Key facts:

- Payoneer blocked funds affiliated with “Prepaid Mastercard” cards issued by Wirecard.

- The event reminds us of the typical phrase of bitcoiners “Not your keys not your money”.

Freelancers are constantly concerned about their money and it is understandable, with cases like the one that just happened with Wirecard and Payoneer. What could be one of the biggest financial scandals in Europe in recent years has become a lesson for freelancers, where Bitcoin could come out on top.

But before we start talking about the benefits that Bitcoin offers for freelancers, it is necessary to delve into the twists and turns of a controversy that has exploded in the heart of Germany. Wirecard is a payment processor with 20 years of experience, initially offering services to gambling and pornography websites. Over time it became increasingly specialized in digital payment methods, even issuing crypto debit cards.

Wirecard was known as “Germany’s Paypal”, being one of the most recognized financial companies in the country and the darling of the stock market for many years. But everything collapsed when in June the firm declared that it had “lost” some 2 billion dollars in bank accounts located in the Philippines.

Markus Braun, who was playing the role of CEO at Wirecard, resigned after the scandal was uncovered. Shortly after, the company reported that it was bankrupt. What at first appeared to be poor business administration, ended up revealing itself as a complex case of corruption and fraud. Braun was therefore arrested by the German authorities.

A thorough investigation by Ernst & Young (EY) confirmed that Wirecard had inflated all of its sales and profits in the past decade. In addition, the company accounted for the cash in the accounts managed by its trustees as a cash balance available in its financial statements. As if that were not enough, even the alleged bank accounts in the Philippines – where the 2 billion dollars were said to have disappeared – turned out to be just false documents.

All this gruesome history has also spilled over to Payoneer, a digital payment processor that works in more than 200 countries and has some 40 million users. Payoneer worked closely with Wirecard to issue the Payoneer Prepaid Mastercard, which was suspended by the company in consideration of the requirements of the Financial Conduct Authority (FCA).

The suspension of these cards led, in turn, to the freezing of the funds of all users who used them to withdraw their money. Although the freeze is “temporary” and Payoneer claims that their clients’ money is “protected”, a large number of freelancers using this platform will now not be able to withdraw their funds or receive new payments indefinitely.

They can buy Bitcoin and other cryptocurrencies with fiat money through credit card and Skrill on the CEX.IO exchange. More information in: Review of CEX.io crypto exchange

The tragedy of freelancers

Wirecard and Payoneer open another dark chapter in freelancers’ experience with digital payment methods, where freezing funds and suspending services is a common experience. No wonder these freelancers tend to have multiple accounts on different platforms where they divide their money to avoid losing access to all of their savings.

The irony of this matter is that this money is theirs, it belongs to them. However, freelancers have resigned themselves to accepting that their life savings and salaries are not in their possession, but in the hands of large companies that may stop working overnight. Always with the notion that a guillotine hangs over their heads and that, at any moment, the day may come when they will have to lose access to their own money.

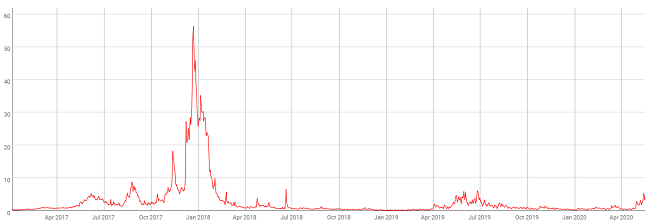

The situation is made even more dramatic by the coronavirus pandemic, when work at home is the norm and the digital world is taking its piece of the cake. However, the employees of tomorrow, those connected to the world from their homes, remain just as unprotected or even worse. Reduced to local banks, which in many cases do not accept international payments, or to volatile payment platforms.

In the case of freelancers who live in countries that are blocked or in very precarious economic situations, such as Venezuela and Pakistan, the cocktail becomes toxic. Payoneer’s freezing of funds has left thousands of workers in these countries uncertain whether they will ever be able to access their money or even receive more payments on this platform. Both countries do not have the option to withdraw their funds through bank accounts, so their users depended to a greater or lesser extent on the Wirecard card.

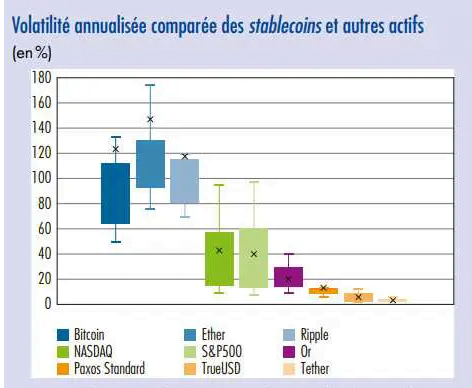

In the midst of this hopeless scenario generated by Payoneer and Wirecard, alternatives such as Bitcoin and other cryptocurrencies are a breeze of fresh air. Satoshi Nakamoto devised Bitcoin under the concept of eliminating intermediaries, allowing each person to enjoy true sovereignty over their money. This feature is what could change the sad story of freelancers.

Not your keys, not your money

One of the most repeated principles in the cryptocurrency ecosystem is “Not your keys, not your money”. Although it may sound heavy when the whole community repeats it to exhaustion, the truth is that it is a lesson that we should never forget. There is nothing more important than being the sole owner and manager of our money, because this way we avoid cases of account suspension and freezing of funds.

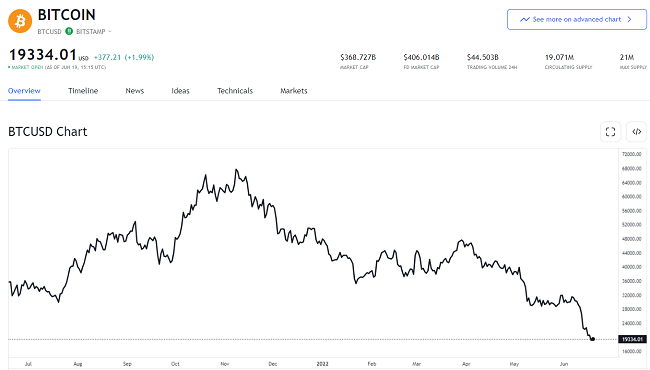

I will speak from my experience. I have more than five years working as a freelancer, and two accepting bitcoin as the only method of payment. Not everything has been perfect, of course, when the network is congested for a day or two I have to arm myself with patience. Very high commissions when I am in a hurry make me cry and I have learned to protect my bitcoins very hard. But when someone asks me how I get along with bitcoin, and I make a count of how the cryptocurrency has treated me, I always say: “Wonderfully.”

On the other hand, I also have friends and acquaintances who have used platforms such as Paypal or Payoneer for years. I have been a faithful witness of their concerns, of those days when their accounts have been temporarily or indefinitely suspended. Also from their contingency plans, how they often lose a lot of money exchanging digital dollars for national currency. In short: I have witnessed more than a financial tragedy and its personal consequences. And I always recommend bitcoin as an alternative, because I trust this and other cryptocurrencies but also because there are provable reasons to trust.

Bitcoin is not a company, nor is it a centralized entity that guards your funds. If the user makes a good choice of cryptocurrency wallet, that is decentralized and instantly generates their own private key, then that money will belong exclusively to him. That money will be so yours that you will even have to deal with other types of problems, such as losing access to it or losing the recovery words. No one else will manage the money for you, because you are the only one who has access to those bitcoins.

It is true (although very rarely) that hacks can occur; armed robbery can also occur. However, your exposure to a corruption case like Wirecard’s is greatly reduced if you don’t use cryptocurrency exchanges or custodial wallets to safeguard and access your money. The more decentralized (and personal) the management of your bitcoins is, the less exposure you have to your funds being frozen or your accounts suspended.

Bitcoin provides freelancers with protection against censorship and abuse of power, since each user can own their keys, so each person owns their money. And that’s the lesson we should learn when cases like Payoneer and Wirecard happen.