When we begin to analyze financial markets, the first thing to be clear about is that prices basically move in two trends. On the one hand we have the bull markets and on the other hand the bear markets. Each type of market offers specific characteristics and requires a different way of trading. In this article we will analyze this.

In fact, trading in bull markets is usually the most common, but there are also those who use the bear markets to find the best opportunities. Markets in general are very volatile and quite irregular. So much that it often seems complicated to predict the fluctuations of the assets that are listed on financial markets.

Next we will analyze both types of markets to distinguish the characteristics that each one has and check which market can best adapt to us, according to our investor profile. Pay attention to the following and you can choose with criteria which market is best for you to get a better return on your capital.

Before going into more details, you can get more information about market trends in the following article: The Market Trends

Investment in bull markets

Usually trading in bull markets is the most common form of investment in traditional financial markets, especially in the stock markets. Investors who bet on bull markets are based on the premise that money is only made in the stock market when the market is rising. Really sometimes it is easier to obtain benefits trading on the bullish trends.

Among the characteristics of bull markets, stability and order should be noted:

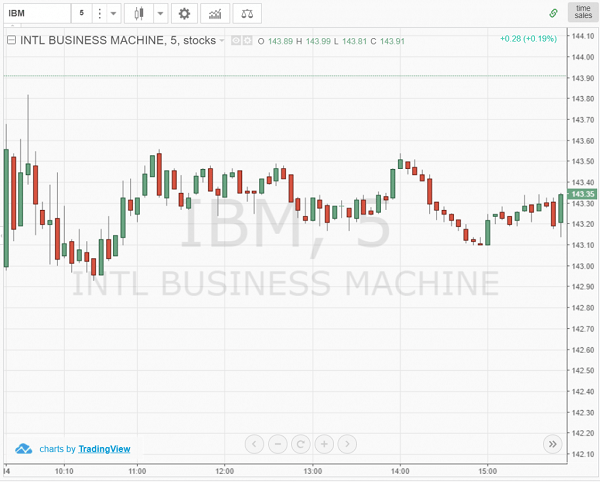

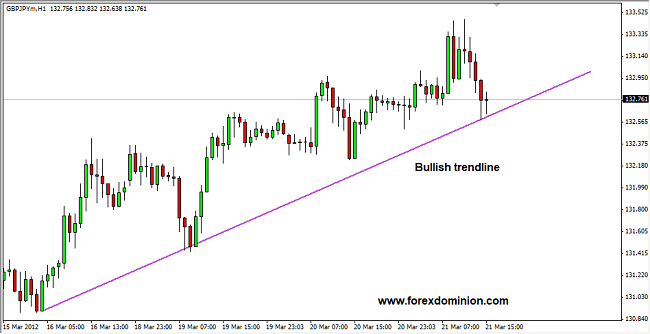

- The series of bullish prices happen in a more orderly way: Although this is not applicable to 100% of the cases because there are always exceptions, practically most times when price rises this occur it occurs in a much more orderly and linear way. Precisely this behavior makes the task of trading in bull markets and predicting their behavior easier.

- The structure of price maximum and minimum is more stable: As is the case with the structure of maximum and minimum price levels, where bull markets enjoy greater stability compared to bear markets.

Bull markets often follow behavior patterns. If we bother to observe the price charts a bit, we will realize that it is true, that the market acts in phases. Understanding this will be much easier to seize opportunities.

Investment in bearish markets

Trading in bear markets requires more work by the investor. As such, this market also offers good opportunities to obtain returns but given its characteristics it is much more complicated to invest in bear markets compared to bull markets.

In this case, the most important points to consider are:

- Bear markets are more volatile: When making predictions about the price behavior in bear markets, we can see that it is more complicated because of their greater volatility. Without a doubt, volatility is one of the characteristics that most define markets with a bear trend, since in the bear market everything is much more chaotic and disorganized than in bull markets where prices usually behave more orderly.

- In the bear markets there are more frequent technical rebounds: The maximum and minimum price levels in the rising markets are easier to control. However, in the bear markets, prices are more turbulent and technical rebounds often occur in full downward trend.

Investing in bear markets is more complicated but it is very interesting to trade under these conditions to look for the best opportunities when a sharp change in trend occurs. You just have to stay tuned and be quick so you don’t lose the chance to make money when the market moves down.

Recommendations

- Price increases occur more progressively while price falls tend to be more aggressive and out of control. Therefore, controlling bullish market trades will be relatively simpler than anticipating reactions in a bearish market.

- Discipline is important in both markets, not being carried away by feelings will be essential to invest successfully. In bear markets, you have to be careful with panic, while in bull markets it will be vital to control euphoria.

- Beware of the speculative factor in bear markets, it is usually much higher than in bull markets. Using Stops limit orders will also be more complicated in the bearish markets, given their high volatility.