In this tutorial we are going to talk about eToro, an online broker totally different from the ones we all know since it is based on a social network where traders share their market trades, being able to copy them quickly and easily.

eToro has been offering its online services since 2006, providing the user with the best technology in the Forex sector, currently becoming the world leader in social trading, with more than 6 million registered investors. One of the biggest advantages of this broker is that its clients can open a demo account with hardly any restrictions, which serves to learn and test their entire platform without facing any risk.

Another advantage of eToro is undoubtedly the low commissions and its complete and easy-to-use trading platform. However, even though the platform is very intuitive, there are a couple of very important things you should know before trading eToro.

In this tutorial, we will cover all relevant topics from scratch. So even if you are an absolute beginner, after completing this guide you will be able to trade in this broker like an expert.

| eToro | – Forex and CFD broker specialized in Forex, CFD and stocks. -Regulated by organizations such as CySEC and FCA. -The largest social trading network (copytrading) in the world. | Visit Broker Website |

Article content

- What is eToro?

- Why choose eToro to trade online?

- eToro trading platforms

- Opening a demo account with eToro

- Elements of the eToro platform

- How does the eToro CopyTrading system work?

- How does the eToro CopyPortfolios system work?

- How to trade manually on eToro?

What is eToro?

eToro is an online broker and social trading platform founded in 2006, which enables its clients to trade multiple financial instruments, including currencies (Forex), company stocks, and CFDs from multiple markets, including precious metals, commodities, stocks, indices, ETFs, and cryptocurrencies.

eToro belongs to the company ETORO (EUROPE) LIMITED, like many other Forex brokers it is registered in Cyprus, which is located in the city of Germasogia where they get great tax benefits and their full address is as follows: Kanika Business center, 7th Floor , 4 Profiti Ilias street, Germasogia, (Limassol) 4046.

Likewise, to cover the UK market, this broker is registered under the company ETORO (UK) LTD, which is registered at: 42nd floor, One Canada Square, Canary Wharf E14 5AB, London, (United Kingdom).

And to cover the rest of the world except the United States we can see that it is regulated by the Cyprus Securities Market Commission (CySEC) by means of an international license.

The first thing we have to know is that at eToro we can earn money in various ways, which we will see below:

- Copying other traders is the most recommended option for beginners.

- Trading in the markets on our own. A good option is if the trader has knowledge of trading and markets.

- Becoming a Popular Investor, for professional and experienced traders.

Its trading platform is designed to search, follow, comment and copy the trades of other experienced traders as well as to invest manually. This large number of tools and functionalities make it a very complete yet easy-to-use platform once we know how each element works.

Why choose eToro to trade online?

eToro is an online broker with a long history in the sector and that has the trust of millions of users in more than 140 countries.

Any trader or person interested in making investments in the markets can use the services of eToro. The interested trader will only have to open an account with this broker and make an initial deposit of funds of at least $200.

eToro has a presence in several countries and is duly regulated:

- The company eToro (Europe) Ltd. is authorized and regulated by the CySEC (Cyprus Securities Exchange Commission) with license number 109/10.

- eToro (UK) Ltd. is authorized and regulated by the FCA (Financial Conduct Authority of the United Kingdom) with license number FRN 583263.

It is also registered with other supervisory bodies such as the Spanish CNMV (National Securities Market Commission) as Investment Services Company of the European Economic Area under the Free Provision of Services therefore it is licensed to offer its services in Spain.

eToro offers a wide variety of instruments for trading. The markets that can be operated with eToro are the following:

- Forex.

- Stocks.

- Indices.

- Exchange-Traded Funds (ETFs).

- Commodities.

- Cryptocurrencies.

At first, you can think of eToro as just another broker, but in reality, it is not. This company, in addition to being an intermediary with which you can invest manually as you would with any other Forex or CFD broker, also offers a powerful social investment network. This is what is called “Social Trading“.

Social trading is a form of investment in which you can see, follow and copy other traders and thus take advantage of their knowledge and winning trading strategies to make profits.

As for the trading platform, in this tutorial, we will see below everything related to its management to enjoy the experience offered by social trading (through the CopyTrading and CopyPortfolios functions) and also how to trade by opening, managing, and closing our positions manually.

eToro trading platforms

As we already indicated, the eToro platform is simple, complete, and easy to use. It can be used on all kinds of devices, from desktop computers to mobile phones.

eToro desktop platform

The eToro trading platform is developed in a web format. It is accessible through the client’s username and password through any web browser without having to download or install anything on the computer.

eToro does not offer other platforms such as MetaTrader, which on the other hand seems logical since due to its business model and services offered, the broker must cover the needs of CopyTrading and CopyPortfolios two key services of eToro. Both types of investment are based on social trading and therefore the platform must be designed to be able to manage these options, something that generally requires its own development (For this reason this broker uses a proprietary platform).

eToro Mobile Platform

There is a version of the eToro platform specifically designed for mobile phones and tablets, therefore in this case we will have to download it to our device.

The platform is basically the same as the one used on desktop computers, with the exception of some details that, due to screen size and technical reasons, cannot be applied to a smartphone or tablet. However, these issues are usually common to all mobile trading apps. What is really interesting is that it is possible to carry out the main operations enabled on the PC trading platform, including manual trading and social trading, with the flexibility of being able to do it at any time and from anywhere.

The version of the eToro platform for mobile devices is available for both devices with Android and iOS operating systems.

Opening a demo account with eToro

The first step to analyzing how the eToro trading platform works is to open a demo account to familiarize ourselves with this application and its functions without putting our money at risk from the first moment.

We will be able to test all the options offered by this broker by trading with the virtual balance of $100,000 offered by this demo account and when we already know the trading platform well we will be able to move to a real money account by depositing funds in eToro.

This process is really simple, the trader only has to fill out a form with the following data:

- Name and surname

- Username

- Email address

- Password

- Telephone contact

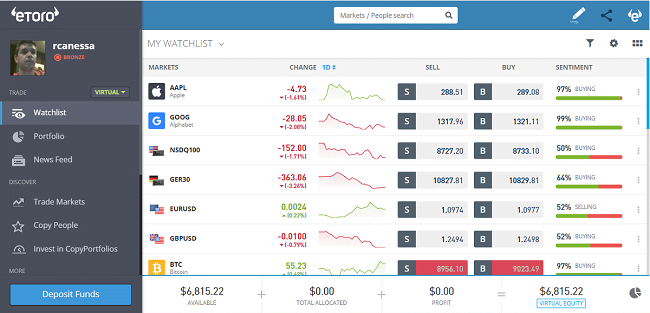

Once the registration is complete we access the following screen:

Note: If you are using a mobile phone or tablet you can now go to Google Play (for devices with Android system) or the Apple App Store (for devices with iOS system) and download the app to continue managing the eToro platform from your mobile device. In our case, we will continue with this tutorial using the desktop version of this platform but the options for smartphones and tablets are very similar so you can follow this guide without problems.

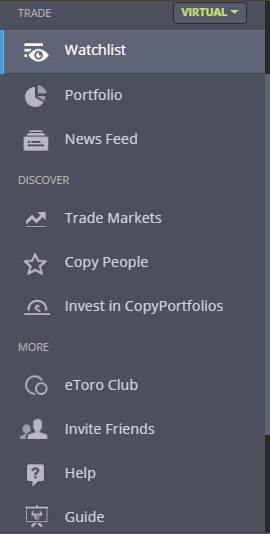

It is possible to switch between the “real” mode (trading account in which we trade with real money that we must have previously deposited) and the “virtual” mode (demo account with virtual balance to carry out simulated trades in conditions identical to a real account). To do this, simply click on the corresponding button on the main screen of the eToro platform, under our username:

We click on “Virtual Portfolio” or “Real Portfolio” and continue.

Elements of the eToro platform

The eToro investment platform has the following elements:

Top Bar

This bar simply has in its central part a search engine, from it it is possible to locate any asset or any trader of the social network. On the right side of this blue bar, we have three buttons that we describe in order from left to right:

- Write a post: eToro is more than just a trading platform. It is possible to express our opinions through publications on the social network of this platform. To do this we must click on this button.

- Share: Through the share button, existing publications or any aspect of our trades can be published on the eToro social network itself, Twitter, Facebook, LinkedIn, or even sent by email.

- Notifications: Here we will see the notification alerts made by the broker or any other user of the social network. Every mention they make of us in any publication is also shown as notification.

Main menu

It is located on the left side of the platform and vertically. The main menu items are as follows:

- Watchlist: This tab gives us access to the screen with the assets that we have in the watchlist list. The watchlist can be modified to suit the trader. Not only is a list of assets displayed, there is also a list of people from the social trading network. The people list can also be managed just like assets. You should only add those assets and traders in which you are interested and delete those that are not useful.

- Portfolio: Clicking on this section we will have access to all investments (trades) that we are making at the moment, either manual traders or other traders that we have decided to copy through the social trading options that this platform offers (CopyTrading or CopyPortfolios). In this section we can also see the history, the orders that are pending execution, see our total exposure and edit the open orders. We will deal with all these questions when we get to the corresponding section of this tutorial on the eToro platform.

- News Feed: From here you can access various news channels. These are the different comments that users make about the available markets in eToro. Most channels are in English.

- Trade Markets: It provides access to all markets and financial instruments available for trading purposes in eToro. Assets are divided according to the markets in which they are listed (indices, stocks, ETFs, cryptocurrencies, currencies or commodities). At the top we can select the market and the assets will appear on the screen. It is possible to filter and carry out advanced searches.

- Copy People: Here we access the differentiating element of the eToro platform. In this section, we access the people (traders) involved in the social trading network. For what purpose? The objective is none other than to be able to analyze them as traders based on the trading statistics that each one has in order to copy their trades. In the following sections, we will see in more detail the usefulness of this section and everything related to social trading. For the moment, suffice it to say that this is a menu item from which we can search for a trader and observe what risk profile he has or how many followers he has, his benefits, his losses, and all the information necessary to evaluate his performance.

- Invest in CopyPortfolios: It is a novel investment system. It is based on investing according to a market package or replicating a set of traders. This proprietary eToro system is based on investing in a portfolio, not a specific asset or copying a single trader. We have also dedicated a complete section to explain how it works. We will see it a little later.

- Help: This option opens the help window, where you can see the most frequently asked questions or contact the broker in case of doubts.

- Guide: There are various videos and tutorials to learn how the eToro trading platform works. In our opinion, they are quite basic which is why, from Forex Dominion, we have preferred to carry out this tutorial on eToro and how to use its platform.

- Withdraw Funds: Through this element, we can access the window in which we can withdraw funds from eToro accounts. According to the withdrawal policy of this financial intermediary, the minimum amount to withdraw funds is $20. Withdrawing funds with eToro is easy. The user only has to select the amount and the order is automatically transmitted by clicking on “Send“.

- Settings: From this section, we access the screen to make the necessary adjustments to the platform, our profile on the social network, the privacy of our account, and other similar elements.

- Logout: Used to log out of the eToro platform.

To finish with the menu, there is a button at the bottom that, as its name indicates, is used to “Deposit funds” in our real trading account through the form that you can see in the following image:

Money management bar

At the bottom of the platform, we have a summary of the account status, a small monetary section that will be updated automatically in real-time according to the results of the trades that we have open. We can see it in this image and we will briefly define each element:

- Available: It is the capital that we have free to invest. They are not the total funds that we have in the account because the invested capital must be subtracted from that amount.

- Total Allocated: As its name indicates, it is the total capital that is invested as a result of all trades that the trader currently has open. At the moment an open trade is closed, the money invested in the trade becomes available, plus the possible profits or less the possible losses.

- Profit: These are the benefits or losses that the trader may have based on all the trades that are currently open. At the moment a trade is closed, the profit or loss will be adjusted in the available capital. Losses are shown as negative benefits on this platform.

- Equity (Real or Virtual): This is the equity that we have in the account at that time. It is the sum of three values (or subtraction in the event that there are losses). The Equity is equal to Available capital + Invested capital +/- Profits or losses.

How to carry out a technical analysis on the eToro platform?

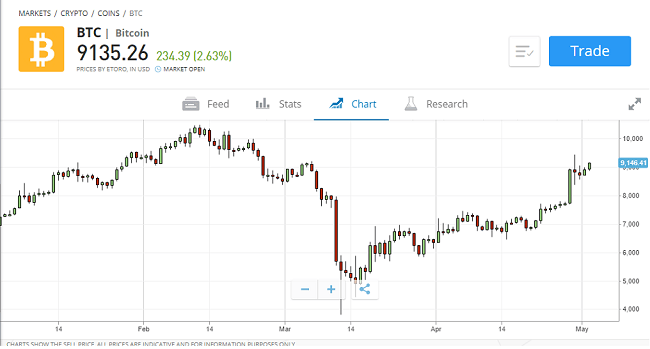

Although it is not a section in itself, now we are going to see how to access the price charts of an instrument in order to carry out its technical analysis.

To access the interactive price chart of a financial instrument in eToro we have to access the tab of the asset itself. First we click on the main menu option called “Trade Markets” which gives us access to all assets grouped by markets.

By clicking on the asset we want, in this case, Bitcoin, we will access the screen of its tab. At the top we have 4 options (Feed, Stats, Chart, and Research). Click on “Chart“.

If we want to carry out a complete technical analysis (beyond seeing the price chart) we can use drawing tools, change the time frame, add indicators (such as Bollinger Bands, Keltner Channel, Ichimoku, ATR, Stochastic, MACD, Moving Averages, RSI, Parabolic SAR, …). For this we must press the icon to enlarge the price chart to the full screen that is in the upper right:

Now on the price chart, we have a series of tools at our disposal to carry out the analysis.

Price chart with technical studies

How does the eToro CopyTrading system work?

The CopyTrading system of eToro is more than just a social network where we can talk and comment on other users’ posts (just as they can interact with us). This feature is what distinguishes eToro from other online brokers since this broker is really one of the best mergers between traditional trading and social trading as it offers the possibility of copying the trades performed by any other trader present on the network in real-time through a simple and easy to use interface. This is the CopyTrading system.

For any beginning trader, this is a useful way to start familiarizing with online trading by seeing the trades executed by other traders, including experienced investors. Also, any eToro user has the possibility to obtain benefits by copying the winning strategies of traders with more experience.

To start investing in the markets through this form of trading, the first thing we must do is search for and select the trader or traders that we want to copy. But before that, we will have to be clear about certain parameters. We will have to answer several questions to define exactly which profile can be the ideal one. Questions such as:

- What maximum risk are we willing to take (maximum drawdown)?

- What performance objective would be appropriate based on the risk assumed?

- What are the preferred time frames for our trades (and the trades of the selected traders)?

- What trading instruments do we prefer?

- What experience and popularity will we demand from the trader as a guarantee of his good work?

Questions like these can give us an idea of what type of trader will best suit our investment style and risk tolerance.

The most logical thing in these cases is that a trader looks for another trader with a profile as similar as possible to his own profile. However, one of the advantages of eToro CopyTrading is that we can design a different investment system than the strategies that we use ourselves. In this sense, this social trading platform allows to develop a diversified investment portfolio based on people that includes traders with different strategies and risk profiles.

It should be said that traders who are copied in eToro get a commission for providing their trading signals, therefore they are the first interested in getting the best possible performance in their strategies. Any trader can enter this program and be copied, becoming a “Popular Investor“. Of course, the trader must have enough experience, a good trading strategy, and high enough performance with good trading statistics to serve as a guarantee for other traders to decide to follow and copy his trades.

The information that appears in eToro about the other traders is totally transparent and reliable, it cannot be altered or manipulated by the users. It is an automatic registry of trading statistics based on all trades performed by the trader since joining eToro and this is what defines the trader’s profile, that is, his achievements in the market instead of his words.

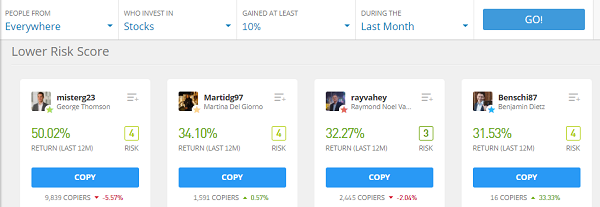

Once the minimum parameters and the profile prototype we are looking for have been indicated, we must carry out the search and selection process in the “Copy People” section, within the main menu of the eToro platform. At this point the following screen appears where we can manage the multiple traders presented by the platform:

Once we enter the page of the section “Copy People” we can perform the search process, for this, the screen is divided into the following sections:

-Filters (Upper Bar): In this bar we have multiple filtering options to facilitate the search for traders that match our preferences, such as:

- People from: It is used in order to select the country of origin of the candidates.

- Who invested in: In this section, we will indicate the markets in which the traders that we are going to follow and copy must trade.

- Minimum profit: Here the investor establishes a minimum performance filter that the signal providers must fulfill.

- During The: Here we indicate for how long traders must have achieved this minimum percentage of return (one month, one quarter, one year, etc.)

In the “GO!” button we will begin the search. Just to the right of the top bar, we have the “Advanced search” option, which is preferable if we want to establish more search filters (for example, a maximum value of daily losses).

-Editor’s Choice: The first group of traders in the top center of the screen are those suggested by the editor. So to speak, they are the signal providers shown by the eToro platform itself as relevant.

-Top Investors: Considered as such by a combination of parameters. The parameters that serve as the basis for establishing the statistics in this section are five:

- Performance.

- Risk.

- Copiers.

- Trading.

- Additional Information.

The Top Investors are defined based on a series of statistical calculations which we can find more information in the “Help” menu of the eToro platform. They are usually traders who have a certain balance between these five characteristics.

-Trending: Those users (Popular Traders) that have obtained higher profitability. As their own name indicates, they are traders who are in the middle of a winning streak. Some of these traders have an acceptable risk level, contrary to what one might think a priori. Although undoubtedly, some of these traders take a higher risk in order to achieve high returns and enter this section.

-Most Copied: They are the traders who have the largest number of followers who are copying them. This is a guarantee that the trader is popular and that other users place their trust in him and his strategy.

-Lower Risk Score: It is a selection of traders who obtain a risk score according to the statistical calculations of the platform between 0 and 4.

-Medium Risk Score: It is a selection of traders who obtain a risk score according to the statistical calculations of the platform between 3 and 6.

Example of how to search and copy a trader in eToro

Let’s see how eToro copy trading works with a practical example:

Suppose we are looking for a trader, someone who applies a stock investment strategy. With an average risk level and a return of two figures.

To do this we go to the menu and select the “People” option. In the upper bar, we begin to adjust the parameters.

We have no preference for the stock market of the United States, Europe, or any other specific market, so it will not be necessary to select a specific country of origin. Therefore, we proceed to leave “People From” as “Everywhere“.

Note: If we narrow the search too much, we will not find any trader to copy. It is necessary to give some margin.

After this, as is logical, in the following table “Who Invest In” we will select Stocks.

We hope to maintain the investment for example over a month and our profitability target is 10%. So we select in “Gained At Least” 10% (which comes by default) and in “During The” we select the last month. The search parameters would be defined as shown in the following image:

That is not all, we decided to adjust the risk. As we have selected a profitability of 10% in the last month, we must be consistent with this profitability. A risk level considered medium would not be bad. In the “Filter” button we will adjust this risk according to our preferences. In this case it gives us the option to select the weekly risk. We adjust the risk between 3% and 10% of weekly maximum drawdown. This is what is considered a medium risk by the eToro platform itself.

This is the list of Popular Investors that the program has generated after applying the search filters (in the following image). The first thing we can see is that the list shows traders with a large number of followers. The first of these traders have a risk level of 5 with an amount of 8111 follower traders. For his part, the second trader has a risk level of 6, with a return of 23.44% and 3650 followers.

Their risk classification is between 5 and 6 although there are various with 4. The returns obtained in the last month are much higher than our objective. Some even triple them.

In our case, because we are looking for certain security, we decided to pre-select two candidates:

- The first trader has been selected for having 8110 investors copying his trades, while the majority of traders, according to these search parameters, have much less followers. Although it must be taken into account that the number of followers does not guarantee the good performance of a signal provider

- The second selected trader has a risk level of 6 with a return of 23.44% and a quantity of 3646 followers. Although it presents a higher level of risk, its profitability seems to compensate for it.

Now it only remains to take a closer look at them before deciding to copy these traders. If we click on the corresponding tab of each trader we can access their profile and we will be able to better observe their statistics.

Well, in the case of the first candidate we have already seen something that does not end up fitting, a maximum daily loss of 10.16%. Could this be a reason to remove the trader from the selection? In principle, the decision made is to reduce exposure to this trader. In the next section, we will see everything related to controlling the result and the risk of the portfolio when copying.

As the parameters are seen in your file, decisions are made and in the end, it will be decided whether to copy or not to copy and what percentage of capital we will allocate to each trader.

Well, in the case of the first candidate we have already seen something that can be problematic, a drawdown of almost 15% during the month of March. Also, it seems that this trader keeps his positions open for a long time. Could this be a reason to remove the trader from the selection? In principle, the decision made is to reduce exposure to this trader. In the next section, we will see everything related to controlling the result and the risk of the portfolio when copying.

Well, in the case of the first candidate we have already seen something that can be problematic, a drawdown of almost 15% during the month of March. Also, it seems that this trader keeps his positions open for a long time. Could this be a reason to remove the trader from the selection? In principle, the decision made is to reduce exposure to this trader. In the next section, we will see everything related to controlling the result and the risk of the portfolio when copying.

As we analyze the parameters in the trader´s profile, decisions are made and in the end, it will be decided whether to copy or not to copy a Popular Investor and what percentage of capital we will allocate to each trader.

To copy a trader we must press the corresponding button (“Copy“) located at the top right of his profile. Next to it is a button with a “+” sign. This button is used to simply follow the trader on the eToro social network.

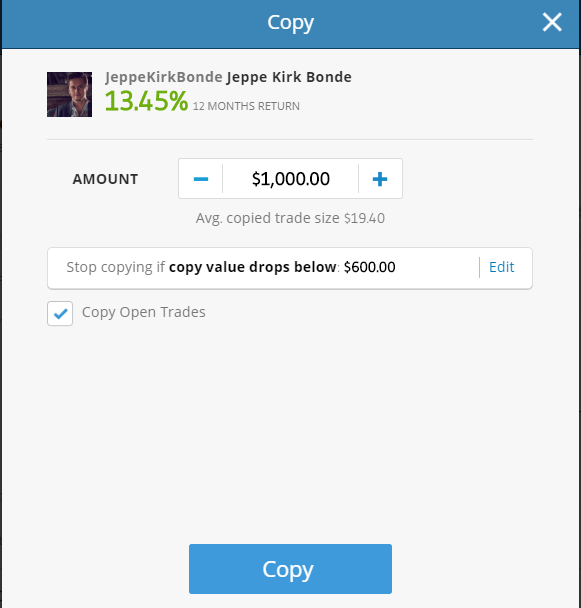

Once you have decided to copy a trader and the button has been pressed, this screen will appear:

In this simple screen, we will adjust the exposure to this trader based on the amount that we are going to allocate as an investment and we will indicate a risk limit through a stop-loss order. With this stop loss, we tell eToro to stop the copying process of the trader’s positions if our losses in the account reach a certain level (this value cannot be less than 5%). In addition, here we indicate if we want to copy the positions that are already open.

In our case, we are going to allocate about $1000 to this trader (from our demo account that has an amount of $1000, approximately 10%) and we will limit the loss to 6% (about $600). We show it in the previous image. We only have to press the “Copy” button to confirm the operation.

How to control the result and the risk of the trades that we copy?

It is possible to adjust the risk level when copying a signal provider by adding or removing funds allocated to a trader that we are following and copying once we start to replicate their trades. This function can be performed in the main menu by clicking on “Portfolio“.

In this section, we can view all trades and manage them. CopyTrading on eToro is like any trading operation, but instead of investing in assets, we replicate the behavior of another trader. But the trades can be managed from the gear-shaped button (setting sign).

From here we can add or remove funds, pause copying, configure and update the Stop Loss (expanding or reducing it), see the investor graph, or write a publication labeling the Popular Investor.

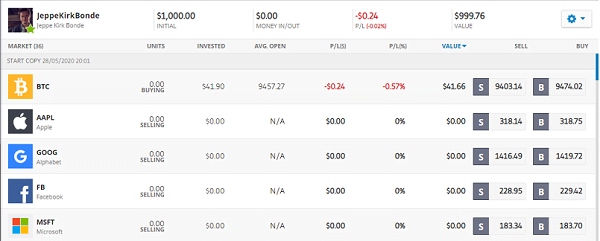

We can also see the trading history and the portfolio of the trader that we are copying, and adjust the investment trade by trade. If we click on the trader we are copying to in the “Portfolio” menu, we will see his trading portfolio. The following image shows this:

Here we have the trades carried out by this trader and which we have copied (plus the pending orders). However, from this screen we can close any trades to stop copying them or adjust the amount of exposure to each one individually.

Here we can vary the weight of the instruments that make up the copied investor’s portfolio. We can also modify from here the Stop Loss or Take Profit levels that this trader has configured for each instrument.

For example, in this case, we can eliminate the position in Bitcoin, because cryptocurrencies do not fit our investment style because it is a very volatile asset (it is only for illustrative purposes). If we press on the “X” at the end of the line of each asset on the screen, it will close; not the complete trade, but we will stop copying this concrete trade only.

In addition, we can also increase the exposure on an asset, for which we only have to click on the asset (the boxes in the columns “Current“, “Stop Loss” and “Take Profit“). A screen will open like the following:

In this window, we can adjust both the amount to invest, the Stop Loss, the leverage, and the Take Profit. We will explain these parameters in the section corresponding to opening positions by manual trading. For now, just say that from this window we can control the results and the portfolios that we are copying. We can shape and personalize our portfolio to our risk level or our personal preferences.

Thanks to this we can take a trader or more as the basis of our investments and modify his or her trades when necessary to have better control of the results. The trader invests, we copy his trades. But if we do not like any instrument, we remove it from the copied portfolio or we reduce (or expand) the exposure in the financial instrument.

To stop copying a trader, not only an individual asset, but all the assets and trades that he has in his portfolio, we must do it from the “Settings” button. One of the drop-down menu options is “Stop copying“.

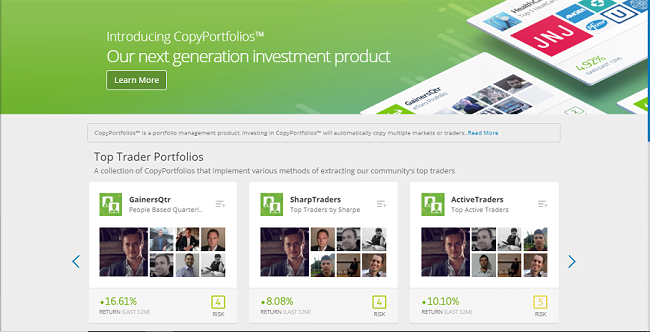

How does the eToro CopyPortfolios system work?

An eToro CopyPortfolio is an investment portfolio, a pack of various assets or various traders.

To give an example, there is a CopyPortfolio on the behavior of 50 traders considered solid, distributing the weight of the investment among all of them in an equitable way (that is, not overweight any). These traders are selected based on an algorithm.

An investor can replicate the behavior of these 50 traders simply by allocating a part of their capital to this CopyPortfolio. It is an investment philosophy based on a specific strategy with an asset portfolio or set of traders. It is the way many investment funds invest.

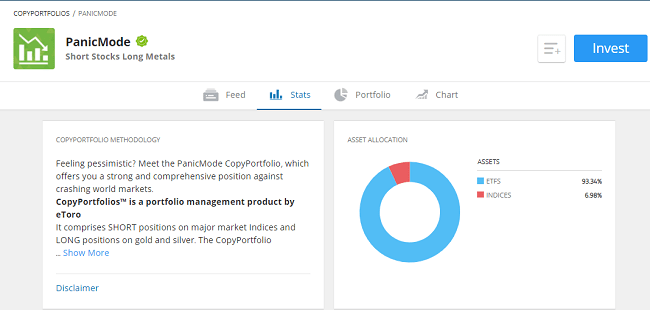

Another example would be a CopyPortfolio that takes short positions in the main markets (through indices and ETFs). In turn, it takes long positions in safe-haven assets such as gold and silver. The idea is to invest against the world economy. It is an investment strategy for those who have a pessimistic vision, ideal for difficult periods such as today, where the economy is being affected by the coronavirus.

To invest in CopyPortfolios, the first thing to do is enter the corresponding page, through the menu (“CopyPortfolios” section). There are no search parameters, only the investment instruments of this class that is displayed on the screen.

We just have to select the Portfolio and examine its profile, its statistics, and invest in case it seems a good form of investment.

The investment is made through a mechanism equal to that explained in the previous step for CopyTrading. Only in this case the authorization is not necessary, only adjust the capital and the corresponding Stop Loss to determine the risk.

The same is true for closing an investment in CopyPortfolios. From the gear button (Configuration) of the Portfolio screen it is possible to carry out this operation.

How to trade manually on eToro?

After having explained the social trading options that we have with eToro, now we are going to explain how the trader can carry out a classic buy and sell trade in its platform, the manual trading that we can do on any other platform of an online broker.

– How to open a position on the eToro platform?

The first thing we must do to open a trading position with eToro is to access the instrument or market in which we wish to trade. The easiest and most direct way is by accessing the market watch list (MY WATCHLIST), where the assets in which traders operate most regularly must be found.

In case the asset in question does not appear in the list, we must look for it in the “Trade Markets” menu.

Both in the market watch list and in the assets that are displayed on the “Trade Markets” menu screen, when you click on the corresponding “Buy” or “Sell” box (which appears in the same asset information box) the trading screen opens where we can open new long or short positions.

Also by accessing the asset screen (the instrument profile that can be accessed by selecting the instrument) and pressing the “Trade” button (at the top right) we can open a new trade. Through any of these forms, the corresponding window opens to adjust the parameters of the trading position to be opened:

The elements that we must configure are the following:

- Trade Direction: The first thing to consider is if we want to open a buy trade or sell trade. When trading Forex or CFDs, as is the case with eToro, buying the asset means that we expect a rise in the market to sell it later at a higher price. This is also called a long trade. On the contrary, if we decide to sell an asset the intention is to buy back the asset at a lower price and therefore our forecast will be down. This operation is called a short trade. Therefore we are in a position to be able to obtain benefits in both bullish and bearish movements.

- Amount: The amount of money to invest. Below we can see the number of units (shares or contracts that we will buy with the amount to invest) that it represents, the percentage of capital that the amount represents, and the real market exposure taking into account the leverage factor. We have the possibility to select the position size by units (as explained, it is the number of shares or contracts) instead of by a monetary figure if we press the “Units” button that appears next to it (when the Units option appears for selection, the button will indicate “Amount“).

- Stop-loss: The Stop Loss order is essential in all trading operations and it is highly recommended to place it from the beginning since the position is opened (although it can be established after it is opened). This order consists of a total and final closing of the position when the market reaches a level at which it causes a loss cap that we have previously defined.

The objective of the stop loss is to ensure the maximum loss, a percentage of the capital that will represent the maximum risk assumed in that trade. If this order is activated, we will assume that the investment strategy we have taken has been wrong and we will prevent our capital reserves from suffering a further drawdown. It is about cutting losses if the market moves against us.

We have two options to place the Stop Loss order with eToro when opening a position. One is by entering the maximum amount that we are willing to lose and another is by programming the price level of the instrument, called “Rate” on this platform. We can toggle the option to choose between the Rate and the Amount by pressing the button that appears on the right.

Below is the percentage of the amount invested that the Stop Loss represents, this percentage is the maximum risk of our trader. An interesting aspect is the possibility of establishing a dynamic stop loss or Trailing Stop. It is a Stop Loss order that, if the price moves in the right direction and produces a profit, automatically adjusts to the distance of the price that we have defined. In other words, Stop Loss adjusts as the market moves in our favor, but it doesn’t move if the market turns against us. This is a Trailing Stop.

- Leverage: Leverage is a tool offered by the broker to its clients that allows them to multiply the buying power of their capital. When we select a certain amount, the market exposure is actually much higher (as seen in the previous paragraphs). This is because the amount invested only represents collateral or a guarantee margin to cover possible losses. This amount that is invested in the market is multiplied according to the chosen leverage.

UPDATE: The new regulation on leveraged trading approved by the European Securities and Markets Authority (ESMA) which entered into force on August 1, 2018 limits the leverage available to retail clients of brokers based in the European Union. The maximum available leverage varies between 1:30 and 1:2 depending on the volatility of the underlying asset:

- 1:30 for the major currency pairs.

- 1:20 for secondary currency pairs, gold and major indices.

- 1:10 for non-gold raw materials and secondary indices.

- 1: 5 for stocks and other securities.

- 1: 2 for cryptocurrencies.

These limits do not affect professional clients or brokers that operate from countries outside the European Union.

For example, we have the option with eToro to choose a leverage of X1, X2, X5, X10 (in the Apple shares shown in the image above as an example. Leverage varies depending on the asset to invest). This means that the selected amount will be multiplied by the number we choose. If we have decided to put an amount of $10,000 in margin and choose a leverage of X5, in reality, the real investment is $50,000 while10,000 is just collateral. The money for leverage is provided by the financial intermediary once we have deposited the guarantee.

Leverage is a double-edged sword. It is a good opportunity to make significant profits with a small amount of collateral if the market moves in our favor. But it also increases the risk if the market goes against us since the losses to be assumed are for the total amount invested, not only for the collateral necessary to open the trade. Therefore, the trader should always apply good risk management and money management practices.

- Take Profit: It is an order very similar to Stop Loss, only in this case it is used to ensure profits. An amount or price is also indicated here, depending on our preferences. When the market reaches that price or the specified amount of profits is reached, the trade will be closed and we will ensure the benefits of the transaction. It is an order that is usually established according to a specific strategy. When we believe that the price has the potential to reach a certain target level.

Once all these parameters have been programmed, we will press the “Set Order” button at the bottom of the window and the position will be open.

It is also possible to place a pending order. It is an order that will only be executed if the price reaches a previously selected level. To set this option, from the position opening window that we have seen a little above and we have just reviewed, we must press the “Trade” button (upper right) and select “Order” instead of “Trade”. At this point, a new field opens in the position opening window to enter the price at which we want the order to be executed and a position to be opened if the market reaches this level.

– How to control open positions in eToro?

Open positions can be viewed in the “Portfolio” menu. They are grouped according to the financial instruments in which we trade, but they do not appear as individual trades. So if we have two independent transactions in the same instrument, the two are added when we look at the instrument on the Portfolio screen.

Each line on the screen represents a financial instrument in which there is one or more open buy or sell positions in the market. If we press any of the lines, the platform will show us all trades broken down in that same instrument.

The data that appears regarding the open positions are the following:

- The financial instrument in which the investor is trading.

- Total exposure in the market (with leverage) and below the direction of the trade (buy or sell trade).

- The price at which we enter the market (buying or selling the asset). If we have several trades opened in the same asset, the average opening price is shown. By accessing the detailed positions we can see the opening price of each one of them.

- The amount invested in the financial instrument (deposited margin, without leverage). It can also be added if we have more than one trade in the same asset.

- The number of gains or losses of the open trade or set of trades in the same instrument.

- The percentage that represents the gains or losses on the amount invested.

- The valuation of the investment (in terms of the amount) if we decided to close the position at this time.

- The price at which the financial instrument is at that moment and what losses/gains we would have to accept if we decided to close the trade.

The last button that appears on the line is the “Configuration” button. Pressing this button we can perform the following functions:

- Open a new trade on the asset.

- Close the position (we will deal with this matter shortly).

- Write a post tagging the asset.

- See its price chart.

- Set an alert for when the price reaches a certain level.

– How to edit an open position?

To edit an open position the first thing the trader must do is access the “Portfolio” screen to view it.

If we press on any line corresponding to any of the assets in which we are investing, the details of the open positions in that asset will be shown. As shown in the following example, we have a trade on the BTC/USD instrument:

Just by pressing the Configuration button for any open position, the corresponding window opens to modify the position. The elements that we can modify are:

- The Stop Loss.

- The Take Profit.

- Introduction of a Dynamic Stop Loss.

– How and when can we close an open position on the eToro platform?

Trading orders can be closed automatically or manually:

When we talk about the automatic closing of a position we are referring to the automated execution of Stop Loss or Take Profit orders that we have configured when the position was opened. In the case of the Stop Loss, it is an order that is executed when the market is against us and therefore it is used to cut losses and in the case of the Take Profit it is executed when the market moves in favor of the trade and reaches the profit target.

In addition to these two previous orders, there is also the possibility that the broker automatically closes our trades if it is strictly necessary in case we experience losses and the available capital in our account is insufficient to bear greater losses. It is a protection mechanism to prevent us from contracting a debt with the broker. It is known as negative balance protection.

As for the manual closing, we can do it when it seems appropriate, for example, if our trades are making money but we have not yet reached the profit target (Take Profit) but we see that the price can turn around and go against us. We can also close a trade manually if we see that the market is against us and we do not want the price to reach the stop loss.

To do this, the first step is to locate the open position that we want to close through the “Portfolio” menu.

Remember that all trades are added according to the instruments. If we have more than one trade in the same asset, the aggregated data will appear, which we can see broken down if we click on the line corresponding to the asset.

At this point we have two options:

- Close all open positions on the same instrument. In other words, stop investing entirely in that asset.

- Close only one of the several positions that we can have open in the same instrument.

To close all positions in one instrument we will not even have to click on the asset line to see the detailed positions. Simply by clicking on the “Configuration” button (remember, the gear icon) and selecting the “Close” drop-down menu, the following screen will open:

If we select the “I want to close all (xx) trades” box and press the “Close all” button, we will automatically close all positions in this asset.

To close only a specific position, we must go to “Portfolio“, click to display the group of instruments where the position we want to close is, and finally click on the “X” on the right side. The following closing confirmation window will appear:

In this window all the data of the open trade that we are about to close appear:

- Position number (ID).

- Amount of the position.

- Gain or loss with which we close the transaction.

- Valuation of the amount, once the corresponding profit or loss has been added or discounted. This is the amount that will be added to the “Available” and will be subtracted from invested capital (at the bottom, the account bar).

Once these data have been reviewed, we only have to press “Close trade“. With this, we have already confirmed the closing of a specific position by keeping other positions open that we may have in the same instrument.

Here we end our tutorial on how the eToro broker works. Through this guide, we have seen practically all the elements of its trading platform, both to take advantage of the social trading functionalities (Copy Trading), its new CopyPortfolios, and how to open, control, edit and close positions manually.

You can obtain more information about the broker and social trading network eToro on their website through the following link:

Warning: eToro is a multi-asset platform that offers both equity and cryptocurrency investments, as well as asset trading using CFDs.

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford the high risk of losing your money.

Cryptocurrencies are a highly volatile unregulated investment product. There is no protection for EU investors. This content is intended for informational and educational purposes only and should not be construed as investment advice or recommendation.