- The company was accused of selling securities-based swaps without proper authorization.

- Despite moving its operations outside the US, the contracts were offered from San Francisco.

The United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) announced this Monday two fines of $150,000 each against the Abra platform. Regulators determined that the company offered unauthorized operations with bitcoin for the acquisition of cryptocurrency derivatives.

In the SEC filing, the agency explained that both Abra based on California and a Philippine affiliate company identified as Plutus Technologies operated financial swaps. The operations were based on traditional securities with retail investors, without registration and without execution on a registered national stock exchange.

This is an Abra service in which traders would have used bitcoin (BTC) or litecoin (LTC) as a guarantee, for example, to bet on the price movement in equity securities that are quoted in the United States.

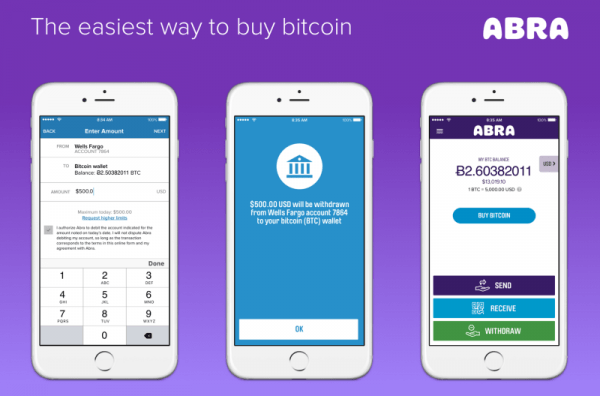

Using the application, individuals were able to enter into contracts that provide synthetic exposure to movements in the price of shares and ETFs in the United States. This through blockchain-based financial transactions with Abra or with related company Plutus Technologies.

The SEC noted in the press release.

The SEC also accused Abra of failing to ascertain the participation of eligible investors and not retail traders. On this point Marco Santori, from the legal department of the Kraken exchange house, explained that Abra was only allowed to offer the service to a certain group of traders, “that is, wealthy people with companies,” he said on Twitter.

The regulator mentioned that Abra started offering these types of services in February of last year in the US and abroad, but temporarily stopped its marketing that same month after speaking with commission officials.

The company resumed its services in May, but limited its offer to non-Americans in an attempt to comply with the regulation and to move part of its operations abroad. However, the SEC alleged that the contracts were designed and marketed by its employees located in California.

In the case of the CFTC, the director of the regulatory section, James McDonald, stated that eliminating “misconduct is essential to promote the responsible development of these innovative financial products.” Abra and its subsidiary company agreed to pay the fine without denying or accepting the facts and to cease marketing operations.

Regarding what happened with Abra, it should be mentioned that a similar service began to be offered by the Uphold platform in Latin America. Users can buy shares of United States companies like Amazon or Apple using bitcoin.

In July of last year, it was reported that Abra had restricted his service in the United States amid “regulatory uncertainty and restrictions.” Back then the company indicated that it had to make modifications to its synthetic assets based on smart contracts. In this case, the synthetic asset offered users exposure to cryptocurrencies without having actual possession of these assets, as occurs in other derivative instruments.

Abra is a platform that integrates a multi-currency wallet and a currency exchange where the user can make exchanges of cryptocurrencies to fiat currencies. Other platforms are starting to offer similar products, such as the aforementioned case of Upload and Currency.com from Estonia.