We have already discussed in previous articles how important the stop loss is. For those who are not yet clear on the subject, the stop loss will be that price level from which our trade would cease to be valid and should be closed.

The stop loss can be automatic and programmed in the broker itself or manual. In the manual stop loss the trader makes the final closing of the transaction after checking the price in the market.

Knowing how to define the stop loss is very important. Depending on the distance of the stop loss from the price, we will have more or less profitability in the trade, provided that we respect an efficient money management.

The stop loss, once defined, may have a double evolution.

On the one hand we can have a fixed stop loss that does not evolve with the price. This type of stop loss is normally used on transactions with a high Risk/Profit ratio, so we are going to look for a price target that is much farther from the stop loss level.

Moving the stoploss with the price

However, most trading systems are based on variable stop loss that move as the price evolves. Adjusting the stop loss to the price means that as the transaction evolves, especially in our favor, we will move the stop loss from the initial position to a future position closer to our point of entry.

To make this stop loss adjustment we can follow several techniques, among them:

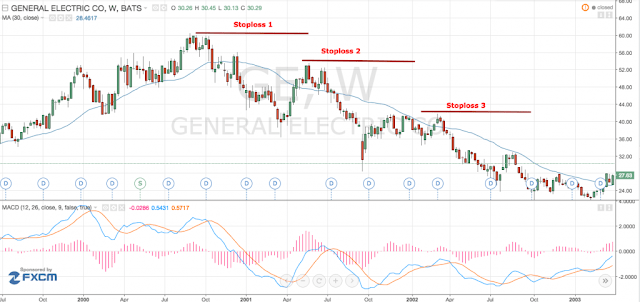

- Adjust the stop loss to a moving average, including the 30-week or 200-day moving average.

- Use a trailing stop, that is, a stop loss that keeps a constant distance from the price.

- Stop loss adjusted to the trend lines drawn.

- Stop loss set to the supports/resistances of the price chart.

- Stop loss set below the annual minimum/minimum of 30 days.

Any of the above strategies are valid and useful to efficiently move the stop loss since most are based on solid technical analysis tools.

However we can not use all at once and therefore we must use a specific stop loss strategy.

Selection of the method to move the stop loss

Moving the stop loss is important and is very personal. There are very nervous people who need to take quick benefits and therefore the trailing stop very tight to the price will be the perfect solution.

Others with a quieter personality can wait to move the stop loss by following a moving average which will evolve slowly and progressively.

As not all traders are equal, the solution will never be the best for all but for each one. It is fundamental for this that when selecting an appropriate stop loss we do a good backtesting of the trading system simulating the transactions in the past and the way we would move the stop loss based on our character.

We must be very clear that we have to know very well what technique of stop loss movement we have and not change from one criterion to another in each trade.

If we make a good backtest we will see if the exit method is effective.

My favorite criterion

Of all of them my favorite criterion is that based on moving averages, among them, the 30-week moving average (medium-long term trading). The reason is that it is a solid and easily identifiable criterion, it is simple to apply and does not generate excessive doubts.

It is also applicable to all financial instruments and is therefore versatile and adaptable to the market in which we trade ourselves.

Here is an example:

Now it’s your turn, the moment to select your method. If you still do not have one, it’s time to test, spend some time on the demo account and evaluate which one suits you best.

Once selected insist with the method since changing the exit method will change your profitability so if you discover something that works for your trading, follow it constantly.

Easily Boost Your ClickBank Banner Commissions And Traffic

Bannerizer made it easy for you to promote ClickBank products with banners, simply visit Bannerizer, and get the banner codes for your picked ClickBank products or use the Universal ClickBank Banner Rotator Tool to promote all of the ClickBank products.