The financial firm holds $1.4 billion in the IBIT fund, managed by BlackRock.

In March, Goldman Sachs acknowledged Bitcoin’s (BTC) significant growth. If it exchanged ETF shares for Bitcoin, Goldman Sachs would hold approximately 20,176 BTC.

Financial giant Goldman Sachs has taken a decisive step in the digital asset market by becoming the largest identified investor in spot Bitcoin (BTC) exchange-traded funds (ETFs) in the United States. With a major investment in BlackRock’s iShares Bitcoin Trust (IBIT), the firm demonstrates growing interest in Bitcoin amid a surge in its adoption and valuation.

Last Friday, Goldman Sachs filed its Form 13F with the Securities and Exchange Commission (SEC), a mandatory disclosure detailing institutional investment holdings at the end of each quarter. According to the report dated March 31, 2025, the U.S. bank holds 30.8 million shares in the IBIT fund, valued at $1.4 billion.

Additionally, it maintains 3.47 million shares in the Fidelity Wise Origin Bitcoin Fund (FBTC), worth $250 million.

By comparison, the December 31, 2024, Form 13F revealed a smaller IBIT position (24 million shares) and a nearly identical FBTC holding (3.5 million shares), per MacroScope data.

This indicates that Goldman Sachs increased its exposure to BlackRock’s fund by approximately 6.8 million shares during Q1 2025, including the addition of around 30,000 shares in that period.

This move came amid market volatility, as Bitcoin’s price declined during the first months of the year—a dip the bank leveraged to boost its investment in Bitcoin ETFs.

Leadership in IBIT Fund and a Strategic Shift

With these figures, Goldman Sachs solidifies its position as the largest holder of IBIT worldwide, according to SEC filings.

This leadership reflects a strategic portfolio adjustment, as the December 2024 13F filing reported additional positions that no longer appear in the current report.

“Among these were a 157millionIBITcalloption,a527 million IBIT put option, and an $84 million FBTC put option, according to MacroScope.

The absence of these positions in the latest report suggests a strategic restructuring of their Bitcoin ETF approach.

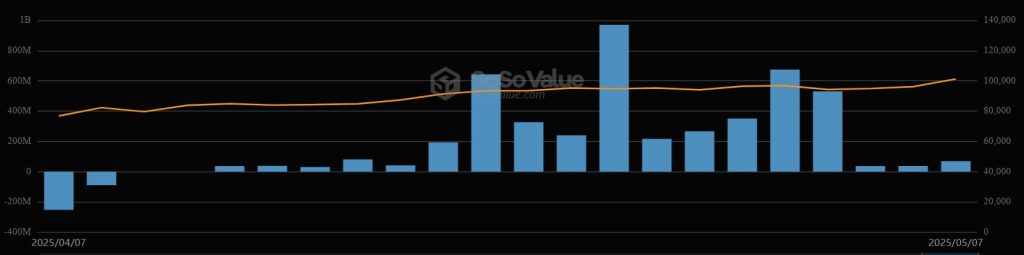

Meanwhile, BlackRock’s IBIT fund has demonstrated remarkable performance. SoSoValue data shows this ETF has recorded net inflows for 18 consecutive trading days.

Over this span, IBIT attracted roughly $4.5 billion in inflows, solidifying its position as the market leader among Bitcoin funds.

If Goldman Sachs converted its IBIT holdings (as of March 31) to direct Bitcoin ownership, it would possess approximately 20,176 BTC – a figure that underscores the scale of its investment.

With this amount, the bank would rank as the fourth-largest corporate Bitcoin holder in the market, trailing only Twenty One. This $3 billion Bitcoin accumulation fund launched in April 2024 and currently holds 31,500 BTC, according to Bitcoin Treasuries data.

In this context, U.S.-based spot Bitcoin funds now hold a net asset value exceeding $121 billion – the highest since January 2025 – reflecting growing institutional interest in this market.

Institutional Adoption Wave Drives Bitcoin Market

Beyond financial institutions, Bitcoin is gaining traction as a strategic asset among corporations across sectors and even some nations exploring its use as a strategic reserve against global economic uncertainty.

This mass adoption directly impacts the market. By lending greater legitimacy to Bitcoin, these institutions strengthen its position as a viable asset, driving broader acceptance.

Moreover, large-scale acquisitions like those by Goldman Sachs and Twenty One generate significant demand volumes that reduce circulating BTC supply. This relative scarcity creates upward pressure on Bitcoin’s price, potentially leading to sustained medium-to-long-term price appreciation.

Public Endorsement of Bitcoin’s Potential

Goldman Sachs’ interest in Bitcoin isn’t new. In March 2025, the institution highlighted the asset’s remarkable growth – a point further emphasized in its 2024 annual report.

For the first time, the bank included cryptoassets in this shareholder-directed document, marking a shift in its sector perception. The report states that cryptocurrency prevalence and distributed ledger technology are intensifying competition in financial services.

Institutional Risks in Bitcoin Investment

Despite current enthusiasm, institutional investments in Bitcoin ETFs face significant risks stemming from the cryptocurrency’s sharp price fluctuations.

Bitcoin’s volatility raises legitimate concerns about its long-term stability – a critical factor for investors like Goldman Sachs. These price swings could erode the value of funds like IBIT, potentially undermining institutional confidence in this asset class.

Background Context

In April, ForexDominion reported that Goldman Sachs acknowledged competing financial products based on cryptocurrencies that clients might prefer.

This acknowledgment, coupled with references to disruptive technologies like artificial intelligence and e-commerce, demonstrates the bank views digital assets as a transformative force in global finance.

Moreover, the unpredictable nature of digital asset markets could trigger a domino effect across the financial sector. Should Bitcoin experience sharp price declines, resulting losses could deter other institutional investors, potentially stalling the current adoption wave driving market growth.

While Bitcoin is gaining recognition as a strategic asset, its inherent volatility remains a significant hurdle—testing the resilience of these investments amid an uncertain global financial landscape.