- Bitcoin does not perform the functions of the currency well, according to the French central bank.

- The so-called stablecoins and CBDCs are also addressed in the study.

The central bank of France states in its most recent newsletter, dedicated to means of payment, that Bitcoin has not fulfilled its initial proposal to “replace legal currencies.” In the document entitled Digital currencies: from myth to innovative projects, the Bank of France also addresses stablecoins, as well as the experiments carried out by that institution with the digital euro.

The French central bank report also highlights the use of bitcoin as a “speculative investment” and to “make payments under a pseudonym, which helps protect privacy, but also facilitates the financing of criminal activities.” He even goes so far as to call Bitcoin a “pseudo-currency.”

The author of the document is Christian Pfister, belonging to the General Directorate of Financial Stability and Operations of the Bank of France. Pfister includes in the bibliography four sources of his authorship, all on the topic of central bank digital currencies (CBDC).

In addition to three newspaper articles, there is a reference to the document The central bank digital currency, published in January this year by the Bank of France. This allows us to infer that the author of this study is a key figure in the design of the bank’s policies on the digital euro.

In general, Bitcoin does not fulfill, or does so imperfectly, the three functions attributed to the currency. It is neither a unit of account (it does not serve, or does little, to determine the prices of goods or services, particularly those of labor or capital), nor a transaction instrument (very few goods or services are paid in bitcoin ), nor a store of value (its price against legal currencies is very volatile for that).

Bank of France, Digital currencies: from myth to innovative projects.

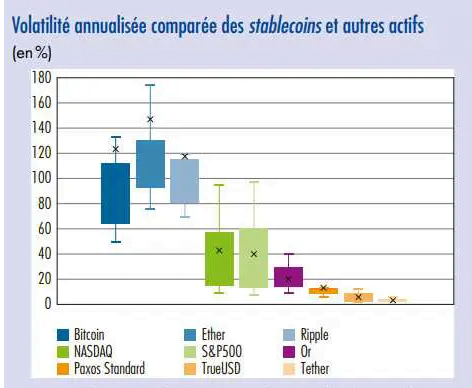

The volatility of bitcoin, and that of cryptocurrencies in general, has been a recurring argument by governments and central banks to oppose its use as alternative currency. The report gives details on the volatility of bitcoin, using figures from November 2019 to May 2020, compared to other financial assets and indexes.

With the figures for the mentioned period, bitcoin exhibits the highest volatility, followed by ether and XRP. As shown in the chart, the Nasdaq and S&P 500 indices follow in descending order of volatility, ahead of gold.

It is notable that three stable coins pegged to the US dollar are included in this comparison, Paxos, TrueUSD, and Tether; since by the design of these currencies anchored to the dollar, this metric must be kept in low values to fulfill its purpose. Stablecoins, along with Central Bank Digital Currencies, is referred to in the report as innovative projects that attempt to fix the shortcomings of their predecessors.

Bitcoin’s volatility, measured in more recent periods, reached record lows, especially between May and July of this year.

The report also referred to the experiments carried out by the Bank of France with a central bank digital currency, for the settlement of digital financial securities issued by the Societé Générale. There will be other tests in this second semester based on a consultation carried out among other organizations, according to the document.