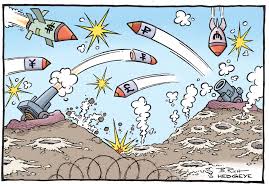

The trade war between the United States and China has lived its nth chapter, with the establishment of new tariffs between the two countries, for tens of billions of dollars.

Donald Trump and Xi Jinping continue to fight a battle that involves not only a commercial pulse between the two largest economic powers on the planet but also a fight for global supremacy, for the ability to influence throughout the world.

Naturally, this struggle between the two superpowers, which agglutinate 40% of the world’s GDP (another 20% corresponds to the European Union), affects not only both contestants, but also has multiple and varied effects on other economies. And more if we take into account that together with the increase in tariffs, we have a currency war, more or less buried.

Back to protectionism

The trade war is one of the pillars with which Trump is trying to shield his economy, closely related to his classic slogans, America First and Make America Great Again, all of this, identifying America with the United States.

The trade balance between the United States and China is very unbalanced. The difference between what the North American country sells to China and what it buys from it exceeds 400,000 million dollars (it has multiplied by four in the last 20 years), and this commercial war aims to reduce that gap.

Behind Trump’s slogans, the protectionism under which the president of the United States underlies. It aims to protect its economy. Let’s give an example:

Imagine that a US company manufactures a ton of steel for $500, including all labor, security, tax, etc. costs. The same ton, made in China, with lower wages, not-so-comprehensive security and less taxes costs 300; even including transportation to the United States, the final cost would probably be around 400

With tariffs of 10%, the material bought in China would cost 440, so some US producers would prefer to buy Chinese steel. As a consequence, the American steel producer could begin to have problems, which will lead to the dismissal of workers or even to closure.

How to avoid it? Apparently it’s very simple. Tariffs are raised to 30%, so Chinese steel now costs 520. US companies buy from suppliers in their own country, and the matter is settled. Or not?

The problems of protectionism

It is not that easy. In a situation like the one mentioned above, the steel industry has been saved and jobs have been protected – at least initially – but what other effects occur?

Companies that purchase steel (for example, those in the automobile sector), now face higher costs. Therefore, they will be less competitive abroad, so they can start to suffer their own problems.

Internally, their products will also be more expensive, so external competition gains ground. In this case, would tariffs also be raised in that sector? As we can see, the rise in tariffs can lead to a chain rise in other related sectors.

Consumers in the country will also be greatly affected. They will no longer have competitive alternatives that come from other countries, so the overall price level will be higher. As a consequence of the tariffs, inflation will be generated, with which, the money will be worthless.

In addition, innovation and competitiveness are limited: if an industry is not competitive and tariffs are set to protect it, it will still not be competitive, it has no additional motivation to improve.

The currency war

The commercial war has a sister who looks a lot like it, the currency war. Sometimes they occur separately and sometimes they occur together, and if so, their effects multiply.

The currency war works similarly to tariffs, but with an additional advantage: its effects also apply immediately to all the products that are exported.

Let’s give an example. In the case mentioned above, we said that steel manufactured in China cost $300. But in China, the currency is the Renminbi (commonly known as Yuan), so that the cost, in fact, is measured in this currency. If 1 dollar = 7.18 yuan, it means that the cost was actually 300 × 7.18 = 2.154 yuan.

With the currency war, it is about artificially altering this currency exchange. Suppose that now, instead of being worth 7.18 yuan, each dollar equals to 9 units of the Chinese currency. What would be the dollar cost of each ton of steel? 2,154/9 = $239.33.

In recent times, the yuan has been reducing its value, to favor Chinese exports. In March 2018, one dollar was exchanged for 6.30 yuan, while a year later it was already at 6.70, and at the end of August 2019 one dollar has a value of 7.20 yuan. Thus, all the products that the United States imports from China have reduced their cost by 14%.

How does it affect other economies?

The conflict between the two powers also affects other countries. Amid the whirlwind of this trade war, other powers such as Canada, Japan, South Korea, the European Union as a whole or, particularly, Germany, have seen how the export of many products to the United States was complicated.

The bad thing about trade wars is that they have an uncertain ending, and there are no winners. The protectionism of some causes the protectionism of others, and so on, in a spiral that seems to have no end. As a result, everyone loses.

In Spain, a famous case was the tariffs on black olives. Since the United States began applying import tariffs on Spanish black olives, sales have been greatly reduced; In 2016, before the start of its application, sales were 32 million kilos. Two years later, they had halved.

If we take Germany as an example, being a purely exporting country, the effect of the tariff war is important; Many of the goods exported to the United States are equipment, machinery, automobiles and, in general, devices with significant added value.

If restrictions continue or increase in a market like the United States, the situation could lead to major problems in an economy that not only lives off its exporting apparatus, and which is also close to the recession.

How does it affect investments?

As we have seen, in addition to affecting ourselves as consumers, the massive application of tariffs has effects in virtually all sectors. Any company that imports or exports can be affected by this global movement.

In the case of our country, companies related to steel and the automobile sector would be particularly affected. But also the agricultural sector and the food sector (olive oil, olives, wine, cheese, ham …) can suffer the consequences of this war that, as we said, has no winners.