Before choosing a Forex signals provider and spend our money paying for their signals, we must take into account a number of important factors since the offer of this kind of services is quite important and each of these services has a number of features both positive and negative which should be assessed in advance.

In this article we will provide a few tips that should be taken into account when selecting a good Forex signal provider that allows us to invest more safely in the Forex market:

1. What kind of signal does the provider offer?

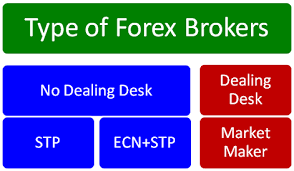

Normally signal providers employ automated systems to generate the signals, which are based on technical analysis, an approach that is based on the price movements of the past to try to predict the future. Also this services make use of mathematical algorithms which analyze market conditions and generate buy/sell signals through specialized software. These systems are subject to constant revision since in the Forex there is no perfect system and sometimes a trading strategy lead to significant losses or draw downs.

Normally the best automated trading systems are those that take into account aspects of technical analysis and fundamental analysis, in addition to market volatility with trading volume. Keep in mind that the market is affected by all kinds of technical, economic, political and even social factors. Therefore, we believe it is best to use signal providers that combine the analysis provided by automated systems with analysts provided by human traders with years of experience in the market.

2. Free signals services

Signal providers generally allow potential customers to use their signals for free for a short time (7-14 days). In this way the person can see how works the service and the effectiveness of their signals, ie if these signals correspond in most cases to winning trades. This is a great advantage since it allows to verify how good is a provider without risking money in the process.

In some cases the signals service offers a demo account through which the user can use free signals received during the test period. Of course this cannot be used as the sole selection criterion since any signals system and real trader used by the service can have negative results in a week or two and this does not necessarily mean that the signal provider is bad.

3. Signal Provider Performance

Most websites of signal providers have detailed information on the daily, weekly, monthly and yearly performance of the signals provided by them. Thus, the potential client can access the historical average monthly profit obtained by the signal system or analysts used by the service. This historical information must be one of the most important aspects taken into account when paying for a service of this type.

It is also important to keep a daily log of all trades performed through these signals, so that the trader can evaluate the average earnings/losses produced by these trading signals. A simple way to calculate the profit potential of a given signal provider is multiplying the average pips obtained in the winning trades by the average volume of transactions. In this way you can determine if the system is profitable or not.

4. Means by which trading signals are sent

The most usual is that the signal providers send their forecasts or alarms directly to the client email. These services also publish their signals on their website which can be accessed through a username and password. Another way in which signals are sent is via SMS text messages to the cell phone.

It is important that you determine which option is most suitable for you based on your daily activity, that is if you can rarely use the computer and work outside the office is best to choose a provider that send their signals to the cell phone.

5. Currency Pairs offered by the service

Forex signals providers usually include major currency pairs like EUR/USD, GBP/USD, USD/CAD, USD/CHF and USD/JPY. However, there are some services that also provide signals for more exotic currency pairs or with less trading volume in the market.

Currently, many trading signals services include precious metals, stocks, indices and more.

6. Schedule for sending signals

The trading signals are usually sent at a certain time and because in most cases these signals are for intraday trading, it is important to see the signal and execute it at the time it is received because otherwise the trader may lose the window of opportunity. For this reason, is imperative that the trader analyze how likely is that he or she can access the trading platform of their Forex broker to open new positions at the time the signals are received. Otherwise it makes no sense to hire this signal provider.

7. Signals for other trading instruments

Some signal providers, in addition to Forex include trading signals services to trade with commodities like oil, gold, silver, platinum and others. They also work with other financial instruments such as stocks, futures and stock indices. If the investor want to add these instruments to their portfolio, it is important to check if a Forex signals provider also offers signals services to other financial markets. If so, the service probably is more expensive.

8. Signals for different types of strategies

Depending on the provider, the signals can be sent to make short, medium or long term trades. In this case, short term signals are those which are sent to perform trades that are opened and closed within a day. The signals based on medium and long term strategies seek to open positions which last several days or even a month land the objetive is to get a much larger gain.

9. Market Research

The best signal providers have a team of analysts who evaluate the Forex market 24 hours a day. This is particularly useful because in every moment can be important events that provide interesting opportunities for profit.

10. Additional Services

Some signal providers provide training on the most important aspects of the Forex market as risk management, psychology, discipline, trading strategies and other.

11. Assistance

Currently most signal providers provide technical assistance to both potential clients and those who have an account with them. This assistance is provided through live chat, email or telephone. It is important that tthe service chosen by the investor have an good customer service to attend any concerns.

12. Cost of service

The investor must analyze how much is willing to spend for a Forex signals service since the cost can range from $40 to $140 per month which depends on the provider, the chosen package and the services requested. Obviously the more financial instruments and currency pairs choose the investor to receive signals, more expensive is the service. It not the same receive signals for one currency pair or two compared to receive signals for 3 or 4 and commodities and stocks at the same time for example. It is a good idea to investigate whether there are discounts for paying several months to one year at a time.

Usually the signal providers offer good discounts for clients that subscribe for several months with them, which is used by many investors to save money in the long run.

13. Risk/Return ratio offered by the Forex signal provider

A smart investor will investigate about the risk/return ratio of the strategy employed by the signal provider because this is one of the key elements for success in the Forex market. If the risk is well managed, at long term a trader will get benefits from their trades.