In this article, you will discover, clearly, what are the commissions that the AvaTrade broker charges for its financial brokerage services.

AvaTrade is an online broker specializing in Forex and other financial instruments (through CFDs). It started its activity in 2006 and its main headquarters are in Dublin (Ireland) for which it is authorized and regulated by the Central Bank of Ireland.

To trade in Forex and other financial markets it is necessary to use the services of an online broker to access the markets. Currently, this is not a problem, since it is easy to open a trading account with AvaTrade or any other broker (the whole process is online). However, it is important for the trader to understand that brokers obtain the corresponding fees for their services through commissions that are charged to the trader’s account.

Next, we show step by step what are the commissions applied by the AvaTrade broker.

More information about the company Avatrade and its brokerage services in the following guide about this broker: Review of Avatrade broker

Avatrade trading fees

Transaction fees are the most common. It is the income that any broker obtains for doing its job of buying or selling on our behalf and according to our orders any financial instrument that the company offers to its clients (currencies, shares, cryptocurrencies, indices, commodities, bonds, …).

In other words, they are commissions that are applied to the trader for their operations. Therefore, if you do not open a trading position, you will not be charged. Let’s see them in detail:

– Spread

It is the main commission of AvaTrade. In Forex and CFD trading, the commission for opening trading positions is usually represented in the form of a spread.

What is the spread?: It is a differential between two prices.

AvaTrade, like any other Forex and CFD broker, offers two prices for each of the available financial instruments.

The two price quotes that you will find are the following:

- One quote to sell: It is called the “bid” price. This is the price you will be paid when you sell.

- One quote to buy: It is called the “ask” price. This is the price requested by the broker to sell you the financial instrument you intend to buy.

Both prices fluctuate constantly in the market, but there will always be a small difference: the ask (price to buy) is somewhat higher than the bid (price to sell).

In other words, if you decide to buy a financial instrument and sell it immediately, you will pay a price slightly higher than the sell price. The existing difference is what is called the spread and represents a cost for the trader for their trades in the markets. Through this price margin, the broker obtains the income from its services for its buying and selling services of financial assets.

The spread is charged to your trading account the moment you open the trade.

We can only say that, when trading with AvaTrade, you can find the spread as a difference between the bid and in other ways that we will explain below.

The spread is usually expressed in quotation points. With this, its cost depends on the size or volume of the position that we intend to open (the value of the profits or losses for each point that the price moves depends on the amount we have invested).

However, there are certain financial instruments (such as, for example, some commodities offered by AvaTrade) in which the trading cost is not expressed in price points, but in monetary terms, which are added to the current market price when the position is opened.

For example, when trading the copper futures market with AvaTrade, a commission of around $0.005 must be paid.

Similarly, there are certain financial instruments in which the spread is expressed as a percentage of the price. Let’s take another example: when trading Tesla shares, the spread is a 0.13% margin.

What spread does AvaTrade charge?

Online brokers, according to their type, offer fixed spreads or variable spreads to their clients. In some cases, the broker offers both fixed or floating spreads depending on the type of trading account the trader selects.

- Fixed spread: as its name suggests, it does not change with market conditions. It may be different for each instrument, but the difference between the bid and the ask prices will always remain the same, despite the fact that both prices do not stop fluctuating.

- Variable spread: unlike the fixed spread, this type of spread is not always the same (even on the same financial asset). The broker tries to offer its clients the best existing price according to the market liquidity at all times. The liquidity of the financial asset influences the value of the spreads offered by the market (the more liquid is the market, the lower the variable spreads with which we can trade).

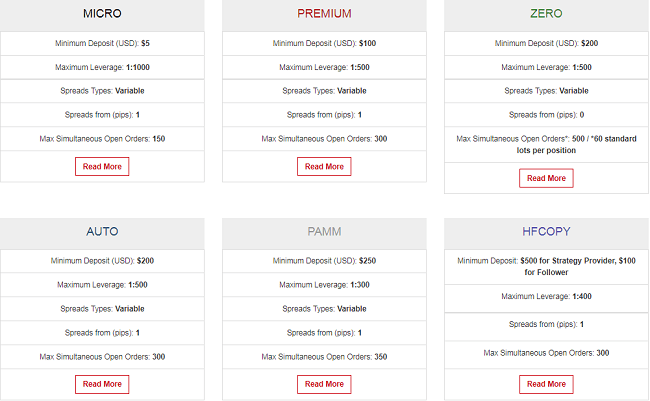

AvaTrade offers variable spreads (although the client can choose between both types of spreads for their transactions in the Forex market). Although this spread type varies, under normal market conditions it is usually lower than fixed spreads.

In short, these are the commissions in the form of spreads that you will find when trading with AvaTrade:

- Forex: A variable spread is applied. The minimum spread of the most liquid financial instrument, that is, the EUR/USD currency pair is usually around 0.9 points or pips of difference, under normal market conditions.

- Shares: When trading stocks, the spread (variable) is expressed as a percentage of the market price. In the case of highly liquid stocks, such as Apple, the percentage is 0.13%, applied to the sell price (bid).

- Commodities: In the case of commodities, we can find a variable spread that, under normal market conditions and for highly liquid products, is usually around 0.34 points for gold and 0.03 for crude oil. There are also certain instruments with less liquidity in which the spread is expressed as an amount in dollars, applied to the market price (for example, the futures contract of cocoa has a spread of $6 over the price at which it is quoted at the time of position opening).

- Stock indices: For stock indices, a spread in points is applied over the market price. For example, trading the Standard & Poor’s 500 indexes usually has a cost of 0.25 points above the market price (variable according to market conditions).

- ETFs: Trading Exchange Trading Funds with AvaTrade involves a commission that, depending on the type of asset, can be in the form of a spread in points (for example, the MSCI Canada Index Fund has a variable spread of about 0.0013 points) or based on a percentage (the MSCI Emerging Markets Index Fund has a spread of 0.13%).

- Bonds: Euro-Bund and Japan Govt Bond can be traded with AvaTrade. The commissions that the trader must pay are a spread of 0.03 points and 0.06 points on the market price for both types of bonds respectively.

- Cryptocurrencies: The cryptocurrency market has a spread in the form of a percentage applied to the market price. For example, trading Bitcoin can cost 0.35% of the Ask price offered by the broker.

Swap

The swap commission is another type of trading commission since it is charged only if we maintain open positions from one day to the next (overnight positions).

It corresponds to the financial costs of the investment. When trading CFDs (Contracts For Difference), in reality, the trader does not invest 100% of the total amount of the trade. The trader only deposits a percentage of the trade volume as a trading margin that works as a guarantee or collateral. This is how trading CFDs, Forex, and other financial derivative instruments works. This is what is known as financial leverage.

Leverage allows the trader to open positions greater than the total amount of money he has in his trading account. . When opening a trading position and holding it for more than one day, the money lent by the broker to leverage the position must be refinanced and daily interest is charged. This is the swap commission.

How and when is the swap commission charged?

Swap commission is also called overnight premium because it is charged at night.

This is because a cut-off time that coincides with 22:00 GMT (21:00 GMT in summertime) is taken as a reference to establish the end of the trading day and the beginning of the next.

The swap will be applied to all trading positions that are open by this cut-off time. Every day the position is kept open.

The same happens when the weekend arrives and the markets close. In this case, the swap commission multiplied by three will be applied (the current day, plus the swap of Saturday and Sunday). AvaTrade collects the weekend swap commission on Wednesdays (since spot currency trades are settled within two days).

Regarding the cost of this commission, the official daily interest of the currency (or currencies) involved in the transaction is taken as a reference. Interest is applied on a 360-day annual basis. Swap commission rates are updated on a regular basis.

What happens with the swap in Forex?

In the Forex market, a currency pair is bought or sold, that is, depending on whether the position is short or long, one of the currencies of the pair is bought and another is sold.

For example, when buying the EUR USD pair, what we are doing is buying euros and selling dollars. The opposite happens if we sell the currency pair.

When selling a currency, the corresponding interest on the leverage will be paid, as a swap commission. However, interest is charged on the currency that is purchased.

Therefore, the result is that the difference in both interest rates will be charged or paid to us. That is, when trading Forex, it is possible that the swap commission represents an income in our trading account and not a charge that must be paid.

Other types of commissions from the broker Avatrade

Apart from the trading commissions that we have discussed so far, the broker can apply other types of commissions for the rest of the services it provides to its clients.

– Commissions for deposit or withdrawal of funds

AvaTrade does not apply fees for deposits or withdrawals, however, this does not mean that the payment option used by the trader for their deposits and withdrawals does not apply any commission.

When choosing the payment option through which we are going to deposit and withdraw funds from the AvaTrade account, we must bear these issues in mind. There may be commissions for example for currency exchanges, our bank may charge commissions for sending or receiving money transfers, electronic wallets such as Neteller or Skrill usually charge commissions for withdrawing funds to our bank account or credit or debit card.

In any case, we are talking about fees for deposits and withdrawals of funds that are not charged by AvaTrade. They are external costs to the broker but it is convenient to know them to estimate how they can impact our funds.

– Commissions for corporate operations

If we trade individual shares, these types of financial assets are subject to a series of operations that include rights (or obligations) for their holder.

For example:

- Collection of dividends.

- Stock divisions (splits).

- Reversal of divisions (contra splits).

- Mergers of companies.

- Acquisitions of companies.

- Etc.

On these trades, AvaTrade may apply commissions. The clearest and most common example is the collection of dividends (since they are usually paid periodically).

Avatrade makes an adjustment to the trader’s account one day before (at the end of the day) the dividend payment day.

Depending on whether the trader is short or long in a share CFD, the broker will apply:

- If a long position is held, the client will be credited 90% of the gross dividend received. That is, AvaTrade will keep 10% as commission for the collection of dividends.

- If a short position is held, 100% of the dividend will be debited from the trading account (in this case, the trader is obliged to pay the dividend by having the shares sold).

– Commissions for inactivity

AvaTrade trading account is subject to commission if it is kept inactive.

If a client does not trade with his AvaTrade account for three consecutive months, the broker interprets the account as inactive and will charge a commission of €50.

This commission is deducted directly from the funds in the client’s account and will be applied for each period of inactivity (every 3 months without opening a position in our AvaTrade account).

One way to avoid this commission is to withdraw funds from our trading account in case we plan not to use it for a long time.

– Administration fees

This commission will be applied after 12 consecutive months of account inactivity period, called by the broker an “annual period of inactivity”.

It is a commission for account administration, in order to compensate the broker for the costs incurred for making their services available, despite not having been used.

The administration fee amounts to € 100 per year of inactivity. As in the previous case, this amount is deducted directly from the funds that the client may have in the account. Therefore, it will be sufficient to withdraw all the money from the account if it is expected to be without trading activity for a long period of time.

These are the most common commissions you can find if you trade with the AvaTrade broker.

A good way to test and find out how these AvaTrade commissions, such as spread or swaps, impact your trading is to open a free demo account in which you will have an environment similar to a real account but with a virtual balance with which you can open and close positions without putting your money at risk.

More information about Avatrade commissions and its many brokerage services is on its website: