The economic cycle is a series of phases that the economy goes through and that happen in order until reaching the final phase in which the economic cycle begins again.

Each cycle goes through periods of recession and periods of expansion. This phenomenon has been common throughout economic history, being known by other names such as “business cycles” or “cyclical fluctuations“.

It is known as economic cycle because once finished it starts again from the beginning forming a continuous wheel. However, due to its unpredictability this cannot be taken as a formal rule.

In the upward phases the economy improves and jobs are created, while in the downward phases the economy decreases. It is in the periods of contraction when economic crises break out. When oscillations of great intensity occur, economies can experience economic bubbles.

Although we know the situation we are in, the future behavior of the economy is practically unpredictable, since it does not follow an established pattern.

Phases of the economic cycle

The life of the economic cycle is usually divided into different parts:

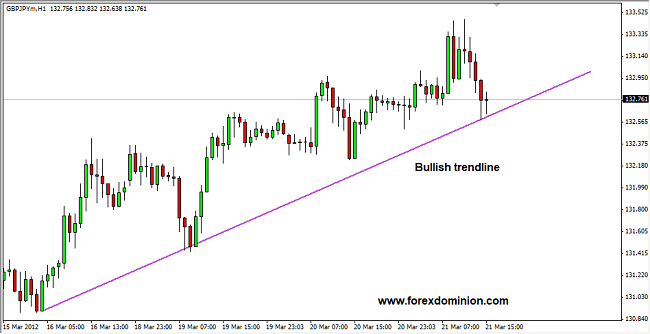

- Recovery: Phase of the cycle in which the economy is stagnant or slightly growing.

- Expansion: Phase of increased economic growth.

- Boom: Phase in which economic growth begins to show signs of exhaustion.

- Recession: Economic activity is reduced. It leads to a decrease in consumption, investment and the production of goods and services, which in turn causes many workers to be laid off, which increases unemployment.

- Depression: When we are in a phase of continuous recession over time and with no signals of improvement.

The economic cycle duration is highly debated since they have rarely had the same temporality throughout history. Sometimes the five phases have taken place in just two years and on other occasions it has taken more than 10 years for all the phases to be completed.

Duration of the economic cycle

The economic cycles do not have a determined duration. However, statistical studies have distinguished economic cycles of different sizes, classifying them as follows:

- Short cycles: They have an average duration of 40 months and do not usually reach the depression phase. They are also known as Kitchin cycles.

- Average cycles: They have an average duration of 7 and 11 years. They are a series of short cycles, which are not completely overcome and end up in an economic crisis. The average cycle is also known as the Juglar cycle.

- Long cycles: They last between 47 and 60 years with an average of 54 years of duration. The phases are smooth and slow, it takes a long time to reach the boom and when there is a recession it is usually slow, but it leads to economic depressions of historical magnitude. Also known as Kondratieff cycles.

How to know the phase of the cycle in which the economy is?

The economic cycles are measured mainly in levels of economic activity of certain periods, normally we would speak of months or years. It is not very difficult to know the phase of the economic cycle we are in, but it seems very complicated to know when one phase will end and the next will begin. As well as how long the next one will last.

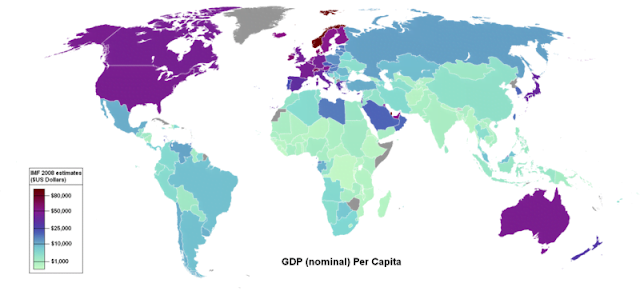

One of the main forms of measurement is with the help of GDP. Basically, if GDP goes up, we would be in an expansive and wealth-creating situation. If GDP falls, we are in a situation of recession and loss of wealth.

Another clear clue to find out where we are in an economic cycle is to analyze the employment factor. Depending on the unemployment rate of an economy with respect to its historical average, it is possible to intuit in which phase of the cycle is the economy. In a recession, it seems almost impossible to find a job and the unemployment rate is high. While in times of boom or economic expansion, the creation of new jobs is favored.

Finally, a distinction needs to be made between the business cycle and seasonal variations or long-term trends. The very basic characteristics of the economic cycle help it to be differentiated from fads or other changes in the behavior of a country’s economy.