The original name of the VIX Index is the “Volatility Index,” and it was created by the Chicago Board Options Exchange (CBOE) in 1993. It was designed to measure the market’s expectations for short-term volatility. Volatility is a concept that helps measure the uncertainty of a market or a specific asset in a simple way, but this does not mean it measures risk.

VIX Index: What Is It and How to Use It?

The VIX Index is also known as the “fear index” because it helps traders understand market sentiment, which can range from fear to optimism. In fact, it can be said that an index is a statistical measure that describes changes in a portfolio of stocks within a specific market sector.

Thus, it is a mathematical tool used by investors and financial managers to analyze and compare specific market characteristics. Volatility indices measure market volatility expectations based on options prices, and among these, the VIX is the most widely used.

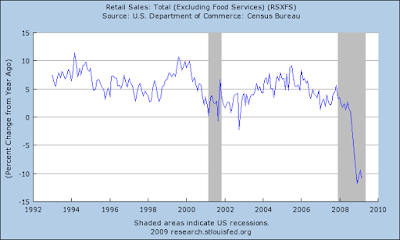

The VIX is an instantaneous measure of the market’s implied volatility. However, it is not retrospective and therefore does not measure recently realized volatility. The VIX is implied in the current options prices of the S&P 500 Index and represents the expected future market volatility over the next 30 calendar days, reflecting the level of concern among investors.

How Does the VIX Index Work?

The VIX increases in value as more investors purchase put options on stock indices. Conversely, it decreases when a larger number of investors buy call options on the same index.

The VIX is the first benchmark index for measuring market forecasts of future volatility. It is based on the call and put options of the Standard & Poor’s 500 Index (S&P 500), considered the main indicator of the U.S. stock market. The S&P 500 tracks the performance of a portfolio composed of the 500 largest U.S. companies by market capitalization traded on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX), and NASDAQ.

Why Is the VIX Index So Important?

Here are the main reasons why the VIX Index is considered of interest to investors:

- It is important because it is a real-time market index that represents the market’s volatility expectations for the next 30 days.

- Investors use the VIX Index to measure the level of risk, fear, or stress in the market when making investment decisions.

- Portfolio managers can also trade the VIX using various options and exchange-traded products or use VIX-based instruments to value derivatives.

- The VIX Index is popular because it allows investors to hedge their investments. They can purchase put options on the index to avoid losses from a potential price decline. Therefore, if investors’ concerns about possible price drops increase, the demand for put options rises, which in turn drives up their prices.

VIX Volatility Index: How Is It Calculated?

Volatility can be estimated using two different methods:

- Historical Price Calculations

The first method involves performing statistical calculations on historical prices over a given period. This process includes calculating several statistical figures, such as mean variance and, ultimately, the standard deviation from historical price datasets. The resulting standard deviation value serves as a measure of risk or volatility. To predict volatility for the coming months, a commonly followed approach is to calculate it for the past months and assume it will follow a similar pattern. - Implied Volatility in Option Prices

The second method for measuring volatility is to infer its implied value from option prices. Options are derivative instruments whose price depends on the probability that the price of a specific asset will move enough to reach a certain level (called the strike price).

VIX Value: Investor Anxiety Level

VIX index values above 30 are generally associated with high market turbulence or volatility, indicating increased uncertainty and investor concern, potentially leading to fear or even panic for levels above 45. In contrast, values below 20 typically correspond to less stressful market conditions and suggest growing optimism.

The following table shows the level of investor anxiety as the VIX value changes.

| Value | Anxiety Level | Value | Anxiety Level |

| 5-10 | Extreme optimism | 35-40 | High concern |

| 10-15 | High optimism | 40-45 | Extreme concern |

| 15-20 | Moderate optimism | 45-50 | Moderate fear |

| 20-25 | Slight optimism | 50-55 | High fear |

| 25-30 | Moderate uncertainty | 55-60 | Intense fear |

| 30-35 | High uncertainty | 60-65 | Extreme fear |

How to Invest in the VIX

Buying VIX ETFs

Another option to invest in the VIX is through ETFs. As you may know, this is a more passive, index-based investment approach. Some examples are:

| ETF | Ticker | ISIN |

| ProShares VIX Short-Term Futures ETF | VIXY | US74347Y8545 |

| ProShares VIX Mid-Term Futures ETF | VIXM | US74347W3381 |

However, these ETFs cannot be purchased from Europe.

Why Trade the VIX on the Stock Market?

VIX volatility index instruments have a strong negative correlation with the stock market, making them popular among traders who use them for diversification or hedging purposes. By opening a position in the VIX, you can offset other open positions in equities and hedge your exposure.

For example, suppose you’ve opened a long position in the shares of a U.S. company that is part of the S&P 500 Index. Even if you believe this stock is a good long-term investment, you may want to reduce your exposure to short-term volatility. In this case, you might enter a long position in the VIX, expecting volatility to increase. By making such trades, you could offset your positions.

If your predictions are incorrect and volatility does not rise, your losses on the open VIX position might be offset by gains in your other open trades.

Finally, remember that the VIX measures the implied volatility of the S&P 500 Index (SPX), derived from SPX options prices, and is calculated and published by the Chicago Board Options Exchange (CBOE). Additionally, since the S&P 500 is considered a leading indicator of economic conditions in the U.S. stock market, the VIX was created to measure the implied volatility of U.S. stock indices.