The polyvalent trading system “Gurusomu” is based on the famous Japanese indicator “Ichimoku“. This trading strategy can be used both for small timeframes (up to 30 minutes) for scalping and short-term trades, as well as for medium-term and long-term trades using 1 hour price charts and higher time frames. With this system we can trade with any currency pair and at any time. Naturally, if you want to do scalping, you will have to choose the time period where there is greater market volatility, and a Forex broker for scalping.

To trade safely in the Forex market, choose one of the best Forex brokers that are regulated. If you have doubts which to choose, you can always make a comparison between them.

Trading system indicators

To optimize system performance, it is important to understand what indicators and what functions they have in the system: The main indicator of the system is, of course, the “Ichimoku” adjusted as follows: Tenkan-09, Kijun-26, Senkou-52.

In addition to the main indicator, other indicators are found in the system, namely the “TTF trend Trail“, “QFF- Macdv1” and “Filter” are used as signal filters. And the “Price“, “VH” and “Volty channel stop” indicators provide us with information on the state of the market.

Description of the trading system

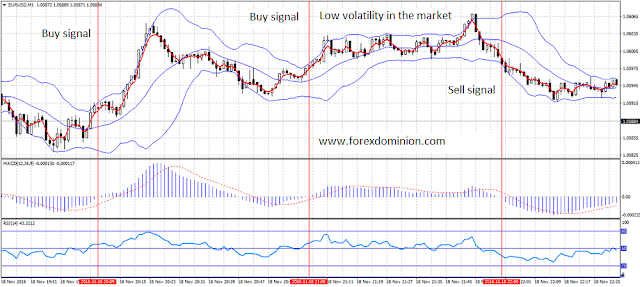

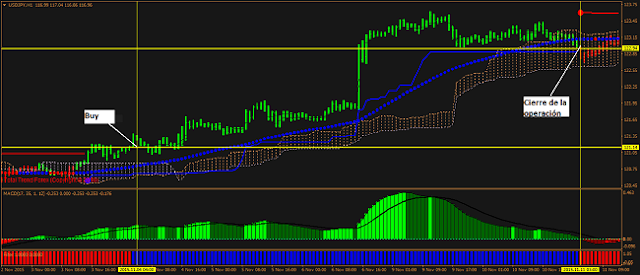

In the screenshot above we have an example of a medium-term trade with this system. For this, we use a H1 price chart (one hour). We observed how the price rose above the Ichimoku cloud and the bars become green, then we must look at the indicators that act as a filter. To open a long position, you must give:

- The indicator “TTF trend trail” should turn blue.

- The bars of the “Filter” indicator should be blue.

- The bars of the “QFF-Macdv1” indicator should be green or dark green.

The position must be closed once a red bar of the “Filter” indicator appears.

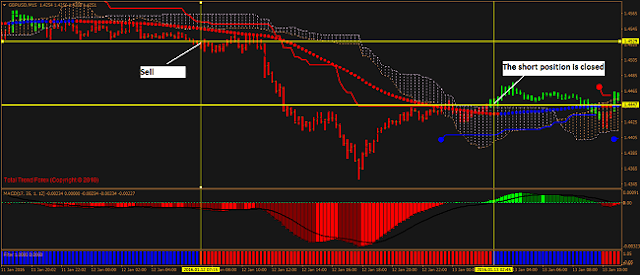

- The bars of the “TTF trend trail” indicator should turn red.

- The bars of the “Filter” indicator should be red.

- The bars of the “QFF-Macdv1” indicator should be red.

The position must be closed once a blue bar appears in the “Filter” indicator.

For a good risk management, the stop loss should be placed on the “Volty channel stop” indicator, as we can see in the image above.

You can download the indicators and the system template for Metatrader 4 using the following link:

-Download indicators and template for MT4