completely clear on which strategy he should choose in terms of the relationship between return and drawdown.

But if you rank strategies based on a criterion such as the recovery factor, you can rank them more reliably. For added reliability, you can evaluate strategies at different time intervals: six months, one year, and over their lifetime.

It makes little sense to consider shorter timeframes, as even a bad trading system can have good results in the short term. In this case, the recovery factor may appear highly distorted as a result of the small statistical sample size, as the strategy may not even have gone through a normal drawdown period and the gains may have been a happy coincidence.

Naturally, the recovery factor is not an exhaustive criterion when choosing a strategy. It is also necessary to take into account the risks, the age of the system and other parameters.

It should be remembered that the recovery factor shows the degree of reliability of the system, but says absolutely nothing about the trader’s ability to manage the capital of its account.

This is especially important when looking at managed account managers and copy trading platform signal providers. After all, it is not uncommon to find managed accounts or traders that have an excellent recovery factor and an excellent profitability, but with drawdowns of 95%, which is excessive from any point of view.

How justified is it to invest in such an account or trader? Investing all your money in such an option would be very risky, as the trader is clearly not applying the most basic measures of money management. Perhaps the trader knows what is money management and consciously assumes that risk, trying to get the highest possible profit. But in this case, investing in such an aggressive strategy will not be less risky.

What recovery factor is considered optimal?

The higher the recovery factor, the faster the system will recover after a drawdown. Therefore, when comparing two systems, one with a higher recovery factor is better.

For truly sustainable and reliable trading strategies, the recovery factor should be at least 6.0 (the higher the better). The value of this indicator for a professional trading strategy is 10 or more.

However, it is worth considering that the recovery factor without reference to the trial period is not informative.

Conclusions

The recovery factor should not be the only criteria when selecting a trading strategy to invest in. But its importance to assess the degree of reliability of a system or trader is unsurpassed.