The flexibility of binary options trading compared to other financial products offers a number of opportunities for the trader, including the ability to speculate based on a variety of markets, which in turn offer a wide selection of underlying assets including currency pairs (Forex), stock indices, commodities and stocks. Having such a variety of assets among which we can choose, there are greater possibilities for the trader to perform an operation with a binary option that ends In The Money.

When we trade with binary options, there are two possible outcomes. The role of the trader in this scenario is to predict whether the price of the underlying asset will go up or down with respect to a certain price (usually the entry price of the option) and an equally predetermined period of time, known as expiration period or expiration time.

For example, if the trader predicts that the underlying price will go up for the time of the option´s expiration and at the end this prediction is correct, then the transaction will have a “In The Money” result in the expiry of the contract. In this case, because the option expires In The Money, the trader receives the default payment for the transaction. Alternatively, if a trader predicts the direction of the asset price incorrectly, then the result of the operation at the time of maturity will be Out The Money.

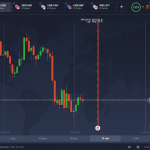

Example of a binary option that expires In The Money

Suppose a trader considers, for example, that the currency pair EUR/USD will close above its current value of 1.3600 for the time of expiration of the option (say a maturity of 1 hour), so he opens a position with a Call binary option of 1 hour through a broker. Call options are those acquired when a trader believes that the value of an underlying asset will go up for the moment of expiry of the option. In this example, if the price of EUR/USD goes up and ends even just 1 pip above the current value of 1.3600 once the option expires, then the operation will end In The Money.

If after an hour, the price of EUR/USD would have fallen to 1.3590 for example, then the option would have expired Out The Money.

With binary options (High/Low mainly, the most common type of binary options) what really matters is the final result and not the behavior of prices during the period in which the option is active. In the above example, if the EUR /USD would have been down 1.3600 for 55 minutes but at the time of the option expiration the EUR/USD would have closed at 1.3610 for example, then the transaction would have finished In The Money.