An efficient market is one in which the prices of the assets traded in it reflect at all times the information available on the market.

Financial asset prices react strongly to market information. When the information is released, the different market agents analyze it and use it to make decisions. So this information is incorporated into the price as it arrives.

Therefore, the more information on the market, the greater the efficiency of prices and the greater reflection of the fundamental value of assets. In this way, an efficient market can be considered as a market in which assets are quoted at their fair price and this price also truly reflects their real value at all times.

That said, not all markets are efficient, in fact, it is difficult for a market to be completely efficient. For this reason, for all those who wish to obtain more information in this regard, we offer a complete description of the different degrees of market efficiency in the following sections.

Investors often look for efficient markets: greater price efficiency, greater reflection of the assets value and, therefore, greater security.

However, finding a market that is entirely efficient is difficult, but not impossible. These are characteristics (we see them below) that must be followed with rigorous respect.

Characteristics of an efficient market

For a market to be efficient, the following premises must be met:

- The information must be available to all participants.

- Access to information is free of charge.

- Prices have to be adjusted quickly upon arrival of new information.

- There must be a high number of market participants that act based on the information flows that reach the market.

Efficient markets hypothesis

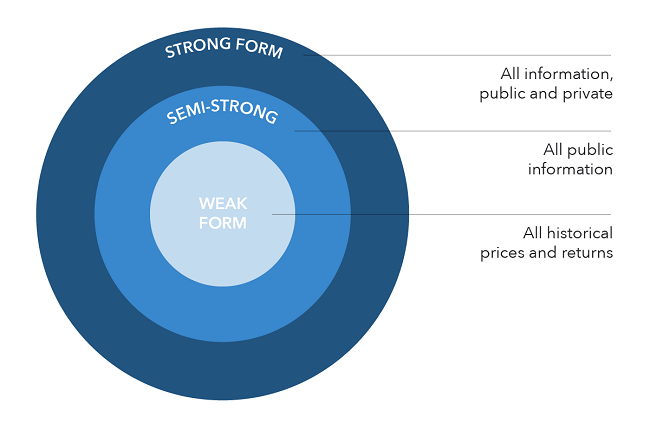

There are three types of efficiency in the markets according to the efficient markets hypothesis:

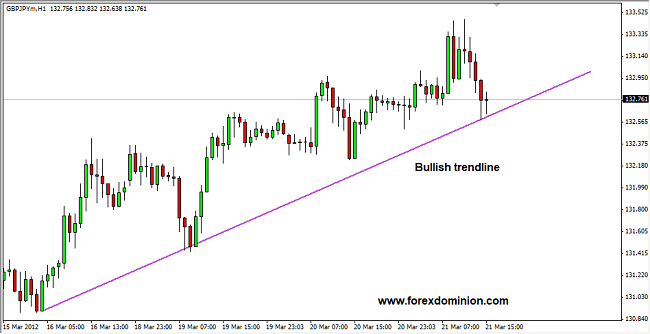

- Weak efficiency: It is based on historical prices, which reflect all the information contained in past prices. So the past information (volume and prices) have no predictive power over the future price of the securities, because the prices are independent from one period to another. In a context of weak market efficiency, risk-adjusted returns cannot be obtained using technical analysis.

- Semi-strong efficiency: It also incorporates public information. Values adjust quickly when information is made public. So the prices reflect all the public information available. This would imply that risk-adjusted returns could not be obtained through fundamental analysis.

- Strong efficiency: It is the efficiency that incorporates the previous two and private (internal) information. Prices not only reflect the historical and public information but also all the information that can be obtained by analyzing the market and the economy. This implies that no investor can access relevant information on the market prices so that no one can constantly obtain excessive returns in the market.

Given the prohibition that exists in most markets to invest based on inside information, it would be unrealistic to think that the markets have strong efficiency.

Many studies have shown that there is a weak form of efficiency. Past prices have no correlation with future prices. Prices turn out to be random. However, they do not support the fact that prices are right and therefore always correctly reflect intrinsic value. Therefore, there are also anomalies that reduce the credibility that the markets are weakly efficient.

Given the prohibition that exists in most markets to invest based on inside information, it would be unrealistic to think that the markets have strong efficiency.

Many studies have shown that there is a weak form of efficiency. Past prices have no correlation with future prices. Prices turn out to be random. However, they do not support the fact that prices are right and therefore always correctly reflect intrinsic value. Therefore, there are also anomalies that reduce the credibility that the markets are weakly efficient.

Behavioral finance proposes an adaptive hypothesis for markets.

The 6 lessons on market efficiency

- The markets have no memory. Past price changes do not reflect or have information about what will happen in the future. We have all heard the famous phrase, “Past returns do not guarantee future returns,” many times.

- Trust the market prices. When the market is efficient, it means that the price gathers all the available information about the value of each asset.

- Learn how to read the market before investing. There are many questions that must be solved to know what are the current market conditions, and if the investor makes a good analysis, he can obtain good conclusions for the future. What does a higher return mean? What is the projection of that asset? How is the interest rate curve? What signals does the market send us?

- Trust only yourself. A good investor would not pay another for something he can do for himself.

- Very high elasticity of demand. Small variations in changes in the price of an asset involve large movements in the demand for it.