What is a broker market maker?

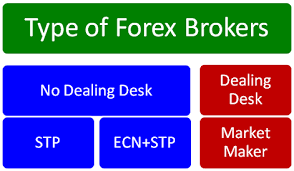

The Market Makers are brokers in which the buy or sell transactions of financial instruments (currencies, stocks, indices, commodities, crypto, …) that their client’s request are not made directly in the market but at the broker’s trading desk of the broker itself (therefore the Market Makers are brokers with trading desk and that’s why they are also called DD or Dealing Desk). In other words, the broker creates the market for its clients and, in many cases, acts as the counterpart in the client’s transactions.

Market makers brokers create an internal market for their clients and allow them to buy or sell at any time without having to wait for a transaction in the opposite direction to make the trade. Market Makers are always prepared to offer a buy price (bid) and a sale price (ask) for each financial instrument they offer, so the trader can execute his operations at any time and with the volume it deems convenient.

In the case of brokers without a trading desk (which are called Non Dealing Desk or NDD) that sends all client’s transactions directly to the market, when an investor places a buy or sale order they must find someone who accepts that order at that moment, and although Forex is a huge market, it is not always possible. In the case of Market Makers when a customer places a buy or sale trade, they always try to find, within their trading desk, another order from another customer that compensates the client’s order for its execution but in case that order is not found, the broker himself is in charge of its execution, acting as a counterparty and ensuring liquidity and permanent availability for all trades, even if a transaction involves a profit or a loss to the broker himself.

For this reason, there may be a conflict of interest between the broker and its clients, since it does not only act as a mere intermediary but also as a counterpart of the trades. It is therefore very important that, especially in the case of Market Makers, work with reliable brokers, authorized and regulated by important regulatory bodies (such as the FCA, the ASIC, …) that ensure investor protection and a policy of transparent order execution by the broker.

Most market makers brokers apply a spread (difference between the bid price and the ask price) slightly higher than brokers without a trading desk such as ECNs. This is a compensation for the risk of having to cover many trades but at the same time, this makes these brokers less attractive to traders who perform a large number of short-term trades such as daytraders or scalpers.

Advantages of Market Maker Brokers

– The great advantage of the Market Makers is that they represent a very agile form of investment and ensure at all times the availability to execute trades in any financial instrument offered by the broker (currencies, commodities, stock indices, shares, …)

– In market makers brokers clients can open a trading account with a small deposit, their trading platforms are usually very easy to handle especially for beginners, and generally also allow a greater leverage.

– The buy and sale prices (bid and ask quotes) tend to be more stable and less volatile than those offered by brokers without a trading desk (NDD or Non-Dealing Desk).

– Market Makers can offer much smaller trade sizes than standard lots (in the Forex market the standard lot is 100000 units). In this way, retail traders can invest with less capital in mini lots or micro-lots.

– Until relatively recently, only large banks, financial institutions, and wholesale investors could invest in Forex and other financial markets. Thanks to the emergence of Market Makers the possibility of trading in these markets is within the reach of any retail investor. Nowadays anyone can open an account in an online broker and start investing easily from home with an Internet connection or from anywhere with a mobile phone or a tablet.

To know which are the best market makers brokers we recommend you to visit our following comparative table and the analysis of each boker:

| Broker | Regulation | Minimum deposit | Broker Review |

|---|---|---|---|

| XM | -CySEC -ASIC | $5 | Review |

| Avatrade | –ASIC -Bank of Ireland -FSA of Japan | $100 | Review |

| EasyMarkets | -CySEC -ASIC | $100 | Review |