This trading system was primarily designed to trade in extended time frames (4 hours later). It is based upon the breakout of a dynamic price channel which is calculated through the highs and highs of the price bars. In this sense, the strategy seeks to enter the market after two events occur:

- The bullish or bearish breakout of the price channel.

- A retracement movement of the price after the channel breakout. After this setback, the trader must open a position in the same direction as the breakout.

The system uses a phenomenon well known in the markets. Usually, after a breakout of resistance, support, a range, or in this case a price channel occurs, the price makes a temporary reversal against the movement. If we expect this setback, we can avoid entering the market too early and limit losses if the breakout is false, as so often.

Creation of the price channel

The price channel is constructed by calculating a channel of minimum and maximum of 10 bars or candles. For this purpose, you can use a simple moving average of 10 periods (SMA 10) on the maximum price and other SMA 10 on the minimum price. To facilitate the use of the system we have included the system template for Metatrader 4 which shows the channel in any instrument and time frame. The system itself is quite simple. But it can have false trading signals like any other. That is why filters for these signals can be used to increase their reliability, although this is not essential.

Rules of the Trading System

Buy positions

- Wait for a bullish price breakout over the top line of the price channel occurs.

- After the breakout, the trader must wait for the price to make a bearish retracement and form a low in a period of two to four bars, within 10 bars from the breakout.

- If these conditions occur, the trader should open a buy position at the opening of the next bar.

Sell positions

- Wait for a bearish price breakout below the lower line of the price channel occurs.

- After the breakout, the trader must wait for the price to make a bullish retracement and form a high in a period of two to four bars, within 10 bars from the breakout.

- If these conditions occur, the trader should open a sell position at the opening of the next bar.

Position exit

- We can use an initial stop loss based on the following criteria:

- The stop loss can be placed on a level corresponding to half the expected gain in the trade, depending on the currency pair and time frame in which the trade is performed (see profit-taking).

- We can also place the stop loss in the line of the channel opposite to the position, which is on the lower line for buy positions and the upper line for sell positions. If the price reverses its direction and reaches the opposite line of the channel we can assume that the market is changing the trend.

- If the price reaches the take profit objective, we can do the following:

- Close the position to take profits.

- Move the stop loss to the entry point and let the trade continue running.

- Use a trailing stop that follows the price and protects the profits generated by the position.

Profit taking

We can use the following recommended take profit objectives depending on the timeframe and currency pair:

- H4 time frame: 60 pips for EUR/USD and 70 pips for GBP/USD.

- Daily time frame: 200 pips for EUR/USD and 250 pips for GBP/USD.

Trading system example

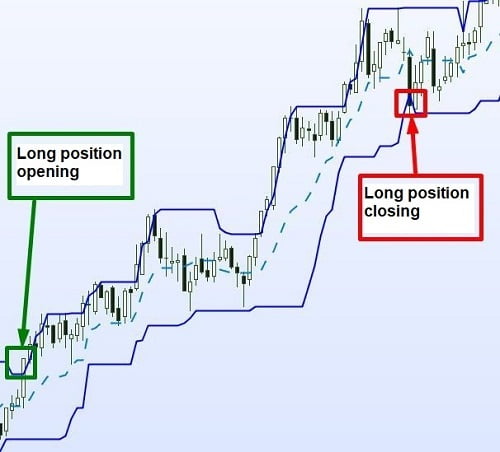

In the picture above we can see several examples of signals generated by this system. In some cases, additional positions are opened each time the price realized retracements into the channel and came out again, as in the zone with a clear downtrend. We can say that not in all cases the system rules are fully met, but as with any strategy, sometimes the trader can apply some “common sense” if he or she thinks the market conditions allow certain variations. In the zone with a clear downtrend, we can open a sell position with confidence every time the price makes a retracement into the channel to take advantage of the downward movement of the market.

You can access more trading systems on our site through the following link: List of Forex Trading Systems