| HFM (HF Markets)

| – ECN/STP broker from Europe specialized in Forex and CFD -Regulated by organizations such as CySEC -Tight spreads and low commissions |

HF Markets – Broker Review

HFM is an ECN/STP Forex broker which offers the possibility to trade in the Forex market with dozens of currency pairs, precious metals like gold and silver, and other financial instruments like Contracts for Difference on indices, stocks, and commodities.

This broker offers many trading solutions for retail traders and institutional clients, including various types of accounts and platforms. Also, the clients of HFM Markets have access to other services such as solutions for copy trading, trading competitions, promotions for new and existing customers, and more. Currently, is one of the main brokers in the sector of retail Forex with thousands of clients around the world. In this review, we will cover the main services of this company.

Type of broker

- HF Markets (Europe) Ltd – CySEC (Cyprus Securities and Exchange Commission) of Cyprus: License number 183/12. (This means that HFM complies with the strict regulations on financial services imposed by the MiFID in the European Zone).

- HF Markets Limited – FSC (Financial Services Commission) of the Republic of Mauritius: License number C110008214.

- HF Markets (SV) Ltd – SVGFSA (Financial Service Authority) of Saint Vincent and the Grenadines: Registration number 22747 IBC 2015.

- HF Markets (SA) Limited – FSB (Financial Services Board) of South Africa: License number 46632.

The headquarters of the company are located in Mauritius and it has offices in other countries such as Cyprus, Spain, the United Kingdom, and Germany among others

- Forex market: HFM allows trading with 50 different currency pairs in the Forex market, from the most important pairs like the EUR/USD and the USD/JPY to others more exotic.

- Commodities: Gold, silver and oil in the spot market, which are the most important and traded commodities in the world.

- Indices: The most important Stock indices in the market such as the S&P 500, CAC 40, FTSE 100, and DAX 30 among others.

- Contracts For Difference: CFD based on the following underlying assets:

- Commodities of different types, including metals like platinum and copper, coffee, sugar, wheat, and others.

- Stocks of the most important stock markets in the world, including IBM, Goldman Sachs, Google, Boeing, Rio Tinto, HSBC, Lloyds, and many other

- Indices of the main stock markets in the world, including the S&P 500, FTSE 100, CAC 40, and DAX 30 among others.

- The main cryptos, including Bitcoin and Ethereum.

- Physical stocks*: HFM clients can now trade over 2,000 physical stocks from all major stock markets.

*More information on physical stocks in HF Markets in the following article: Physical stock trading in HFM

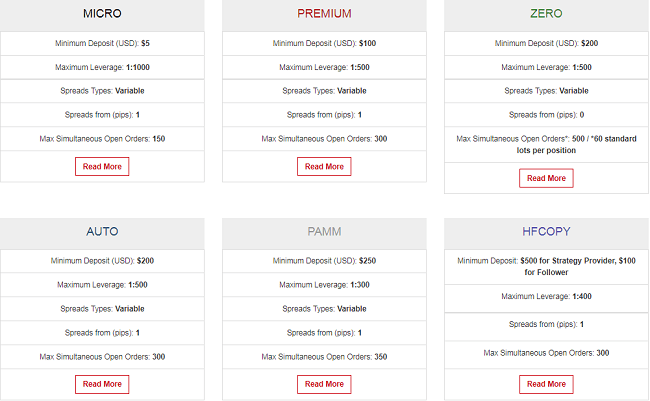

- Micro Account: This type of account is designed for beginner traders with little capital and experience in the market. It can be opened with a minimum deposit of $5 and does not charge commissions for customer trades. The Micro Account uses the Metatrader 4 trading platform and allows a minimum transaction size of 0.01 lots. It offers maximum leverage of 1:1000.

- Premium Account: This account is for traders with more experience and capital to invest in the market. It can be opened with a minimum deposit of $100 and does not charge commissions for customer transactions. The Premium account uses the Metatrader 4 trading platform and allows a minimum transaction size of 0.01 lots. The maximum leverage that it offers is 1:500 with variable spreads from 1 pip for major currency pairs. HFM offers a Premium Account version for PAMM accounts (trading accounts managed by professional traders). It also allows phone trading.

- Zero Spread Account: A type of trading account of HFM in which the broker charge particularly low spreads in the quotes that offer to its customers, even from only 0.0 pips for major currency pairs (for the EUR/USD the average spread is 0.2 pips). It is a low-cost trading solution suitable for all traders but is especially useful for scalpers, high-volume traders, and traders using Expert Advisors. Through the Zero Spread account, the trader can operate with extremely low interbank spreads, which are supplied by the largest liquidity providers without mark-up or additional margin. HFM gains come from the fees charged per transaction depending on the trading volume, which ranges from $4 per standard lot (major currency pairs) to $6 per standard lot (the other currency pairs). This account requires a minimum deposit of $200 and provides market execution with a maximum leverage of 1:500 and a minimum transaction size of 0.01 lots. This account uses the Metatrader 4, WebTrader, and Mobile Trading platforms and accepts all types of trading strategies.

- FIX Account: This is a trading account designed for traders who prefer to trade with fixed spreads regardless of market conditions. This type of account allows the trader to make decisions carefully calculated with respect to its transactions in the market based on specific conditions that allow the implementation of trading strategies with maximum control. The FIX account uses the Metatrader 4 and Webtrader trading platforms and allows a minimum transaction size of 0.01 lots. It offers maximum leverage of 1:400 with fixed spreads for transactions with currency pairs (Forex). Also, it offers telephone trading and works particularly well with Expert Advisors designed to operate with fixed spreads.

- VIP Account: These are trading accounts designed for institutional clients and big investors that trade with larger volumes of capital compared to the majority of individual traders and require optimal trading conditions. To open an account of this type the investor must deposit at least $40000. It offers ECN trading conditions with extremely fast execution and low spreads from 0.2 pips for major currency pairs. In this case, it charges a fee of $3 for each traded lot. The VIP account uses the Metatrader 4 trading platform and allows a minimum transaction size of 0.1 lots. The maximum leverage offered is 1:300.

- Auto Account: It is a specialized account that was designed to access the service of trading signals and copy trading that HFM created in conjunction with the MQL5 community, which offers hundreds of signal providers (traders) with trading systems of all types. The selection of signal providers and automated execution of trading signals is done through the Metatrader 4 and Webtrader platforms and applications for mobile devices. This account was created specifically for traders interested in automated trading as an option to trade in the financial markets. MQL5 has both free and paid signals providers (the customer must pay a monthly fee for using the signals from these providers). The Auto Account requires a minimum deposit of $200 and offers a maximum leverage of 1:500, a minimum transaction size of 0.01 lots, market execution, and low spreads from 1 pip on.

- Islamic Account: This is a trading account designed especially for clients belonging to the Muslim religion. For this reason, it is characterized by not including rollover normally charged by brokers to keep open a market position for a period longer than one day (overnight positions). The Islamic account can be opened with a minimum deposit of $150 and it does not charge commissions. This account uses the Metatrader 4 platform and accepts a minimum transaction size of 0.01 lots with a maximum leverage of 1:300. In general, it provides nearly the same conditions as the Premium Account.

HFM PAMM managed accounts service

Currently, this broker offers a PAMM accounts service for all customers (managed accounts to invest in the Forex market). These are accounts managed by experienced traders with years of experience in the market, which are responsible to make all transactions in the foreign exchange market (open and close positions) with equity formed with their capital and the money of the investors. PAMM accounts are an excellent option for investors interested in the Forex market but who lack the time and/or knowledge to analyze the market and trade successfully with their own money.

- HFM Metatrader 4: The most famous trading platform for the Forex market. This is a reliable application that offers a lot of trading tools for the experienced trader such as advanced charts, more than 30 built-in technical indicators, and many more. Metatrader 4 allows the creation, testing, and use of automated trading systems known as Expert Advisors. This user-friendly application offers fast execution and the interbank liquidity of HF Markets.

- Metatrader 4 Multiterminal: A platform based entirely on Metatrader 4 (which has all the capabilities of the MT4 terminal with greater functionality) which provides a suitable solution for professional traders and account managers who need to manage multiple trading accounts simultaneously. It is designed so that it can manage an unlimited number of trading accounts in real-time.

- Metatrader 5: This trading platform is the new version of the Metatrader platform family and includes new enhancements such as the possibility of trading currency pairs in the Forex market, physical stocks, CFD, futures contracts, and options (at the moment HFM does not offer futures or options) in a single interface. This allows the trader to build a more diversified portfolio and access more markets. Metatrader 5 also has more built-in technical indicators, more time frames for its charts (21 timeframes), the possibility of opening up to 100 different price charts at the same time, more order types, four types of execution, the new programming language of Metaquotes (MQL5) designed for programming indicators and EAs, and more.

- Hot WebTrader: It is a web-based trading platform with a user-friendly interface in a highly customizable trading environment. This application requires no download and installation and can be accessed from any place with an internet connection. It offers position management tools, updated quotes, price charts, and market analysis tools including technical indicators.

- MYFX: For customers who deposit in their accounts at least $2,000, the broker provides the MYFX platform, which is a powerful complement to the Metatrader 4 platform This application has a fully customizable and user-friendly interface and various trading tools such as execution with one click, default stop Loss and Take Profit, a function to close all positions with a single click, OCO functions and other.

- HFM RapidTrader FIX/API: It is an application based on Integral (a platform that provides direct market access through an ECN network) which is ideal for customers requiring direct market access with the best trading conditions and execution because they perform high-volume transactions. The types of clients that can use this application are corporations, brokers, hedge funds, and money managers requiring high trading capacities in real-time in the Forex market. This product provides direct market access for clients who are interested in using the FIX protocol and is ideal for traders who use advanced order types, quotes automated systems, automated trading systems that are not based on Metatrader 4, and order-routing management systems. To use this platform the client must deposit at least $100,000 in the account.

- iPhone.

- iPad.

- Smartphones.

- Blackberry.

- Mobile devices based on Android technology.

For the moment, HFM accepts money deposits and withdrawals through Bank Wire Transfer, credit cards (the major credit cards), Skrill, Webmoney, Neteller, Perfect Money, CashU, and cryptocurrencies like Bitcoin, Ethereum, and others

- The company is regulated by important regulators of financial services such as CySEC in Europe.

- HFM is an ECN broker so it offers fast execution and very low spreads.

- This broker offers regular promotions and bonus packages for new and regular clients.

- It offers a free and complete Forex education through the company´s website using various resources such as Video Tutorials about the market, trading, and Metatrader 4, an e-course, and a blog that offers market news and analysis.

- As an ECN Forex broker HFM allows trading strategies based on scalping.

- This company offers a complete service of PAMM Accounts (managed accounts) for its clients. In this case, the investor has the option of opening a Premium Account version with the best trading conditions offered by the broker.

- It is a Metatrader 4 broker.

- HFM organizes several contests for its clients including the following:

- Trading contest for demo accounts.

- An award for the best traders of the month.

- HFM allows the execution of automated trading systems through the Metatrader 4 platform.

- Free trading signals for its customers through the signal provider Tradesignals.com.

- Free real-time news and market analysis tools for their clients.

- HFM offers trading tools for its customers such as market analysis tools (Fibonacci calculator, Pivot Points Calculator, Position Size calculator, and other) and Expert Advisors for Metatrader 4.

- HFM offers copy and trading signals services based on the MQL5 community, which provides access to hundreds of signal providers and operates on the Metatrader 4 platform. To implement this service, the company created a specialized account called Auto Account.

- HFM allows earning money promoting the services of the company through an interesting affiliate program named HFAffiliates.

- A 50% deposit bonus of up to $5000/EUR 3500 for any deposit made by the client. This bonus can be withdrawn once certain requirements are met.

- A 15% rescue bonus created to protect accounts from drawdown periods.

- A 100% Super Charged bonus. Traders can earn daily cash rebates up to USD 2 per lot traded directly to your trading account.

Other Categories of this broker

- Metatrader 4 broker.

- ECN Broker.

- Gold Broker.

- Silver Broker.

- CFD Broker.

| Company | HF Markets Ltd. |

|---|---|

| Minimum account size | $5 for the Micro account and $500 for the Premium Account |

| Minimum lot size | 0.01 lots ($1000 or the equivalent in another currency like the euro). |

| Maximum leverage | 1.1 to 1:1000. |

| Spreads | -For the regular accounts the spreads can be as low as 1-2 pips for the most liquid currency pairs. -For the currency account, depending on the market conditions, the spreads can be as low as 0.2 pips for the most liquid currency pairs. |

| Link to Website |

Easily Increase Your ClickBank Banner Traffic And Commissions

Bannerizer makes it easy for you to promote ClickBank products with banners, simply go to Bannerizer, and grab the banner codes for your selected ClickBank products or use the Universal ClickBank Banner Rotator Tool to promote all of the available ClickBank products.