Below, we present a modified indicator for the well-known MetaTrader 4 platform, designed to detect when the price on various instruments and timeframes is overextended either upwards or downwards relative to the average, represented by a moving average such as the 200-period SMA. This is a screener-type indicator that shows the markets where the price has reached a high/low of n periods above/below the average.

In other words, it highlights instruments where the price could experience a mean reversion.

The tool is also designed to display an alert window within the MT4 platform, send email alerts, and generate push notifications.

The indicator was created by the Forexdominion.com team and, although it is not free, like many of the other indicators we offer, you will find it quite affordable.

Before describing what the mean reversion indicator for MT4 is and how it works, let’s briefly discuss the concept behind this trading approach.

What is the mean reversion strategy?

Mean reversion is a financial theory suggesting that asset prices will eventually return to their long-term mean or average. This concept is based on the belief that asset prices and historical returns tend to gravitate toward a long-term average over time. The greater the deviation from this average, the higher the likelihood that the asset price will move back towards it in the future.

This theory has given rise to many trading strategies that involve buying or selling stocks or other securities whose recent performance has significantly diverged from their historical averages. However, a change in returns could also signal that a company no longer has the same prospects as before, in which case mean reversion is less likely.

Percentage returns and prices are not the only measures considered in mean reversion; interest rates and even a company’s price-to-earnings (P/E) ratio may also be subject to this phenomenon.

Traders use mean reversion strategies to capitalize on asset prices that have deviated significantly from their historical mean. The underlying assumption is that prices will eventually return to their long-term average.

What is the mean reversion screener indicator for MetaTrader 4?

In general terms, this indicator is a tool for MetaTrader 4 that detects markets where the price has risen or fallen sharply and has reached a high or low of n periods relative to the average, represented by a long-term simple moving average, such as the 200-period SMA.

In such markets, where the price has become overextended, it is expected that the price will eventually return to the average, offering good opportunities for higher-probability countertrend trades, though they always involve some risk.

As we will see in the settings window, the trader can adjust the number of bars or periods to be considered for the high or low, as well as the period of the SMA used as the average.

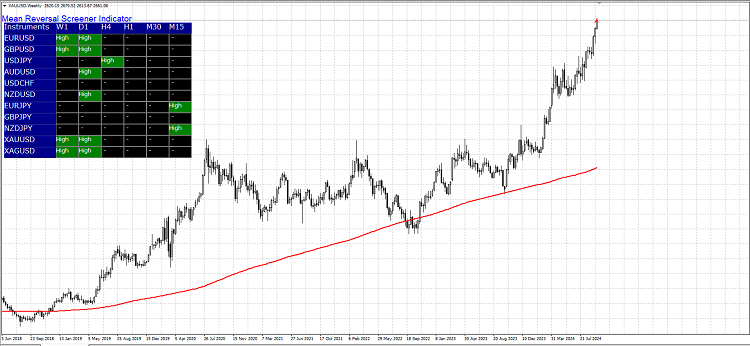

When activated, the indicator displays a screener consisting of various currency pairs and timeframes, allowing traders to monitor multiple markets and periods simultaneously. In the following image, we show an example of this screener with the major currency pairs, precious metals, and cryptocurrencies:

Through the screener, the indicator shows in which instrument and timeframe the price is reaching a high/low of n periods by changing the color of the cell corresponding to the asset and period where the market is becoming overextended.

Thanks to this, the trader can go to the price chart of the asset where the signal was generated (by clicking on the corresponding box in the screener) and evaluate the market conditions to determine whether or not it’s worth taking the risk of making a countertrend trade.

Alerts for markets distant from the average

In addition to the signals shown on the price chart and the screener for markets where a mean reversion might occur, the tool allows the trader to configure trading signal alerts that notify the user when an opportunity arises through:

- Push notifications.

- Email.

- A signal alert window on the platform.

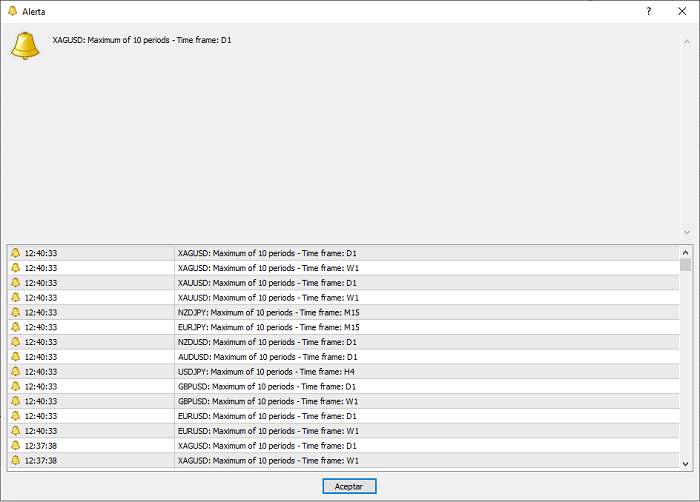

In the following image, we can see the signal alert window:

Indicator Settings

The mean reversion indicator is quite simple and can be configured with relative ease. By default, the screener is set up with the major currency pairs, gold and silver, as well as the cryptocurrencies Bitcoin and Ethereum, and includes all timeframes from M15 to W1.

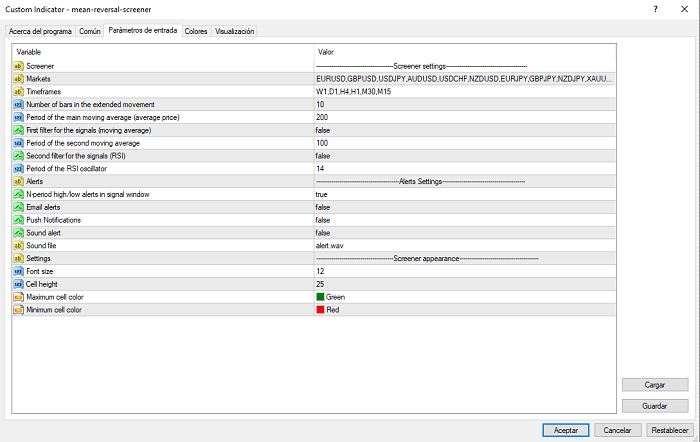

The following image shows the settings window:

As we can see, the first two parameters allow us to add the assets and timeframes we are interested in analyzing. Next, we have the parameters where we can specify the number of candles or periods the indicator should consider to detect highs/lows (for example, the 10-period high/low) and the number of periods for the moving average.

There is also the option to activate two indicators that can be used to confirm signals, including an additional moving average and the RSI oscillator. For example, we can configure the indicator to detect markets where the price has reached a 10-period high/low above/below the 200-period SMA and 100-period SMA and is in overbought/oversold territory.

Next, we have the parameters that allow us to activate various signal alerts and finally several parameters that enable us to adjust the size of the signal screener, which can be very useful if we are tracking multiple instruments.

Recommendations

This mean reversion indicator for MetaTrader 4 is only a support tool and should not be used as the sole criterion for entering the market. Just because the price reaches a 10-day high doesn’t mean it will drop the next day and fall back to the average.

Markets that experience especially strong trends can rise and fall for many periods with few corrections. That’s why countertrend strategies can be risky if risk management tools, such as stop-loss orders, are not used.

Therefore, it is recommended to combine this indicator with other market analysis tools, such as support/resistance levels or oscillators like the RSI that show when a market is overbought or oversold.

Trying to predict price turning points can be complex.

How can you get the mean reversion screener indicator for MT4?

This technical market analysis tool was created by developers from ForexDominion and can be purchased for $30 USD via PayPal through the following form:

| Item to buy | 1 copy of the modified Mean Reversion Screener indicator for MetaTrader 4 in .ex4 format

|

| Unit price (USD) | $30 |

| Instructions | *By clicking on “Purchase” you will be redirected to the Paypal page to complete the payment. |

| If you have any problems please contact admin@tecnicasdetrading.com with the payment details. You can also contact us at https://www.forexdominion.com/contact-us. | |

You can also purchase this indicator through the MQL5 marketplace via the following link: https://www.mql5.com/en/market/product/12634

If you prefer to purchase this tool directly, you can contact us at: admin@tecnicasdetrading.com.

Accepted payment methods:

PayPal, Skrill, Neteller, Airtm, and Bitcoin. If the customer wishes and it’s feasible, alternative methods can also be used.

Interested in developing a custom technical indicator or Expert Advisor for MT4 or MT5?

If you would like to develop a custom technical indicator or Expert Advisor (EA) based on your own trading methodology or idea but don’t have the time or knowledge to do it yourself, we can complete this project for you in a short time and at the best prices.

You can contact us through: Contact Form.