What is hedging?

Hedging involves making an investment in order to reduce the risk of an adverse movement in an asset in which has been made the main investment. A typical example of hedging in Forex would be, for example, buying EUR/USD as main investment and cover with a buy position in USD/CHF because these two pairs have a high negative correlation and buying USD/CHF reduce the risk of a buy position in EUR/USD as our main investment.

The Hedging is a practice that every trader should know as a possible method of protection and risk management. Throughout this article we will see what the hedging is, how it works and what hedging techniques are most commonly used by traders.

The best way to understand hedging, in my view, is to think of as insurance. When hedging is done is like an insurance against situations contrary to the expected. But do not mistake, this is not a safe place to prevent the occurrence of unexpected and negative situations but is done to reduce the impact of this situation on our portfolio of positions. This means carrying out strategies using financial instruments and tools available in the market to offset the risk of a position, that is, investors do hedging respect of an investment with another compensatory investment. Portfolio managers, investors and individual traders, corporations or banks use hedging techniques almost daily to reduce the risk exposure.

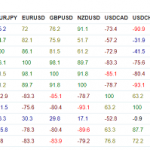

Technically, to make a coverage, we should invest in two assets with negative correlation. For example, we buy EUR/USD and hedge by buying USD/CHF. These two currency pairs have a high negative correlation, so if you buy EUR/USD and this trade goes wrong, ie, EUR/USD is going down, it’s likely that the USD/CHF goes upward so buying USD/CHF reduce losses with the buying in EUR/USD. Note that by making two investments we pay double commission or spread, one might say that this is the cost of our insurance.

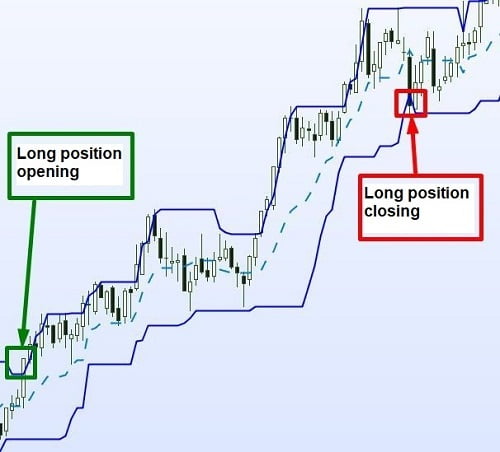

We have talked about the use of hedging (hedging positions) as a risk reduction strategy, and as long as the risk is reduced, the potential gains are also reduced. That is why I would like to stress here that the hedging is not a trading strategy in itself, as you can see and read on many websites, that is, is not a strategy for profit. It is a strategy to reduce the risk and potential losses to which we are exposed when we opened a position in the market. If our investment goes well, the hedge position will reduce the profits that could have been obtained, but if our investment goes wrong, the hedge position will reduce the losses.

How to apply the hedging in Forex?

There are several techniques to hedge and protect our investments among which we can choose the one that is most comfortable. These methods can be used when things are not going as we think or when we have doubts about what the market is going to do. And in trading, the most important thing is always to control the risk. With good risk management the gains will come sooner or later.

For example, one of the most popular and used techniques for hedging in Forex is to make two investments in two negatively correlated instruments (like the previous example between EUR/USD and USD/CHF), and another is the use of derivative financial instruments, and among them the most common are options and futures (see currency futures and futures contract). A financial option is a contract giving the right, but not the obligation, to buy or sell a security (underlying asset) at a predetermined price before the agreed expiration date. The option may be call (buy) or put (sell). Meanwhile, the future is a contract that binds the parties to buy or sell the underlying asset at a future date and at a previously agreed price.

We will not elaborate how financial derivatives products work in this article but we think that with this brief definition you can understand how would be used in a hedging strategy. Investment losses will be offset by gains in a derivative product. For example, suppose you make a purchase in GBP/USD since according to your analysis you think the currency pair will go up but you are worried about certain economic news from the UK that can cause losses in the GBP/USD, so you buy a put option on the sterling as coverage of the trade. If the GBP/USD falls below the price at which you bought, the generated losses will be reduced by gains from the put option. Hedging positions can be made in many different instruments, for example, an investment in oil can be covered with an investment in currency, an investment in a textile company can be covered with an investment in cotton if this is the raw material of the textile company, etc, etc.

As I mentioned earlier in the article,hedging in Forex has a cost. Therefore before making a coverage you must be clear about the benefits that you can make given that it is not a strategy to get money but to reduce risks and protect ourselves from possible losses. For example, if you make two investments in two pairs of negatively correlated currency, you pay the spread or commission of both positions and the benefits for the main position are reduced to. If you buy an option you must pay the cost of the contract, etc. Also keep in mind that hedging is not intended to fully compensate for any loss of a position, if so the benefits if the main position generate earnings could be reduced to zero by the hedge.

Most traders never will operate using derivatives and may not even us use any hedging strategy but I think it is important to understand, albeit at basic level, how works the hedging to understand certain aspects of the market, which is always good and to make us best traders.