The difficult part to begin to trade in any market is to define the strategy or trading system that we are going to apply to make money, as there are many trading systems but:

- Which trading systems are really robust?

- What are the main features of robust trading system?

A robust trading system is a trading strategy that is designed to perform well under different market conditions and over long periods of time. A robust trading system is not overly sensitive to minor changes in the market or to specific market conditions, but rather has a built-in flexibility to adapt to changing market environments.

A robust trading system typically involves a combination of different trading strategies and risk management techniques that are tailored to the individual needs and objectives of the trader. The system should have clear rules for entering and exiting trades, as well as a well-defined risk management plan that includes strategies for managing drawdowns and minimizing losses.

A key characteristic of a robust system is that it has been thoroughly tested using historical market data to ensure that it has a high probability of success in the future. This testing should include multiple market scenarios and time periods to ensure that the trading system can perform consistently over a wide range of market conditions.

Overall, a robust system is designed to help traders achieve their trading goals while minimizing risk and maximizing long-term profitability. By having a well-designed and thoroughly tested trading system, traders can have confidence in their ability to navigate the markets and make informed trading decisions.

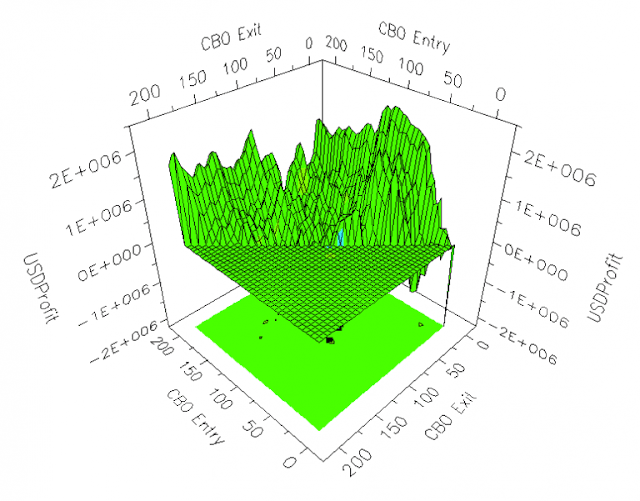

We can do a practical exercise to evaluate the robustness of two well-known trading strategies: