Regarding the issue of probability, a lack of understanding can lead to incorrect assumptions and predictions about the occurrence of certain events. One of these incorrect assumptions is known as the Gambler´s fallacy.

In the gambler’s fallacy, an individual mistakenly believe that the occurrence of a certain random event is less likely to occur after an event or series of events. This line of thinking is incorrect because the past events do not change the likelihood of certain events occurring in the future.

For example, consider a series of 20 coin tosses in which all have landed with the head side facing up: Under the gambler’s fallacy, a person can predict that the next coin toss is more likely to fall to the tail side facing up. This line of thinking is an incorrect understanding of probability, because the possibility that a coin lands heads or tails is always 50%. Each coin toss is an independent event, which means that each and every one of the previous tosses have no effect on future releases.

Another common example of the gambler’s fallacy can be found in the relationship of people with the slot machines. We’ve all heard the stories of people who are placed in a machine for hours without moving from the spot. Most of these players believe that each losing move with these machines is leading them closer to win the big prize. What these players do not understand is that because of the way these machines are programmed, the odds of winning the prize are the same in each of the runs (as with the coin tosses), therefore it does not matter if we are playing with a machine in which a player recently won the grand prize or one in which no one has won recently.

The gambler’s fallacy applied in trading

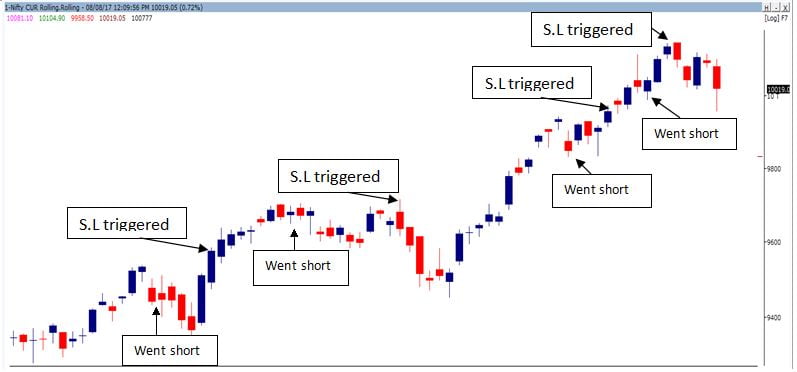

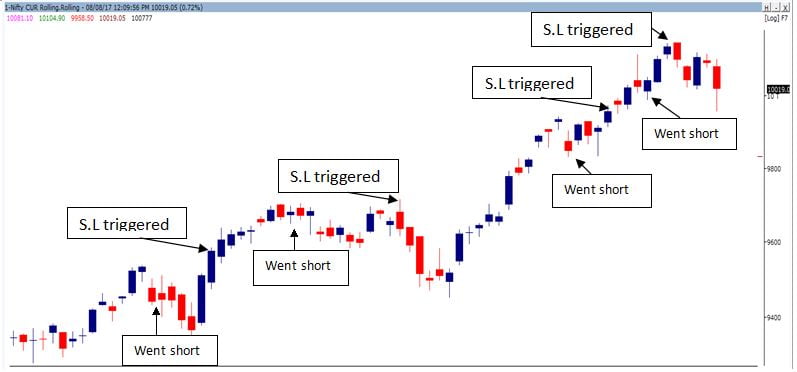

It is not difficult to imagine that under certain conditions, investors or traders can easily fall prey to the gambler’s fallacy. For example, some investors believe they should liquidate a position after it has risen for a number of consecutive trading sessions because they do not believe the price may continue rising. By contrast, other traders can maintain a position that has been moving against them for several days because they believe it is “unlikely” that the market will continue to move in that direction. Just because the price of a currency pair has risen or fallen for several days this does not mean that it is less likely that the market will continue in the same direction during the next session.

How to avoid the gambler’s fallacy?

It is important to understand that in the case of independent events, the probability for any specific outcome at the next opportunity remain the same no matter what happened before. With the amount of noise always present in financial markets, the same logic applies: buy or sell an asset in the market because we believe that a long-term trend is more likely to reverse at anytime is simply irrational. Instead, traders must base their decisions on

fundamental and/or

technical analysis before determining what will happen with the trend.