Volatility is an inherent element of financial markets, and even more so in currency markets, but in 2023 the ups and downs could skyrocket. Investors will have to keep a cool head in this scenario.

After rising around 25% since the summer of 2021, the dollar has fallen sharply in recent weeks. “Looking ahead to 2023, the question is whether this is the start of a new downtrend or whether the factors that drove the dollar to those highs still have something to say,” the analysts Chris Turner and Francesco Pesole of ING say in a report in which they warn: “We expect the currency markets in 2023 to be characterized by a lower trend and greater volatility.”

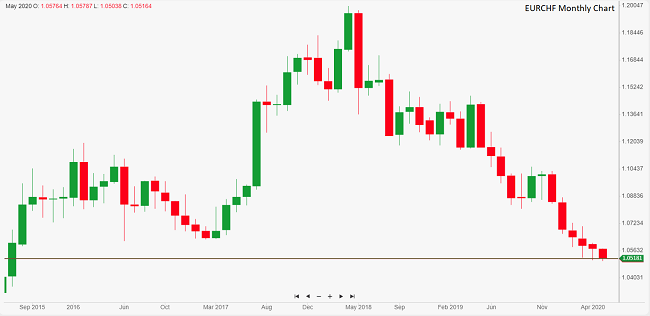

Since the most liquid currency pair, the EUR/USD, was an important factor in the evolution of currencies worldwide in 2022, the experts of the Dutch bank use a scenario approach to analyze a series of results of this currency pair in 2023, derived from the expected volatility in the currency options market. The range of scenarios and price levels of currencies at the end of the year stretch from “strong crisis”, where the euro could be trading at $0.80, to ‘safe and sound’, where the single currency could be closer to of the 1.20 dollars.

The key factors that will determine these scenarios are several: the aggressiveness of the Federal Reserve; Ukraine, Europe and energy; China; and the general risk environment. “Given ING’s view that the Fed will take rates to 5.00% in early 2023, four quarters of recession in Germany amid higher energy prices, relatively weak Chinese growth and an environment of equities still difficult, our analysis favors a more volatile scenario for the EUR/USD”, the experts point out.

But perhaps the strongest message to emerge from the Dutch bank’s outlook is that “Forex markets in 2023 will see fewer trends and more volatility.” “We say this because the conditions for a clear trend in the dollar do not seem to be in place”: there is neither a decline nor a rise in the dollar due to risk factors. In addition, “the tightening of liquidity conditions by central banks by raising interest rates and reducing balance sheets will only aggravate the liquidity problems already present in financial markets. Volatility will continue to be high.”

Analysts further believe that weakening global activity and trade volume growth of less than 2% “will likely limit gains for procyclical currencies in 2023.” In this sense, the euro/dollar cross could end the year near 1.00.

Other European currencies

The cross between the euro and the dollar will also set the tone for European currencies in general. “We are in favor of the Swiss franc underperforming and the British pound underperforming. Scandinavian currencies could continue to struggle in the highly volatile environment. Further east, we see room for the Hungarian forint to appreciate positively, while the overvalued Czech koruna and Romanian leu look more vulnerable as FX intervention eases.”