General definition and importance

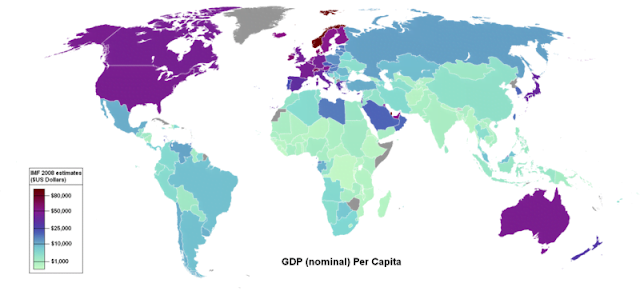

The “International Trade & Trade Balance” is an economic report that measures the difference between imports and exports of goods and services in countries like United States. Imports and exports are important components of accumulated economic activities. Furthermore, representing 14 and 12 percent of the gross domestic product in the United States, respectively. Normally, increases in exports are positive for corporate profits and also good for the stock market. Changes in the trade balance with particular countries may have implications in the monetary policy with respect to those countries for which this report is important for investors who are interested in diversifying their investments globally.

Frequency with which the report is issued in the United States

The economic report “International Trade & Trade balance” is monthly, is opened to the public the 19th of each month at 8:30 (PST). You can also access the data from up to two months earlier.

Investors and American politicians are increasingly using the information `presented by trade balances as a way to determine the health of the U.S. economy and its relationship with the rest of the world. The best known indicator on the trade balance report is the nominal trade deficit. It represents the current dollar value of U.S. exports, minus the current dollar value of U.S. imports The report also covers the trade of services, such as financial management and the information sector, of which currently E.E.U.U. is a major exporter. Generally, there is a surplus in that category.

In the category of physical goods, we can find the major components of the nominal monthly value and the energy (oil). Several aggregates of the trade balance are presented in the media, and the current account value is one the most important. A more detailed financial breakdown between the U.S. and foreign countries is available quarterly. This report summarizes monthly data and reports necessary adjustments to be made. The report is brought to light by the Bureau of Economic Analysis (BEA).

Strengths of this economic indicator

The monthlies publications are concise and give results in nominal terms (dollars). It stresses the countries with the highest percentage in the trade balance and exchange rates. Also, it displays results in the context of the last six months. Trade analysis is very important because it represents approximately 25% of total economic activity in USA and is a significant component of the GDP of virtually all countries that are currently in the Forex market.

Weaknesses of this economic indicator

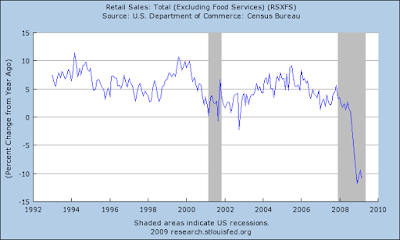

Some weaknesses of this economic analysis are that the monthly report does not show reconciliations of completed transactions ((although the quarterly report shows these data). Another disadvantage is the potential volatility due to seasonality and oil prices.

Effects of this indicator in the market

The trade balance report may give clues to future fluctuations in GDP. Thanks to this report the investors can know more about the trade balance and investment decisions can be made more easily as United States is the main economy worldwide. Also, it provides data to policymakers.

The Trade Balance Report can move markets if the data show a marked change compared with the previous periods. Compared to other indicators, this report is difficult to estimate due to the aforementioned effect of oil and surprise factors that may occur from time to time. Many investors want that the trade balance maintains the current levels or fall, as this is a sign that exports are growing and exporting firms experience an increase in sales in areas of the world where the balance has shifted to for the United States.