- Tether dominates among stablecoins in terms of bitcoin trading volume.

- Coinbase remains the leading cryptocurrency exchange for bitcoin in terms of trading volume.

On June 2 Coin Metrics released a report explaining various relevant facts about bitcoin market volumes.

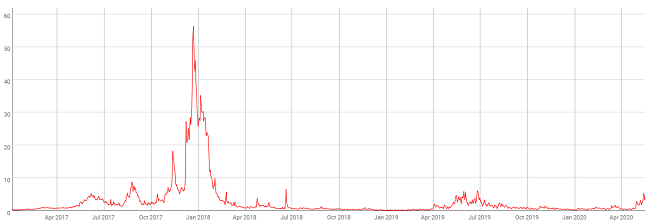

Given the growing institutional interest in bitcoin, Coin Metrics decided to study the subject from the perspective of an institution that considers entering the market, distribution and size of bitcoin volume in various markets. The data expressed in that report was taken from the bitcoin market records in May 2020.

Coin Metrics made a graph showing that most of bitcoin’s spot trading volume is distributed among Coinbase (USD 186 million), Bitstamp (USD 121 million), Bitfinex (USD 86 million), and Kraken (USD 85 million) . Among the 4 exchange mentioned is 95.6% of the trading volume of the spot market. As explained, this shows that institutions must wait to go through a process of incorporation through multiple exchange houses. This only if they plan to access the full spectrum of trading activity.

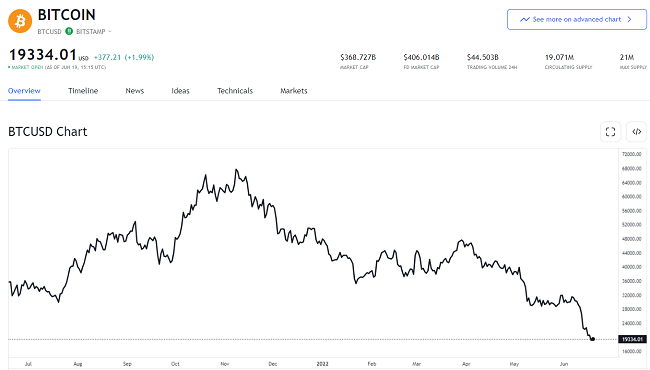

Additionally, Coin Metrics estimated the free float market capitalization for bitcoin to be $136 billion. A free-floating market implies that any government will refrain from manipulating it, so the price is set by supply and demand. According to the study, the mentioned market capitalization is similar in size to that of the largest companies on the United States stock exchange.

On the other hand, the report explains that the market trading volume for bitcoin positions is 500 million dollars a day.

US dollar dominates bitcoin trading volume

Regarding the distribution of bitcoin trading volume among the main fiat currencies, the US dollar represents about USD 539 million, then there is the Japanese Yen with about USD 380 million and third is the euro with about 166 million. In fourth place is the Korean Won with USD 59 million and in last place we have the British pound with 17 million.

Another highlight was the distribution of stablecoins in terms of bitcoin trading volume. The Tether completely dominates with about USD 2.192 billion, second is the Binance USD with about USD 65 million, and thirdly the USD Coin with about 44 million. The Paxos Standard comes in fourth with about 6 million, followed by TrueUSD with 6 million, and last is HUSD with $3 million.

One of the largest sources of bitcoin volume is the perpetual futures contract market. Binance takes first place with a volume of 2,596 billion, followed by Huobi with 2,531 billion, and third is BitMEX with USD 1,608 billion. Bybit took fourth place with $924 million, and OKEx came in last with $ 474 million.

The report also reveals that bitcoin volume is small compared to the largest assets in the US market today. All bitcoin spot trading markets represent a volume of $ 4 billion. While all the North American spot markets add up to a volume of USD 446 billion, the volume of the bond markets is around USD 893 billion, the global Forex market handles a volume of USD 1,987 billion.

Bitcoin trading volume is highly fragmented

The report concludes that the fragmentation of the trading volume of the most important cryptocurrency prevents a direct assessment of the market size. That is why the institutions that wish to enter this market must examine the landscape, and consider the different exchange houses, markets and assets available to carry out transactions.

Trading tethers or using perpetual futures contracts can have a tremendous impact on assessing bitcoin trading volume and liquidity. Despite any decision that institutions make, bitcoin’s trading volume has experienced exponential growth. If this growth continues, bitcoin could grow at levels similar to that of the main assets of the US market.

The bitcoin market registered a higher daily trading volume in April. Most of the traded volume was done through premier platforms such as Binance. On the other hand, it was also learned that Africa exceeded for the first time the Latin American bitcoin trade volume in Localbicoins and Paxful.