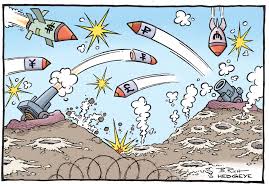

Definition of currency wars

It consists of manipulating the currency to sell more. You lower the value of your country’s currency and artificially lower your products to make them more attractive in other countries and increase your exports.

How can a country manipulate its currency? There are many ways, but simplifying, the two main ones would be:

- Lower interest rates. You pay less to have the coin. People prefer to invest in other currencies with higher interest rates.

- Sell a lot of your currency in exchange for other foreign currencies. In this way, you flood the market with yen, for example, and that depreciates the currency.

Implications of currency wars

Currency wars occur mainly among rich countries. It has some logic. Rich countries and their economies are not getting out of the crisis. Japan has in fact already lost nearly two decades. And on several occasions, this country has made depreciation of its currency to relaunch its exports since its economy is based on exports. The problem is that this strategy has a counterpart: the yen is worth less, yes, but with respect to what? In this case it worth less with respect to the dollar, the euro, and other important currencies, which become more expensive, and therefore, its products are less attractive in the competitive foreign market.

However, in the case of rich countries, embarking on a currency war would have a negative sum: that is, all would lose. Even Japan and China.

History has already demonstrated in the thirties the nefarious effect of policies that were called “beggar thy neighbor”, something like “impoverish the neighbor”. If all countries maneuver to sell more abroad, via manipulation of their currency, imposing barriers to imports, world trade suffers, and in the end, all lose. Not a good path to recovery.

But gaming theory also points out the strong incentives that all have to adopt these types of strategies, even knowing that if they cooperate it will be better for everyone, nobody trusts that the other does not end up making blind maneuvers to depreciate their currency.

Conditions required for international currency war

In order for an extended currency war to occur, a large portion of significant economies must wish to devalue their economy at one and the same time. This fact has only happened during a global economic recession.

A devaluation of an individual currency has to involve an increase of value in at least one currency. The corresponding increase will generally be allocated to the other 18 currencies and unless the devaluing country has a large economy and depreciates substantially, the increase in other currencies will be small or even unrecognizable. In normal times, countries are happy to accept small increases in the value of their currency or, in the worst case, they are indifferent to this fact. However, if a large part of the world suffers from recession, low growth, or is pursuing strategies that depend on a favorable balance of payments, then nations can begin to compete among themselves to devalue their currencies.

Under these conditions, once a small number of countries begin to intervene, this may cause the corresponding intervention of others as they try to prevent further deterioration in the competitiveness of exports.