There is no need to remember the amount of technical analysis tools currently available, however, it is curious how we end up resorting to the simplest of all, which are not other than moving averages. The truth is that despite its simplicity, the media provide us with a fairly reliable information about the direction the market is taking, serving as reference points to establish the possible levels of support or resistance.

The moving average MEMA (it is the acronyms of the Modified Exponential Moving Average) is a type of exponential moving average that presents a series of particularities with respect to the traditional EMA. In the present article we are going to talk about this analytical tool.

Definition of MEMA

The formula of the MEMA moving average has the same origin as the formula of the base exponential moving average, although it differs in the way of calculating the smoothing factor. Actually, the function of this factor is to determine the speed with which the moving average approaches the price. Precisely because of this, perhaps you would understand more the use that is given to the smoothing factor if we call it an acceleration factor. Well, the formula of this acceleration factor in the standard exponential moving average is the following:

Acceleration factor = 2/(n+1)

However, in the MEMA this value is calculated following the following equation:

Acceleration factor = 1/n

As a consequence, by applying a lower acceleration factor, as is obvious, the movement of the moving average is less accelerated. Which translates into a slower exponential moving average.

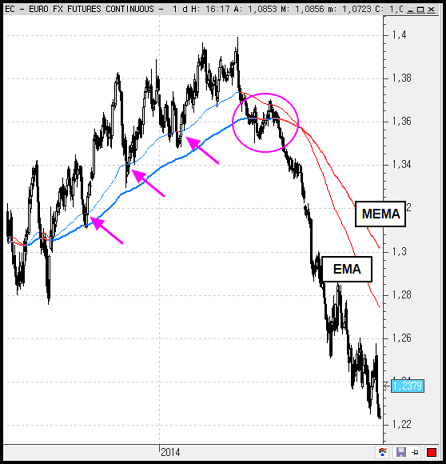

In the following chart of platinum futures contracts (weekly time frame) we observe the movement of the standard EMA and the modified EMA with the same period (30). When the descending phase starts, the MEMA takes longer to go down. As a consequence, it is further away from the price than the exponential moving average is, which means that it reacts more slowly to the price change.

As a curiosity, we can comment that an exponential moving average with a period that duplicates the period of a MEMA will behave in a very similar way to that modified moving average. This data would mean therefore that there is no particularity in the modified moving average that we do not find in an exponential moving average of a longer period, although we will maintain the interest in this indicator even if this interest is due to the fact that the results are obtained with half of the price bars needed to calculate the standard EMA.

Interpretation

We already said at the beginning of the article that the moving averages are characterized by their simplicity, therefore, with the interpretation of this indicator the same happens: We consider that the market is bullish if it moves above the MEMA moving average or bearish if the price moves below the MEMA.

However, we will highlight a particular use that is actually the justification of the article itself. What we are looking for with this idea is to take advantage of the way in which this moving average acts that makes it different from the others.

MEMA as an indicator of long-term sentiment

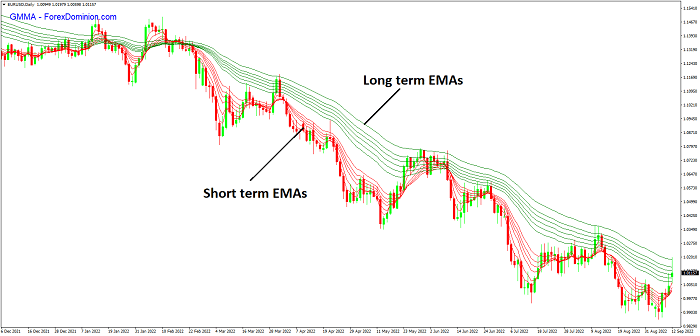

Obviously, if we use a moving average to decide the point of entry, we are interested in having an indicator that reacts as quickly as possible to the change in price direction. For that we have moving averages such as Double or Triple Exponential (DEMA and TEMA), Hull’s moving average or Wilder’s moving average. This indicator is not one of them, because as we have seen, the MEMA takes time to change the cycle.

This that could be taken as a weakness can be a virtue if we give it the right use: For example, as a method for long-term trend confirmation. The idea is to apply other types of tools to detect the entries, and use the MEMA moving average to establish if the general trend is bullish or bearish. Due to its characteristics, it will allow us to filter the failed entries, since with the due time period, the MEMA crosses with the price can only be the result of a clear change in trend.

Let’s see an example. In the following price chart of the eurodollar future, we have applied an exponential moving average and a modified exponencial moving average (thickest line). Both with a period of 100 sessions.