Quantitative trading is a way of trading in financial markets using quantitative metrics that allow analyzing numerical variables.

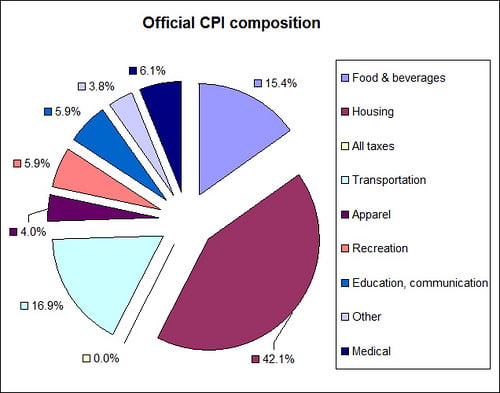

This type of trading uses only that information that can be represented by numbers, in tables or charts, that is, of a quantitative nature. For example, the value of the unemployment rate of a country or the evolution over time of the price of a share.

Therefore, the qualitative aspects, that is, not measurable, are left out. Thus, bad news that affects the price of a share cannot be represented by numbers. In this case it will not be taken into account for investment decisions.

Quantitative trading process

We are going to see how one could work through quantitative trading, with a process similar to the one that would be followed for any type of economic analysis. The steps are the following:

- Data collection. We must obtain the values of the different variables that we are going to analyze. For example, the gross domestic product (GDP) of the country in a period of time and the price of a given share.

- Data tabulation. Once collected, we must take the data to a table for further statistical treatment. In this case, a spreadsheet is a great tool.

- Data modeling. With the tabulated data, predictive mathematical models can be created. For example, what relationship does GDP have with the price of shares? At this point, charts are very helpful.

- Feedback. Once launched, you have to test it and see if it works. Once the model has been created, you have to test it and see if it works. Otherwise, corrections will have to be made.

Technical analysis and quantitative trading

Technical analysis is a way of trading in financial markets using charts such as Japanese candlesticks or certain numerical indicators, like moving averages or oscillators, with the aim of predicting market movements. In this case, we trade in the short term, even intraday.

Quantitative trading includes that part of the measurable technical analysis, but also the fundamental one based on acTherefore, with this approach the trader will trade in the short and long term.

Quantitative trading. The formation

Financial education is the essential basis when we want to enter the world of financial markets. Although it is true that your broker would be in charge of knowing these aspects, sometimes can decide to invest directly through specialized platforms.

For this reason, training and acquiring economic and financial knowledge is important. It is very useful to know what a moving average or what are the ideal conditions for the stock markets, for example. All this will help us better understand quantitative trading and many other aspects of our life.

Example of quantitative trading

Let’s look at a simple example. Imagine the historical price of a fictitious stock in 12 years and plot it on a chart. In this case, what we relate is price, a quantitative variable, with time, which would be the other variable.

In this specific case, we are interested in checking if the price has risen in the long term (trend), with its respective decreases in the short term that can offer good opportunities to buy. To analyze this evolution we use simple linear regression, drawing a regression line.

If we look at the price, it started out at 100 and in 12 years it increased in value to 145, that is, 45%. It seems that this stock is interesting to invest in the long term. Of course, the past does not have to happen again and it is convenient to reinforce our analyzes with other variables.

The spreadsheet shows the coefficient R squared, which is 0.6631 (a numerical value). Since it is close to 1, above the average value of 0.5, we can say that the line fits quite well the price value. In other words, that the price seems to end up increasing over time.

Although it is a very simple example, through quantitative trading we would make the decision to invest in that stock, but in the long term. In this way, it would be an investment to keep for several years.