Durable Goods Order definition

- The progress report on durable goods.

- Manufacturers’ shipments, inventories and orders.

The reports are broken down by industry, which serves to eliminate the effects of a single volatile industry such as defense spending.

Relevance of the durable goods order report

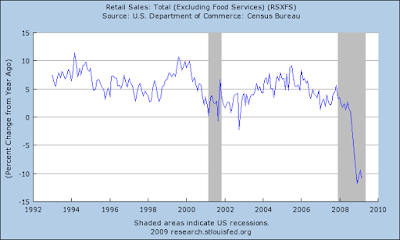

Due to the fact that investment prices react to economic growth, this indicator is important for investors to be able to recognize trends in the growth of the economy. The report of the Durable Goods Orders factory can provide valuable information on how can be the occupation (jobs) of the factories in the future. Orders placed in the current month can provide work in factories for many months to comply with such requests.

In this way, the major occupation of factories is the result of the increase in durable goods orders, which leads to higher employment of workers in factories, a condition that affects the country’s economy by reducing unemployment. This in turn causes the reactivation of domestic consumption.

Effects of the Durable Goods Order Indicator in the financial markets

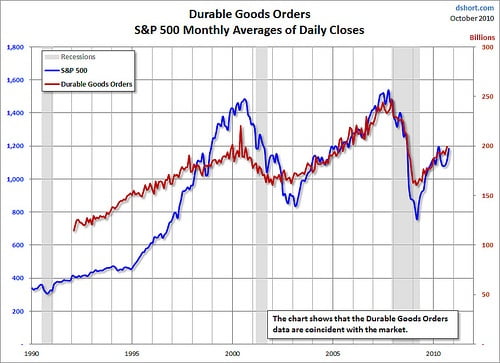

Considering that the Durable Goods Orders indicator offers a report about the future of the manufacturing industry in terms of how busy it will be in the future, it can be assumed that the data show also how the economy will behave in terms of growth or recession level.

When the indicator reflects an increase in durable goods orders, investors can expect the stock market to go up because it advances an expansion of the economy. he more orders enter the factories, more units will be manufactured, so more workers will be needed, and that create new jobs in the economy.

In addition, an increase in orders in an industry leads to an increase in total sales, which usually means a higher income for businesses.

Thus, higher expected benefits are interpreted by markets as a potential revaluation of the shares, which encourages investors to invest in companies.

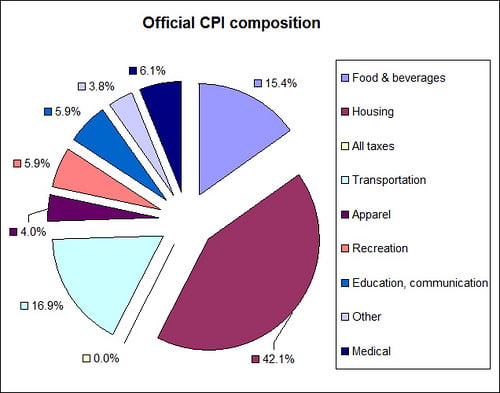

On the bond market, the configuration of an expansive economic scenario is considered as the beginning of a rise in inflation which therefore can cause a change of the national monetary policy in favor of an increase in interest rates to control prices.

Whenever there is an increase in Durable Goods Orders indicator, there is a possibility that investors lose interest for debt and bonds due to the expectations of economic prosperity, so they will choose stock market investment as it is expected to be more profitable. Thus, it is also understood that investors ask higher returns to bonds at this stage of growth, as they will have to compete directly with the returns of the securities or shares.

Regarding the national currency, a situation of increased Durable Goods Orders sustained over time result in a revaluation of the currency as a result of the strength of a growing economy, which is capable of generating employment, with dynamism in its domestic demand, rising corporate profits and increased revenue collected by the government authorities which in turn have the capacity of fulfilling their obligations regarding debts (principal amortization and interest payments). In this situation, domestic currency strengthens against other foreign currencies, therefore, an increase in this indicator may result in increased purchases of domestic currency by speculators and investors. So, the Durable Goods Orders should be followed by Forex traders.