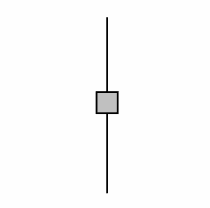

The candlestick pattern High Wave candle is a formation which indicates indecision in the market and it has a medium reliability. This pattern can be identified as follows:

- A small body of white or black color with fairly long tails above and below which could have or not the same extension.

- It can occur in both the higher parts (highs) as in the lowest parts (lows) of market trends.

This pattern indicates that there is basically a tie between buyers and sellers. The interpretation given by the japanese is that the market “has lost its way.”

The High Wave candle is very similar to the pattern Long-Legged Doji and it shows that the market is dominated by indecision. This formation occurs when the price has traded during the session in a fairly wide range both upwards and downwards with respect to the opening price of that day. This means that the end result is not very different from the initial price at the opening despite the volatility and market activity showed during the session.

Likewise, this pattern indicates a loss of sense of direction and hence the great indecision experienced by investors about whether to buy or sell. In other words there is no consensus in the market. A group of candles of this type is a sign of a possible change in the mains market trend.

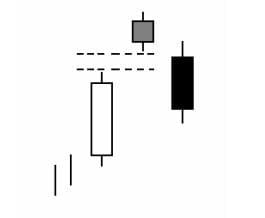

Something important to bear in mind is that this pattern is especially important in the high and lows of market trends. However, it is only a candle and it is not recommended its unilateral use to take decisions regarding the opening and closing of trading positions. It is therefore necessary a confirmation at the next session (or period depending on the time frame) in the form of a bearish candle (for uptrends) or a bullish candle (in downtrends) so that the trader has greater assurance that it is about to occur a change in the market trend. The trader also should use other means of confirmation such as technical analysis indicators for example. But if a confirmation of this type is not produced it is recommended to stay out of the market and wait for more favorable trading conditions to occur.

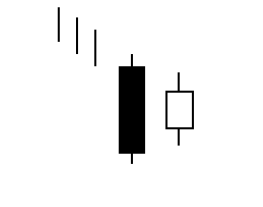

Example