– Bull Market

- Accumulation phase: At this stage falls occur in the market as the investors sell because the economic news are mostly negative. There is a moderate activity that begins timidly to recover.

- Recovery or expansion phase: In this case the activity begins with a modest progress and it produce a shy rising in market prices.

- Distribution phase: There is great activity in the market. There are major upward movements in market prices and trading volume and investors take long positions without objection.

– Bear Market

- Distribution phase: This is the last stage of the counter-trend, in this case, the upward trend. The volume is still high, but tends to decrease in their recoveries.

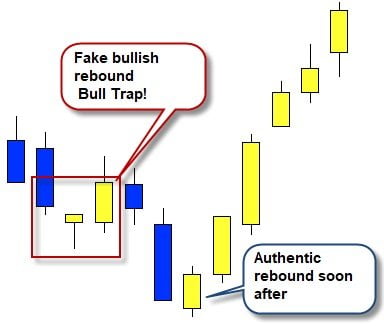

- Panic Phase: The selling pressure is far superior to the buying pressure. Prices drop dramatically and speeds up the bearish movement. Secondary bullish reactions (corrections) are often produced.

- Third phase: The sell-of continue. The reports are very negative and continuing the general decline in prices, but the movement is less violent than in the beginning of the previous phase.

Principle of Confirmation

We can only get a confirmation of the trend using at least two moving averages, instead of one. That is, all moving averages must be in an uptrend in the case of a bullish trend or in a downtrend for a bearish trend.

The volume moves with the trend

If the market is bullish, the volume will increase with the price increase and decrease with the decrease of the price.

The sideways markets replace the secondary trends

A sideways market consist in a lateral move in prices that can fluctuate without trend. It may take several weeks or even months. Its meaning is that the forces of supply and demand are balanced. A break upwards or downwards of that line indicate an increase in the strength of the buyers or the sellers.

Only closing prices are used

It is recommended not considering either the maximum or minimum of each session.

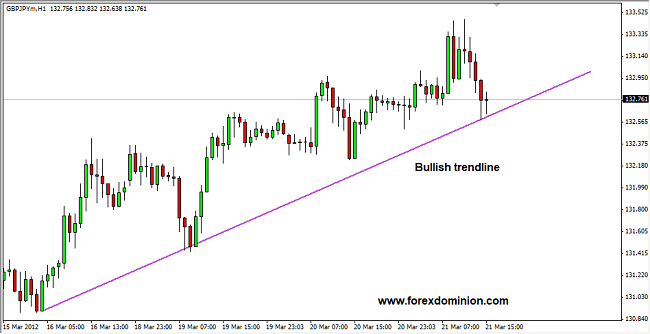

The trend is valid until a final confirmation of the change of direction is produced

In the following article you can find information on identifying market trends and how we can identify the end of a trend: Tips to identify the end of a trend