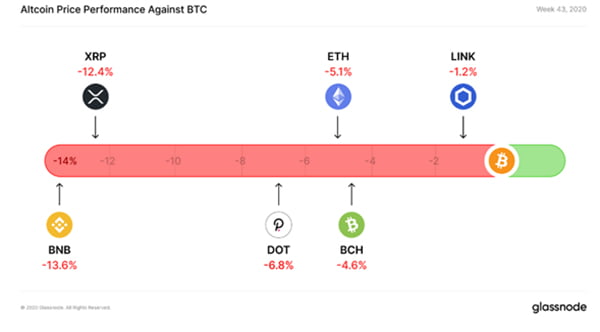

- Binance coin (BNB) fell over 13% compared to bitcoin.

- Only Chainlink (LINK) performed close to that of bitcoin last week.

The upward momentum that the bitcoin (BTC) price has experienced recently has spread, as it usually happens, to the rest of the cryptocurrencies in the market. However, while the major altcoins have risen in value against the dollar, the story has been different when compared to BTC.

In its most recent weekly report, published this Monday, the firm Glassnode highlights how the bull market has given a greater boost to bitcoin than to other major cryptocurrencies, including ether (ETH) from Ethereum, bitcoin cash (BCH), chainlink (LINK ), polkadot (DOT), ripple (XRP) and binance coin (BNB).

During the past week, bitcoin increased about 14% against the dollar. In that same period, LINK appreciated more than 12%, while BCH and ETH had increases of at least 8%. DOT, with 6.1%; and XRP (4.3%) also appreciated against the dollar in that period. Of the list studied by Glassnode, only BNB performed negatively in those 7 days.

However, against bitcoin, all of the aforementioned cryptocurrencies had losses. BNB and XRP especially, with drops of more than 13% and 12%, respectively. The least loser on the list was LINK, which lost 1.2% of its value compared to BTC.

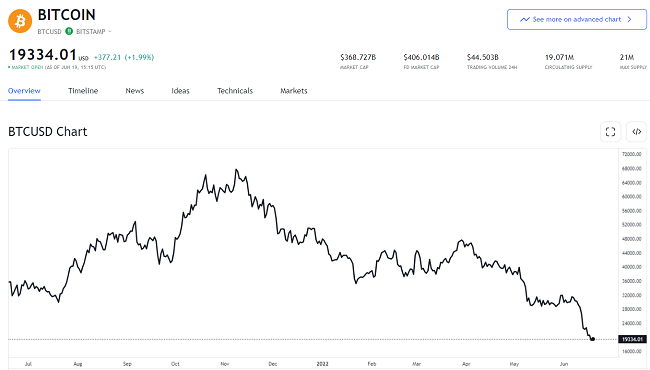

Precisely, during the last week the price of bitcoin experienced a significant rise. Apparently, the news that PayPal will include cryptocurrencies on its platform served as a boost for BTC to exceed $ 13,000 and even approach $ 13,800 at times.

Bitcoin outperforms traditional markets

The performance of bitcoin has not been remarkable this week alone, clearly outperforming the major altcoins in the market. So far this year, BTC has also outperformed traditional markets, with a higher rise than equity indices, precious metals and stocks.

As ForexDominion reviewed last Friday, the closest thing to the increase in bitcoin in percentage terms has been the revaluation of Google. While BTC is up around 80% in 2020, the company’s shares are up 70%.

Gold and silver are up more than 50%, getting a bit close to BTC’s performance. But indices like the S&P 500, with just 6% appreciation this year; or the Nasdaq (30%) have clearly underperformed bitcoin.

Bitcoin has been decoupling from the behavior of traditional markets. This, after the fall caused by the pandemic in March was followed by high levels of correlation between BTC and gold, and even the S&P 500.