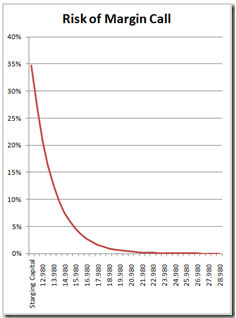

This is probably one of the most important articles for long-term success in trading that I have written so far. If I am not mistaken, this is the first time I have written about it, although the issue of risk of ruin is of the utmost importance in achieving long-term profitability. It is about evaluating, objectively, the risk I have of losing a certain percentage of the capital dedicated to investment and trading.

We have talked a lot in the past about drawdowns in general and in trading systems in particular. Specifically, we have explained the concept of the historical maximum drawdown as a risk measure of any kind.

When using a trading system in Forex and in other markets we must be able to answer two questions:

- With a certain capital, what risk do I have of suffering catastrophic losses in the system/portfolio due to lack of funds?

- If I want to risk only a certain capital, what probability of success do I have in the long term?

They are two questions that come to express the same thing, the relationship between the probability of long-term success and the capital available for the system/portfolio. Naturally we all know that the more we put in, the better, but it is about optimizing the use of money, right?

Read more