| Avatrade

| – Market maker broker from Europe specializing in Forex and CFD -Regulated by organizations such as ASIC -Access to many markets through CFD | Visit Broker Website |

Avatrade-Broker Review

It is a broker with many awards from magazines and specialized media. Let’s see some:

- Best Forex Broker 2019; daytrading.com

- Broker #1 2020; The European

- UK Most Innovative CFD Broker 2019; International Business Magazine

- Best Forex Broker in Portugal 2019; Rankia

- Top 10 Forex Brokers, China; WikiFX

- Best Forex Broker 2018; FXEmpire

- Best Customer Service 2009; DailyFX

As we can see, it is a broker that has received very varied awards from various regions, which shows its international reach. This is because there are few brokers with more global offices than Ava.

Avatrade Overview

Foundation | 2006 |

Regulation | Australia, Ireland, Japan, Dubai, South Africa, Virgin Islands |

Broker type | Market maker |

Leverage | Latam and Asia: 200, Europe: 30, Crypto: 2 |

Minimum deposit | $100 |

Deposit methods | Wire transfer, Credit Cards and Debit Cards, Skrill, Neteller and Webmoney |

Trading instruments | Stock CFDs, ETF CFDs, Forex, Commodities, Indices, Cryptocurrency CFDs, Bond CFDs, FX Options, Future CFDs |

Trading platform | Metatrader 4 and Metatrader 5 |

Warning: Between 54 and 89% of clients lose money when trading with CFD providers. CFD trading involves a lot of risk due to high leverage. You can lose all your capital. Before making an investment with CFDs you should seriously consider whether you have the necessary knowledge about the titles and if you can face the possible loss of all your capital.

Advantages | Disadvantages |

|

|

Regulation of Avatrade

Avatrade is one of the best-regulated brokers in the world. It can boast no less than 6 global regulations. Let’s see what they are:

Broker | AvaTrade EU Ltd | Ava Trade Ltd | Ava Capital Markets Australia Pty Ltd | Ava Capital Markets Pty | Ava Trade Japan K.K. | Ava Trade Middle East Ltd |

Regulator | Central Bank Ireland | FSC | ASIC | FSCA | FSA | FRSA |

Segregated accounts | Yes | Yes | Yes | Yes | Yes | Yes |

Negative balance protection | Yes | Yes | Yes | Yes | Yes | Yes |

Deposit compensation | Yes | No | No | No | No | No |

The accounts are segregated into maximum security accounts from Natwest and Barclays, two of the most important British banks and which, due to regulations, must maintain constant security audits. The broker’s money is handled in other perfectly separate accounts.

The broker offers negative balance protection in the event of any extraordinary movement, but at the same time maintains stricter policies of surveillance and compliance with trading margins. This is actually a good thing as it further ensures the safety of the trader and the broker.

Type of broker

AvaTrade is a Market Maker Broker specializing in Forex and CFD trading.

Trading Instruments

Ava Trade has a very interesting investment offer due to its variety, since it offers a significant amount of all kinds of assets in the form of CFDs such as stocks, bonds, cryptocurrencies, etc., in addition to Forex. But it is that it also offers quite sophisticated trading and in quite good conditions in vanilla Forex options.

- Forex market (44): More than 40 currency pairs in the spot market, from the most important like the EUR/USD and the USD/JPY to other most exotic like the USD/MXN.

- Commodities (28): The most-traded commodities in the market like oil, gold, silver, grains, and others in the spot market and through CFD.

- Forex Options (44): OTC Vanilla Call and Put options (conventional options) based on more than 40 currency pairs

- Contracts For Difference*: CFD based on the following underlying instruments:

- Commodities like oil, heating oil, gold, platinum, soybean, wheat, gasoline, and others.

- The major government bonds include 5 Year US T-NOTES, 10 Year US T-NOTES, GILT LONG, and EURO-BUND among others.

- The main stock indices include the S&P 500, Nasdaq 100, CAC 40, DAX 30, FTSE 100, and Nikkei 225 among others.

- The main stocks of the US and European markets include Coca Cola, Exxon Mobil, Google, Bayer, and Siemens among others.

- The most important cryptocurrencies in the market such as Bitcoin, Ethereum, and others.

Some of the basic trading conditions are as follows:

Spreads

- Asset spreads vary according to market conditions

- FX options can be traded up to 24 hours before their expiration

- Options are European style

- Futures positions will be closed upon termination and will not be automatically opened

Overnight commissions

Overnight financing premiums (swaps) are variable and depend on market trading conditions

Many markets charge triple commissions on Wednesdays, corresponding to the weekend positions.

Leverage

Leverage levels may change due to volatility and extreme cases.

Trading volume

The Metatrader 4 platform only supports a maximum of 500 open trades at a time

The minimum lot is 0.01 on Forex and one share on Stock CFDs

Cryptocurrencies

- Cryptocurrencies are available 24/7 for trading

- Volatility can cause margins to change without notice

- Cryptocurrency spreads change often due to market conditions

- There are no cryptocurrencies for Islamic accounts

Avatrade Trading Accounts

The accounts section is the simplest because, unlike many other brokers, AvaTrade does not offer different types of accounts and concentrates all its offers in a single account, although the offer varies if what we want to trade is options or stock CFDs, for example.

However, what we can do is create many sub-accounts even in different currencies and manage the funds between them using different strategies for each other.

Another thing we can do is open a 21-day demo account but we can extend it many more times.

Opening an account in Avatrade

Opening an account with AvaTrade is a fairly simple and straightforward process that is designed to make it as easy as possible to open accounts without major bureaucratic obstacles and with the maximum speed that electronic systems guarantee today. If everything goes correctly you can have an account open in a matter of an hour.

The first thing we have to do is go to the AvaTrade website and look at the top of the page where we will see a button that says “Create an account”. We click on it and it opens a screen where we can enter our personal data or if we want we can register with our Facebook or Google profiles. Once we have done that, they will send us a confirmation email and after confirming it, they will ask us for some documents to prove our tax residence, something very important in the global regulatory environment and that is necessary to be able to open the account in this regulated broker.

These documents can be an identity document such as a passport or DNI and another that proves the address where we live, such as a water or electricity bill or a bank statement. Once we submit this, the AvaTrade team will review it and if it’s not too busy in a matter of minutes we’ll have our trading account ready to make the first deposit.

Avatrade Demo Account

If you plan to use this broker but do not know how its platform works, you can create a demo account in Avatrade to practice before depositing real money.

Avatrade puts at your disposal a free 100% operational demo account with €100,000 so that you can invest unlimitedly in the assets you want. Thus, you can practice until you feel comfortable investing real money.

How to open a demo account in Avatrade?

If you want to open a demo account in Avatrade to start practicing, you have to follow these steps:

- Access the form to create the Avatrade demo account.

- You can open the account with an email or connect with your Facebook or Google profile. We recommend that you select the last option (as long as you have a Google account).

- If you have selected any of the registration options through social networks, all the fields of the form will be completed and you will only have to click on “Create account”.

With these 3 simple steps, you will have created your Avatrade demo account. As soon as you create the account, you will enter the investment platform and a banner with a password will appear. This password is for the Avatrade WebTrader, not for your Avatrade account.

When you have created your demo account in Avatrade and enter its investment platform for the first time, you will be able to see its tutorials. There are 3 fairly short and interesting videos on how to open trades, close them and move around the platform.

However, and as a summary, to trade with the Avatrade demo account you have to follow these steps:

- Search for the asset you want to invest in, either with its search engine or with its menu. You’ll find them all listed in categories on the left sidebar.

- The asset will appear on the central screen, along with 2 buttons, one to buy (long trade), and one to sell (short trade).

- Click on the type of order you want to launch.

- A box will open to the right of the screen where you will need to edit your order.

Once you execute the order, you will be able to edit it in the “Positions” section that you will see in the menu on the left side of the screen.

In short, the Avatrade demo account is perfect for people who are just starting out or want to switch to Avatrade. But remember, the goal is to prepare you for real investing, so we recommend that you follow the same strategy that you would if you were investing your own money.

The duration of the demo account is 21 days but it can be extended if we wish.

Avatrade Trading Platforms

Avatrade is one of the brokers with a more complete and varied offer of trading platforms. Let’s see what platforms this broker offers us.

WebTrader

This is a proprietary platform that is designed for AvaTrade itself and that allows the trader to invest and trade in the markets from the broker’s website, without the need for any computer involved. The trader can open the platform from any location, be it a PC, a laptop, a tablet, or a mobile or cell phone. This platform does not need downloads, obviously.

This platform is designed for those who do not need too many features such as algorithmic trading, robots, and excessively complex orders that ultimately make trading more complicated. As an advantage, it offers a simpler and more robust trading environment.

The platform has a market sentiment system where we can see the global statistical summary of client positions in this broker.

AvaTradeGo

This is the standard AvaTrade platform and it is the one that offers us the most complete trading experience with the broker, offering exclusive services such as AvaProtect, live news, etc.

This platform needs to be downloaded and can be used on any software device such as a PC, laptop, tablet, or mobile/cell phone. It gives access to more than 1,000 instruments.

The market trends point is an exclusive technology of this platform, which is capable of measuring the general sentiment of the clients and making it available to everyone, in order to see what people are buying or selling the most.

The fact that it is not a platform with advanced features makes it simple since it has all the necessary orders for the most demanding operations. There is access to charts, technical indicators, stops, limit orders, and much more.

Metatrader 4

In addition to its proprietary platforms, AvaTrade offers the well-known Metatrader 4, the most famous platform in the world by far and which is highly appreciated in Forex and especially in algorithmic trading circles, since its inception it focused on market-related programmers for the ease of creating and plugging automated trading strategies into it.

This is one of the most comprehensive and used trading platforms in the Forex market sector. It is a downloadable application that offers multiple tools for market analysis, including advanced charts with dozens of built-in technical indicators among other technical analysis tools. Also, this platform allows the creation, evaluation, and implementation of automated trading systems known as Expert Advisors, designed to trade automatically in the Forex market.

Like Ava’s proprietary platform, it can be used from any software device.

MetaTrader 5

This platform is the older sister of Metatrader 4 and is designed to cover the shortcomings of the previous one, especially in relation to being able to offer stock, futures and options trading and with a more complete offer of stock CFDs.

Metatrader 4 is better, however, in algorithmic trading since its use continues to be more widespread, which makes many algorithmic traders decide to continue using MT4, since it is not easy to transfer automated strategies to MT5 without great effort.

With Metatrader 5 you also have access to advanced functions as:

- Expert Advisors

- Custom indicators, being even more than those in MT4

- Script

- Libraries

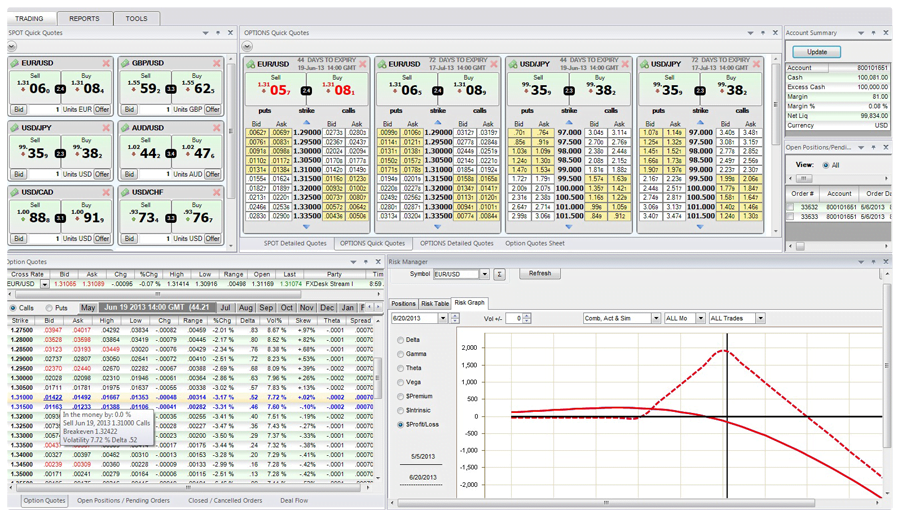

AvaOptions

This is a very important platform of AvaTrade because it is designed to offer its service of vanilla Forex options trading with more than 40 pairs. With these contracts, traders have the possibility to buy call or put options with different time maturities.

It is a web-based trading platform designed to trade with OTC Forex options (Vanilla Call and Put Options) based on many currency pairs over a range of expiries. This application has a user-friendly interface that includes a Strategy Optimizer that allows the trader to design a complete strategy based on options. It also includes a Risk Manager to analyze the net risk of a portfolio and explore how different trades could impact a position. AvaTrade offers options with expiries from one day to one year. More information about this platform through the following link:

It is a very powerful platform with functionality worthy of vanilla options trading in centralized markets and with excellent market depth, giving the possibility of trading 1, 2, 3, 6 and 12 week contracts and even options with monthly maturities.

More information on Avaoptions here: Options Trading Platform Avaoptions

Mobile trading

All Avatrade platforms can be accessed from mobile devices and from the web, including the Metatrader and AvaTradeGo platforms.

These platforms offer applications on Google Play or the App Store, from where they can be downloaded.

Mobile trading is becoming more and more popular and we believe it will become even more popular in the future as Wi-Fi technologies improve further.

Avatrade Autotrading Options

In addition to being able to do automated trading through Metatrader 4, Avatrade gives its clients direct access to two of the most popular copy trading services in the world of online trading, such as DupliTrade and Zulutrade.

The first requires a Metatrader 4 connection, while the second allows a direct connection with Avatrade.

Zulutrade is one of the most consolidated in the field of Forex Autotrading. Thus, the clients of AvaTrade have the option to trade in different markets using trading signals that are automatically executed in their accounts through the main platforms of the company. These signals are generated by real traders associated with Zulutrade, among which we find real professional traders in the market. The customer can choose the signal providers that he considers most profitable, integrate his account with Zulutrade, and allows the automatic execution of the trading signals produced by these providers through the trading platform.

- AvaTrade customers can follow in real-time the transactions performed by selected traders according to their trading strategy and performance in the market. In this case, Zulutrade offers the ability to select one or more traders and copy their trades which are executed as automated trading signals in the AvaTrade customer accounts. In this case, this social network for traders allows checking the performance of all affiliated traders so that the member can select only the most profitable.

Commissions and spreads

Avatrade is a broker that operates without commissions and therefore they are included in the spread.

Instrument | Spread | Leverage UE | Leverage (clients outside UE) | Minimum lot |

EURUSD | 0.9 (1) | 30 | 400 | 0.01 |

GBPUSD | 1.6 (1.8) | 30 | 400 | 0.01 |

USDJPY | 1.1 (0.9) | 30 | 400 | 0.01 |

AUDUSD | 1.1 (1.8) | 30 | 400 | 0.01 |

Oro | 0.34 | 20 | 200 | 1 |

Petróleo | 0.03 | 10 | 100 | 10 |

DAX30 | 2 | 20 | 50 | 0.50 |

SP500 | 0.50 | 20 | 200 | 1 |

Nasdaq100 | 1.75 | 20 | 200 | 1 |

IBEX | 4 | 10 | 50 | 1 |

Bitcoin | 0,20% | 2 | 25 | 0.10 |

Ethereum | 0,24% | 2 | 20 | 1 |

AvaTrade does not charge commissions but is compensated on the spread, that is, on the difference between the bid and ask price.

The data in parentheses next to the current spreads is the spreads from the last time the analysis was done so we see that AvaTrade has improved its trading conditions lately.

The conditions of Bitcoin and cryptocurrencies, in general, are quite attractive, with quite good spreads compared to other brokers. Although yes, you have to count on variations according to market conditions.

More information on Avatrade commissions and fees in: Avatrade Broker Commissions

Market information and analysis resources of Avatrade

CFD Futures Roll List

AvaTrade is a broker that offers futures CFD trading, which means that these contracts have to follow the expiry structure of the futures markets that are traded on centralized exchanges. This means that the CFDs have to replicate the expiry date of said futures and then reopen them in the next period. Many of these futures expire on a monthly basis while others expire more in the long term.

Economic calendar

This broker also provides a free economic calendar service on its website where we can see the economic data of the main countries in the world. This is always helpful for high-frequency Forex traders who are on the lookout for those times when volatility is highest. But be careful, as we have already commented on this website, it is very complicated trading.

AvaTrade has a market analysis section with technical analysis and fundamental analysis tools that are provided by Ava experts and can be consulted by the broker’s clients. That is, to be able to see these analyzes you have to register with Avatrade. In addition to news, we can see relevant information about the different markets.

AvaProtect

This is a custom tool from AvaTrade to protect against risks and make traders feel more secure in their trading, which is always dangerous when trading CFDs. This application offers protection for an amount of up to 1,000,000 euros and can be managed from the platform. This obviously adds an extra cost to the trade and should only be used in cases where you are sure of what you are doing. It is available in gold, silver, and Forex.

This application is not available for Metatrader but it is included in the other broker platforms, where the AvaProtect icon is already available. In these cases, if we click on this icon when we are going to trade with an instrument, Avatrade gives us the option to add that protection with a cost and a determined duration.

More information on this tool in the following article: Avaprotect of Avatrade

Education and Training Options at Avatrade

AvaTrade is a broker that has a series of training resources for novice (and not-so novice) traders to learn the most important concepts and strategies in the world of trading and investment.

The trading section for newbies has an extensive series of articles on various topics such as:

- What is Forex?

- What are CFDs?

- What is leverage?

- What is MetaTrader?

- How to read stock charts?

- What is Copy Trading?

- And many more

These articles are informative and introductory in general.

Ava offers a free Forex eBook if we sign up for its mailing list.

It also has a section of tutorial videos divided into 6 sections:

- Assets and tools: 12 videos

- Trading strategies: 11 videos

- Advanced trading tools: 14 videos

- Trading platforms: 7 videos

- Trade safely: 3 videos

- Beginner Lessons: 9 Videos

Minimum deposit

Once we have the account open, the next thing is to make the deposit, which has a minimum of 100 EUR or USD, depending on our region (the broker accepts GBP and other currencies as well).

AvaTrade does not charge deposit and withdrawal fees. Check with the particular method in case they charge us external commissions.

European clients have two methods of deposit and withdrawal which include bank wire transfer and credit/debit cards, while international clients can use other electronic methods, like Skrill, Neteller, and Webmoney. This is due to the strict laws of the Central Bank of Ireland.

Payment Options

The clients of AvaTrade can deposit and withdraw funds through bank wire transfer, credit card (the most important like VISA and Mastercard), Paypal, Skrill, Neteller, Webmoney, and Western Union.

Also, the client has the option to withdraw money through a debit card offered by AvaTrade called Ava Mastercard. This debit card was created by this broker in conjunction with Payoneer, a company property of Mastercard.

Customer service

Customer service is one of the most important points when choosing a broker. For some clients, there is not much of a problem as long as the broker provides a good trading service in general, but others have high expectations of communication, especially in cases where problems with live trades may arise.

AvaTrade is a broker that has a large number of channels to maintain communication with its clients. These channels are available from Sunday at 21:00 GMT to Friday at the same time, resting on the weekend.

The main contact methods are:

- Contact form on Avatrade website

- Direct web chat

- Telephone

- General number: +353766705834

- Instagram: avatradeofficial

- Youtube: AvaTradeTV

- Twitter: avatradelatam

Main Offers of AvaTrade

Review of Avatrade – Conclusion

After reviewing what is stated in this article, we can conclude that our opinion about AvaTrade coincides with the opinions of other users that we have found:

- AvaTrade is a perfectly regulated and legally established broker.

- It offers a good variety of trading platforms, for different devices and operating systems.

- In addition to Forex and CFDs, it also allows you to trade vanilla options.

- It has good customer service, complete and in different languages.

- It could improve by shortening the processing times of withdrawal requests.

- The list of assets available to invest can be expanded, it offers few indices and shares. However, it offers a range of different markets in which the trader can find investment opportunities.

As you can see, AvaTrade has aspects in which it stands out positively and others in which it can improve. If you want to try this online broker for yourself, you can open a real account or open a demo account with up to €100,000 of virtual money to practice.

| Company | AvaTrade is a trademark property of the company Ava Capital Markets LTD. |

|---|---|

| Minimum account size | $100 |

| Maximum leverage | 1:400 |

| Spreads (Forex) | It offers fixed and variable spreads from 0.9 pips for major currency pairs like the EUR/USD. |

| Link to website |

FAQ – Additional questions

What type of broker is AvaTrade?

AvaTrade is a market-maker type broker. This is something that many people do not like but in reality, it is the main business model in this sector because even ECN brokers use other market makers to get liquidity. So in the end we have to trust that our broker is trustworthy. The main thing here, as always, is the issue of regulation.

Is it a safe broker?

There is no fully secure broker or company in the world. Even General Motors went bankrupt and had to be bailed out back in the day. AvaTrade is also not exempt from risks due to its inherent business activity. However, it is one of the most serious brokers out there and has been delivering services for many years. In addition, there is an important detail and that is that it is directly regulated by the Bank of Ireland, a totally strict and serious institution, on a par with any other world central bank.

Can you scalp with AvaTrade?

Yes, in theory, there are no limits to the trading strategies that can be used with this broker. At the moment we have not found limitations in this regard. The tricky part will be being able to craft a winning scalping trading strategy. This is very difficult for the retail trader, if not almost impossible. That is the reality of trading. The typical retail trader would be better off trading more in the medium term, with longer-lasting trades.

Is AvaTrade a scam?

Many people wonder if this broker might be a scam and for good reason. In the world, there are always scams everywhere and you have to make sure that the company with which you are going to trade is legal. In the case of Ava, we can say that it is not a scam because it has been offering services at the highest level on all continents for 15 years, and it is regulated by very important institutions such as the Bank of Ireland or the Australian ASIC.