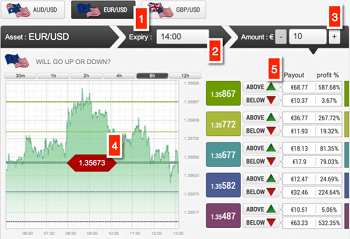

In binary options trading, the expiry time or maturity is defined as a predetermined time, or hour in which the result of a trade is determined. When a trader opens a position with options, the broker indicates the relevant expiry time for the binary option. When that moment arrives, the value of the underlying asset (known as Expiry rate) is determined, which results in a positive or negative result of the transaction for the trader.

When a trader opens a position with digital options (High/Low), the time of initiation of the trade is known as Strike Time. Before the execution of the transaction, the trader is required to select an underlying asset and make a prediction about price direction. If the trader believes that the asset price will go up, he places a call option based on the asset, but if he thinks that the price will go down, then he places a Put option based in this asset.

Depending on the broker, the trader receives a range of alternative of maturity periods that can be applied in a variety of types of underlying assets (Forex, stocks, indices and commodities). This range of maturities includes periods of a few minutes, hours, days or even weeks. The expiry time is an important element in the execution of a trade with binary options, as the length of time may influence how the price of an asset reacts to various changes in the market. Once the transaction reaches the expiry time of the binary option, the value is determined, and finally is determined whether the trader’s prediction was correct or not, and subsequently, if the transaction finished In The Money or Out The Money.

In the above example, the expiry time for the option would be 23:00 EST on Tuesday, and if the price of the EUR/USD has risen to that point, then the option expires In The Money.

If we take the time to learn more about binary options, we can get the knowledge that can help us improve our profits.