| Pepperstone

| – ECN/STP broker from Australia specialized in Forex and CFD -Regulated by organizations such as ASIC and FCA -Tight spreads and low commissions |

Pepperstone – Forex Broker Review

Pepperstone is a regulated ECN/STP Forex and CFD broker from Australia which is licensed by the ASIC. This company allows to trade with Forex (dozens of currency pairs), precious metals in the spot market, and CFD on different markets, including stocks and indices. As a pure ECN/STP broker, it has many liquidity providers, such as major global banks. The clients of Pepperstone can trade with variable and low spreads, excellent market quotes, and market depth access (Level II quotes).

It is a broker regulated by the FCA of the United Kingdom and by the Australian ASIC.

The company was founded in 2010 in Melbourne (Australia) and currently has branches in four countries such as the United States, Thailand, the United Kingdom and China, thus being able to provide service coverage to the five continents.

In this Pepperstone review, we will cover your main services and advantages for your clients.

Type of broker

Regulation

This broker is regulated and licensed by the ASIC (Australian Securities and Investment Commission) from which it has received the license AFSL # 414530 (Australian Financial Services License).

Country of origin

The headquarters of Pepperstone is located in Sidney, Australia.

Trading Instruments

- Forex Market: 52 currency pairs in the Forex spot market, including the most important such as the EUR/USD, GBP/USD and the USD/JPY and other more exotic like the USD/ZAR and USD/SGD.

- Commodities: Gold and silver in the spot market, two of the most important and traded commodities in financial markets.

- Contracts for Difference: Pepperstone offers CFD with DMA execution * based on the following instruments:

- 13 of the main stock indices such as the Dow Jones, Nikkei 225, DAX 30 and others

- Crude oil and natural gas

- The most important cryptocurrencies – Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Dash (DASH) and Litecoin (LTC).

* Direct Market Access – CFD transactions in Pepperstone are executed through a DMA/STP model with ultra-low latency, without re-quotes, without broker intervention and without manipulation of price and execution. All traders CFD orders are directed directly and systematically to the main liquidity providers of the company for stocks, derivatives and commodities through an STP system (Straight Through Processessing) for its execution.

Trading Accounts

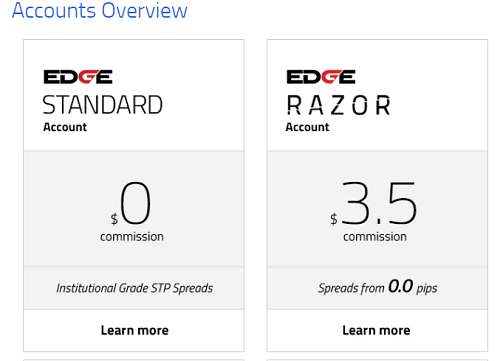

- Edge Standard Account: This is a type of trading account that offers STP execution with institutional grade spreads and is designed for regular Forex traders. It requires a minimum deposit of $200 and it is based on EDGE technology which allows to trade with fast and efficient executions and with extremely low and variable spreads. This type of account offers the possibility to trade with 52 currency pairs with a maximum leverage of 1:400 and a minimum transaction size of 0.01 lots. Through this account, the investors can use any trading style that they want and open new positions in the market with a single click. Pepperstone does not charge fees for customer operations.

- Edge Razor account: It is a trading account type with pure ECN execution that offers access to the best market prices and is designed for advanced traders and investors who operate with Expert Advisors. The Edge Razor requires a minimum deposit of $200 and it is based on EDGE technology which allows trading with fast and efficient executions and with extremely low and variable spreads This type of account offers the ability to trade with 52 currency pairs with a maximum leverage of 1:400 and a minimum transaction size of 0.01 lots. Through this account, the investors can use any trading style that they want and open new positions in the market with a single click. Pepperstone charges a fee of $3.5 for each lot traded in the market.

- Joint Account: These are trading accounts that are designed to be opened on behalf of two people.

- Company Account: A type of trading account that can be opened on behalf of a company or business.

- Superannuation or Trust Accounts: This account is specifically designed to be opened and managed by trusts or pension funds.

Demo Account

Trading Platforms

- Metatrader 4: It is the most widely used trading platform in the industry for its ease of use, stability, and its many benefits to the trader. It is a downloadable application that has many trading features such as updated market prices in real-time, various order types, advanced price charts with multiple time frames (from 1 minute to 1 month), market analysis tools, 85 built-in technical analysis indicators, and more. This platform enables the creation, evaluation, and implementation of automated trading systems, known as Expert Advisors, which are based on all kinds of trading strategies.

- Metatrader 4 MAM / PAMM: A platform based on Metatrader 4 which is designed for account managers who manage multiple trading accounts in Metatrader. Through this application, the trader can manage all accounts from one terminal. It is ideal for managing multiple accounts that use Expert Advisors.

- Pepperstone Webtrader: It is a web-based platform (no download or installation is required) that allows trading in the market from anywhere with an Internet connection. This application provides direct access to the Metatrader 4 account and is fully compatible with this platform. Webtrader has full functionality and is integrated with Pepperstone EDGE technology. It also has various trading functions such as market updated quotes, various order types, positions management tools, advanced price charts, built-in technical indicators and updated market news. Through this platform, the trader can view the trends of the transactions made by customers of Pepperstone on each instrument provided by this company, which means that it indicates what is the percentage of buying or selling positions in a currency pair like the EUR/USD for example.

- Applications for mobile devices: This broker offers several platforms designed to access the trading account and trade in the market from mobile devices like the iPhone, and Android technology-based smartphones, and tablets.

Payment Options

Main Advantages of Pepperstone

The main advantages of this broker that we have found in this Pepperstone review are:

- Pepperstone is a properly regulated broker of Australia (is regulated by ASIC of Australia and FCA or UK).

- It is an ECN/STP broker means that it provides direct market access to its customers. In this way the investor can trade with fast executions and interbank spreads thanks to the large number of liquidity providers of this broker.

- Daily Market Analysis made by experts.

- The customers of this broker can use automated trading systems (Expert Advisors) through Metatrader 4 platform.

- This broker offers several applications that allow access to the account and trade in the market from mobile devices such as smartphones.

- This broker accepts all types of customer strategies, including scalping (fast transactions in the market that can take a few seconds) and hedging.

- Pepperstone clients can trade with extremely low and variable spreads (depending on market conditions) from 0.1 pips for major currency pairs.

- Pepperstone offers good customer service.

- It has several applications that allow the clients to trade in the market for mobile devices such as smartphones.

- A personal account manager for major clients that trade with large volumes through this broker.

- This broker provides free education about the Forex market through the website.

- VPS Hosting (Virtual Private Servers) for Expert Advisors (Metatrader 4).

- Through Pepperstone FIX Api the customers of this company can have direct market access through the FIX protocol (Financial Information Execution).

- Pepperstone offers the possibility to earn money by promoting its services as a broker through an affiliate program of its property.

Pepperstone Main Promotions

- For the moment this broker is no offering any promotion.

Other categories of this broker

- Gold Broker.

- Silver Broker.

- CFD Broker.

- Metatrader 4 Broker.

- Metatrader 5 Broker.

- Cryptocurrency Broker

Conclusion of the Pepperstone review

After reviewing what is exposed in this article, we can conclude that our opinion about the Pepperstone broker coincides mostly with the opinions of other users we have found:

- Pepperstone is a regulated and reliable broker.

- It offers a good level of service and the trading platforms it provides are very well valued.

- It is also a good broker for experienced traders thanks to its ECN/STP execution model without conflicts of interest in which any trading strategy is welcome, including scalping and hedging.

- It has enough trading instruments available to invest in. It is specially indicated to operate in the Forex currency market. The possibility of trading with shares is missing.

Company | Pepperstone Group Limited (Australia) and Pepperstone Limite (the UK and Europe) |

|---|---|

Minimum account size | The minimum deposit is $200 |

Minimum lot size | 0.01 lots |

Maximum leverage | 1:400 |

Spreads | It offers variable spreads from 0.1 pips for major currency pairs like the EUR/USD and the GBP/USD. |

Link to website |

“CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.“