Opinions about Pepperstone broker

One of the most important factors when making online trading is to choose a reliable and safe broker that offers a good level of service and transparent trading conditions. A broker in which our funds are completely safe and can be withdrawn when we want without problems.

In this article, it is time to analyze in-depth the opinions of clients of Pepperstone, the Forex broker of Australian origin that today is already one of the references in the online trading sector at an international level.

All the data analyzed in this article are based on our own experience and the collection of positive and negative opinions of users that we have found in various investment forums, blogs, and specialized web pages.

You can read a review of this broker in the following article: Review of the broker Pepperstone

What is Pepperstone?

Pepperstone is an online broker specializing in Forex and CFD. The origin of this financial intermediary dates back to 2010, in Australia, a country in which it enjoys a good reputation.

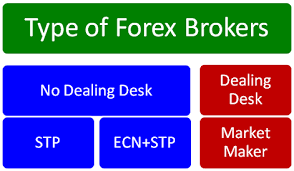

It is an ECN/STP broker, a pure intermediary, which executes the transactions of its clients without a trading desk (No Dealing Desk), therefore the trading orders sent by the traders are transmitted to the market and the broker does not act as a counterparty, so there are no conflicts of interest between Pepperstone and his clients (as can happen in market makers brokers).

As we will see in detail later, Pepperstone is a broker regulated by the FCA of the United Kingdom and by the Australian ASIC. The clients of this broker can trade in a wide range of financial instruments such as Forex currency pairs, cryptocurrencies, stock indices, precious metals, energy, commodities, and more.

You can open an account with this broker with a minimum deposit of $200, the spreads offered are quite low and any trading strategy is allowed without restriction (scalping, hedging, EAs, …).

Let’s see below the opinions of users about Pepperstone grouped into several categories:

Opinions about Pepperstone trading platforms

There are several options when choosing the trading platform with the broker Pepperstone, although it also depends on the type of trading account we open.

For a Standard Account (the most basic, as we will see later), only Metatrader is allowed for all clients. Pepperstone offers Metatrader 4 and Metatrader 5.

This platform is well known, the most used by traders around the world, and, in addition, very well valued by the user community, as we can see in numerous comments.

If you decide to open a more advanced account (Razor Account) you have the possibility of using the cTrader platform, a high-speed platform ideal for scalping and using trading algorithms.

We have also found mostly positive opinions about cTrader, which in addition to Pepperstone is also offered by some other online brokers. In our opinion, it is more focused on experienced traders than for example MetaTrader which is suitable for users of all levels.

Both types of platforms can be downloaded and installed on your computer or through any web browser without installing any software thanks to the web trader version.

In addition to the previous platforms offered by Pepperstone, we would need to talk about their respective versions for mobile phones and tablets with the iOS or Android operating systems. In this case, the best source of comments and opinions can be found on Google Play and the App Store.

In general, the experience of users is good, although it can be improved in some aspects. Remember that the versions for mobile devices generally present a series of limitations for market analysis and optimization with respect to PC platforms. These deficiencies are usually motivated by the functional and technical aspects of the devices to which they are intended. Their main advantage is the maximum flexibility to carry out and/or supervise our transactions from any place and at any time.

Opinions about the Pepperstone service

Trading instruments available

Clients of Pepperstone can trade with a wide variety of instruments, specifically:

- Forex (Currency Market)

- CFD on cryptocurrencies

- CFD on Stock indices

- CFD energy commodities

- CFD on precious metals

- CFD on agricultural commodities

Is something missing? Of course, CFD on individual stocks. More and more traders are approaching their transactions through these versatile financial instruments. Stock trading allows applying a great variety of strategies.

Pepperstone is a broker oriented especially to the Forex market. Forex continues to be one of the most important markets due to its high liquidity, its trading times (market seasons), its different pairs (each with specific characteristics and volatility, which allows the trader to choose his favorites), and their low commissions.

If what is intended is to trade with stocks, we already know that with Pepperstone it is not possible and this is reflected in the opinions of some users that we have found.

Trading accounts

Real accounts of Pepperstone have an initial minimum deposit requirement of $200 and there are a number of fundamental differences between them (not just commissions), for example:

– The Standard account: It is the most basic type of account of the Pepperstone broker. This account applies commissions in the form of spread (the difference between the bid price and the ask price). These spreads are from 1 pip for the most liquid assets. With this account, the trader only has access to the Metatrader platform.

– The Razor account: It is the most advanced account, without limitations. With it you have access to the cTrader or Metatrader platforms, lower spreads that can be up to 0 for the most liquid assets (with commissions per lot traded), fast trading execution, all types of trading strategies, use of Expert Advisors, etc.

In addition to the previous accounts, it is possible to open a free demo account with $50000 of virtual balance that will be available for 30 days. It is a very useful tool to test the trading platform and the trading conditions of the broker.

You can open a real or demo account with this broker through the following link:

In some portals we have found some negative opinions about the experience with the demo account although, it seems, the deficiencies are corrected when moving to the real account.

Another negative aspect, from our point of view, is the inability to operate with the demo account for an unlimited period, as it can be found in other brokers. Despite this, 30 days is a period at least sufficient to test the characteristics of the broker and see if it fits into what we are looking for.

Access requirements

Like any other online broker, Pepperstone has a simple procedure to open any of the accounts seen in the previous section. For this, we just have to access the company website.

The process is guided by the intermediary and the requirements are the following:

- Have the ability to agree on a contract with the broker (it is assumed unless the client is a minor or is incapacitated for some reason).

- We will need to provide an email address.

- We must also indicate a mobile phone number.

- Send the documentation accrediting our identity, our address, and the ownership of the means of payment chosen to deposit/withdraw funds. This process is common in all regulated brokers.

- Make a deposit (from $200, depending on the account in question).

The truth is that the access requirements to work with Pepperstone are industry standards. Perhaps this is why nobody is positioned neither for nor against.

Customer Support

Pepperstone is considered internationally as a good broker in terms of customer support but has an important point of improvement in terms of customer service in Spanish and other languages. Although its website and trading platform are in Spanish, customer service through the various media it offers is in English.

We have found several opinions that reflect the general good opinion that Pepperstone customers have on Trustpilot.com.

For the rest, the means of contact are several and appropriate:

- It has 24-hour service.

- Assistance during the weekends.

- Possibility to contact by email.

- Several phones for international clients.

- Online chat on its website.

As you can see, Pepperstone’s customer service is very complete. It is a real pity that we can not say that the service is 100% adequate because it is not available in Spanish and other languages. We assume that they will be able to incorporate this option as their clients increase in other geographical regions.

Opinions on the reliability of Pepperstone

Pepperstone Group Ltd., with headquarters in Australia, is a company that acts as a business center. It also has offices in London, Shanghai, Dallas, and Bangkok.

Pepperstone Group Ltd is a company authorized and regulated by the Australian Securities and Investments Commission (ASIC) under the number ACN 147 055 703 and holds the Australian Financial Services License (AFSL).

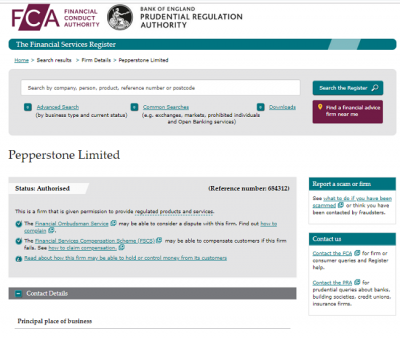

Here in Europe, it operates through the company Pepperstone Limited based in London. Pepperstone Limited is regulated by the Financial Conduct Authority (FCA) of London, under license number 684312. The FCA is one of the most rigorous financial supervisors at present.

We have checked the records of the FCA and we see that Pepperstone is duly authorized:

We have not found negative opinions in this regard, although some customers may doubt whether Pepperstone could be affected by European regulations as it is an Australian company. Having headquarters in London and operating as a company located in the United Kingdom, we see that this is the case (as long as we choose the company based in London for trading purposes).

In addition, the regulation of the FCA implies another series of advantages in terms of the security of customer funds, the solvency requirements of the company, and others.

In case this is insufficient and the broker becomes bankrupt, it is required to join a guarantee fund (compensation fund). In case of having to suspend the payments for insolvency, this fund indemnifies the client with a maximum of 50,000 pounds sterling.

To finish, we just need to be sure that the broker does not use the funds improperly. This is also true because the regulatory body imposes that customer funds must be segregated and guarded by a bank outside the broker. The segregation of funds prevents the broker from using them for purposes other than compliance with trading orders. Pepperstone can not even use these funds to cover a transitory need for liquidity. The money is in a bank account, with an entity that works, but does not belong to Pepperstone. These client funds can not be seized or affected by the company’s financial situation.

To reinforce its security, the broker Pepperstone has contracted insurance with the firm Lloyds. This insurance is also designed to compensate customers in case some type of problem can happen.

The opinions we have found on the security offered by this broker have been favorable.

Finally, we are going to analyze a key aspect such as deposits and withdrawals of funds:

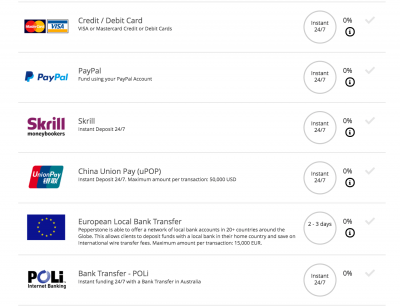

The mechanism to make deposits is simple, just click on a button, and the process starts (section “Finance account“). Regarding the deposit options, Pepperstone has a wide variety to choose from:

- Credit or debit card

- Wire transfer

- BPay (Fast transfers between Australian banks)

- Neteller

- Skrill

- Instant bank transfers POLi

- China Union Pay

- Quiwi Wallet

- B2B (transfers between brokers)

- Fasapay

Bank transfers are the slowest payment channels (between 12 hours and 3 working days) while electronic payment options are the fastest. According to our assessment, it is a more than adequate amount of options and with reasonable deadlines. Some payment options may apply some commission, but this is something that is out of the control of Pepperstone.

Regarding funds withdrawals, normally, the payment option chosen for the deposit is the means used by default for withdrawals. Many intermediaries offer different means, but for security purposes, one is usually used, which logically is chosen by the client, for cash movements in both directions (deposit and withdraw).

We contrast this information with what the Pepperstone website displays:

We have not found negative opinions on the process of deposits and withdrawals with Pepperstone except for some old ones that complained about the lack of flexibility in allowing withdrawals only by bank transfer. Nowadays the broker seems to have overcome this inconvenience because it has added several alternative payment options so that the client can use the one that best suits him.

Conclusion

After reviewing what is exposed in this article, we can conclude that our opinion about the Pepperstone broker coincides mostly with the opinions of other users we have found:

- Pepperstone is a regulated and reliable broker.

- This broker offers a good level of service and the trading platforms it provides are very well valued.

- It is also a good broker for experienced traders thanks to its ECN/STP execution model without conflicts of interest and in which any trading strategy is welcome.

- It has many trading instruments available to invest in. It is specially indicated to operate in the Forex currency market. But at the moment it does not offer CFD on shares.

- The company must improve by offering customer services in other languages.

As you can see, Pepperstone has aspects in which it stands out positively and others in which it can improve. If you want to try this online broker for yourself you can open a real account with a minimum deposit of only $200 or open a demo account with a $50,000 virtual balance to practice and test the trading conditions of this broker.

And if you already have experience working with this broker you can send us your own opinions about Pepperstone using the comments form at the end of this page.

| Broker Type: ECN/STP Forex & CFD Broker Regulation: ASIC & FCA | Free demo account with $50000 balance |