- Clayton views tokenization as positive as long as it is registered with the SEC.

- Blockchains will be “the internet of finance,” according to Brian Brooks, Comptroller of the Currency

The Securities and Exchange Commission of the United States (SEC) would have the disposition to promote the tokenization of shares through blockchains. This was stated by the president of the SEC itself, Jay Clayton, this weekend.

During a digital seminar organized by the Chamber of Digital Commerce, Clayton assured that he does not look down on the tokenization of traded securities. Provided they are duly registered with the SEC.

In Clayton’s view, the emergence of blockchain networks such as Bitcoin and others has opened the doors for a new form of negotiations in financial markets. So much so, that in the future “it is very possible that all shares will become tokens,” he added.

The executive considered that nowadays all stock operations are executed in the digital environment and the panorama is very different from what existed 20 years ago. Before, he explained, the shares had physical certificates, while now there are digital inputs that represent those certifications.

What his institution cannot allow, Clayton added, are cases in which projects aspire to evade the SEC by claiming that their tokens do not represent stocks or sources of funding.

“What we don’t like is when someone says [that] the function is payments, so we really should look beyond the laws of securities. I can’t do that, I wouldn’t be doing my job. Do not pretend that it is a payment system when in reality it is a financing vehicle »

Jay Clayton, SEC Chairman

Blockchains will be the Internet of finance: Brian Brooks, Comptroller of the Currency

For his part, Brian Brooks, interim controller of the Office of the Comptroller of Currency (OCC), assured that from his institution blockchains are seen as “basically the Internet of finance” in the medium-term future.

“We have a great interest in trying to envision a medium-term future, not a future for tomorrow where people speculate on bitcoin price movements, but a medium-term future where these blockchain networks that have been built are basically the internet of finance… they are kind of a mind-boggling challenge to the banking model. “

Brian Brooks, Acting Comptroller of the Office of the Comptroller of Currency of the United States

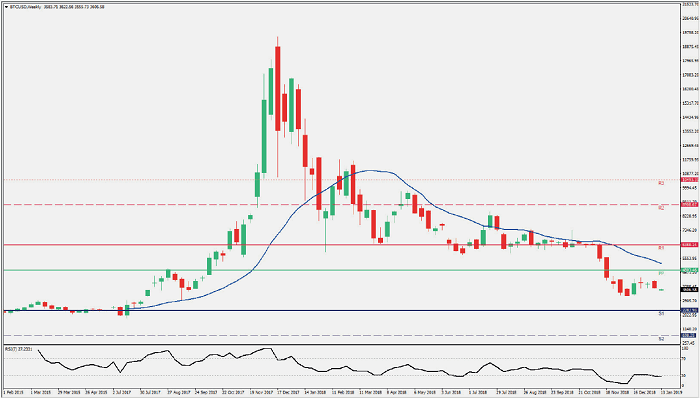

Brooks also assured that this does not mean that in the future there will be as many cryptocurrencies as there are today, with more than 7,000 according to CoinMarketCap. On the contrary, “most cryptocurrency projects will fail”, in his opinion.

“They’re not going to be relevant to a particular need, or they’re going to raise fundamental legal compliance issues or something like that,” said Brooks, a former executive at Coinbase, a well-known cryptocurrency exchange with millions of clients around the world who trade Bitcoin and other crypto digital assets.

His arrival heralded a paradigm shift in the US government in its vision of Bitcoin and the rest of cryptocurrencies and blockchains. Brooks himself had stated months before his appointment the need for a tokenized version of the US dollar, with an approach to digitization that is common among countries today, with the attempts to create CBDC or Central Bank Digital Currencies.