Today we will present a strategy that requires mainly time. This is a 1 minute Forex scalping strategy. As its name implies, it is designed to perform quick transactions to achieve a series of small gains, which in the end add up and accumulate a big profit.

This technique is ideal for Forex beginners because of its simplicity. Read on to learn how to implement it.

What is Scalping?

Before explaining the strategy, it is worth remembering the concept of “scalping” in Forex trading. Scalping refers to a trading style in which many trades are made in a very short period of time. The goal of this style is to get a few pips of profit and get out of the market quickly.

Due to the short duration of its trades, scalping is a style that develops at a dizzying speed. However, for the same reason, it does not use many indicators or fundamental analysis, which makes it perfect for beginners. In scalping strategies traders usually perform hundreds of trades per day, making it a time-consuming style.

Requirements of the 1-minute Scalping Strategy in Forex

To execute this strategy successfully, it is necessary to have some fundamental elements:

Time

First of all, you should have at least a few free hours per day to devote to scalping. This is a method that can deliver big profits, as long as you spend the time necessary.

A good broker

Not all Forex brokers are the same. To execute the 1 minute scalping strategy without problems, you need to select a broker with excellent execution speed and low spreads. Non Dealing Desk brokers (with STP or ECN execution) are the best options as opposed to brokers with trading desk (Market Makers). Similarly, you have to find brokers who offer the lowest possible spreads or commissions.

A recommended ECN/STP Forex broker is ICMarkets, which is regulated by ASIC Australia and offers very low spreads and good execution. You can find more information on:

Stable and fast internet connection

As scalping develops at high speed in short term time frames, it is necessary to have a stable Internet connection. The last thing you want is that the trading platform does not correctly recognize your orders due to a failure in the Internet connection.

Now that we have seen the basic requirements of this strategy, let’s see how to implement it!

Trading system configuration

The following configuration can be implemented in the well-known MetaTrader 4 platform, which is available in almost all Forex brokers. However, it is also possible to apply the settings in many other trading software:

- Currency pairs: All (the lower the spread, the better)

- Time frames: 1 minute

- Indicators: EMA of 100 periods, EMA of 50 periods, Stochastic with default configuration (5, 3, 3)

- Time periods: Market sessions of high volatility, such as London and New York

Trading signals of this Forex scalping strategy

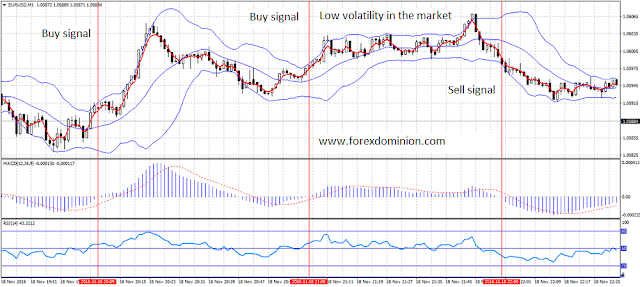

Buy signals

To open a buy position with this system it is necessary to meet the following criteria:

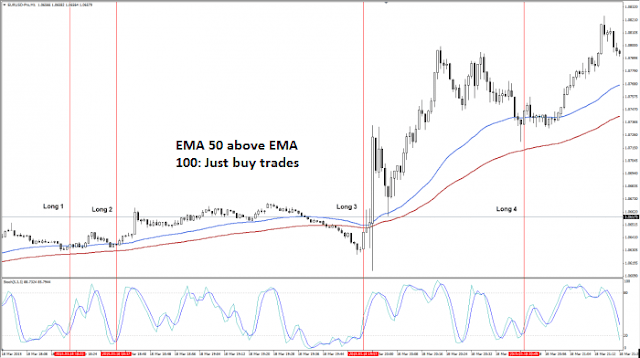

- The 50-period EMA should be above the 100-period EMA

- Stochastic oscillator must cross level 20 from below to above

- The price chart should touch the 50-period EMA

When these 3 criteria are met, you can open a buy position with a market order.

The 1-minute Forex scalping strategy is ideal for people who are just starting out in the Forex market and have a lot of free time. As you can see, this technique uses only two technical indicators (EMA and Stochastic) and the applicarion of fundamental analysis is not necessary, so it is perfect if you do not have a deep knowledge of the market.To protect the position, you can set stop loss orders at about 2 or 3 pips below the last minimum price. Similarly, to ensure profit taking, you can set a take profit order at about 8 to 12 pips of the entry price.

Sell signals

To open a sell position with this system it is necessary to meet the following criteria:

- The 50-period EMA should be below the 100-period EMA

- Stochastic oscillator must cross level 80 from above to below

- The price chart should touch the 50-period EMA

When these 3 criteria are met, you can open a sell position with a market order.

Conclusions on the trading system

To implement this strategy with greater chances of success, it is necessary to operate in a broker with good orders execution and low spreads. With a poor execution, your orders will not be taken into account or will be executed too late. On the other hand, with high spreads, the broker commissions will end your winnings.