General Definition

The Producer Price Index-PPI indicator is a weighted index of average prices in the wholesale market, or in the manufacturing sector. This is a monthly figure, which always refers to the previous month in which the “Bureau of Labor Statistics” issued the report. This information is published between the second and third week.

The PPI shows trends in the wholesale markets, manufacturing industries and commodity markets. This indicator includes all physical goods produced by manufacturing industries in the country, so imports are excluded.

The release of the PPI contains three figures: the index of raw products, the semi-finished goods index and the index of finished products. To get the core of the IPP the following formula is used:

Index of finished goods – food and energy components (these components are removed due to their volatility)

The PPI tries to obtain only the prices paid during the month in which the survey was conducted. Many companies that regularly do business with major customers have agreed prices for long-term contract, which are known at present, but not paid until a future date. The PPI excludes future values or contract rates.

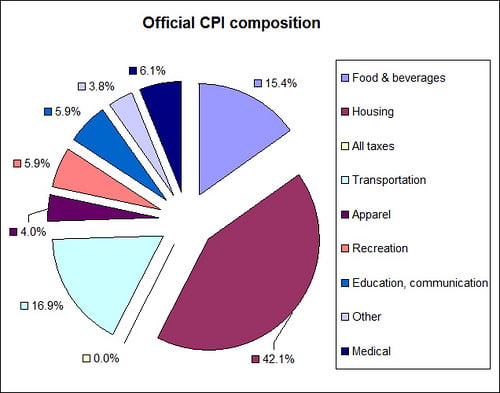

Like the CPI, the PPI uses a base year in which is measured a basket of goods, and every year thereafter compared with the base year, which has a value of 100. For the PPI, this base year is 1982. Changes in the PPI should be presented only on a percentage basis, because the nominal changes can be misleading because the base number is not longer 100.

Relevance of the index

The greatest attribute of the PPI for investors is their ability to predict the CPI. The explanation is that most cost increases being experienced by retailers will be passed on to customers, that the CPI can validate later. Because the CPI is considered the indicator of inflation, the investors try to get a previous look of this indicator by analyzing the numbers of the PPI.

Effects of the indicator in the market

The elimination of food prices and energy to calculate this indicator does not relieve investors to determine for themselves what are the rates of long-term growth of these two key elements. Everyone buys food and energy, so if these expenses are growing faster than the core PPI (or CPI) over time, consumers and ultimately GDP will notice its effects. For investors that are involved in these industries there is a clear interest in increasing prices of these two elements as these increases will translate into higher revenues from these companies.

Furthermore, the PPI is useful for investors in the covered industries who have the aim of analyzing the potential sales and revenue trends. The PPI has a great ability to predict inflation, and therefore can be a major market driver.

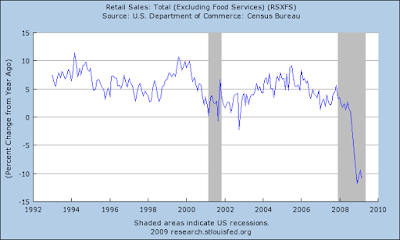

When the PPI index is rising, investors may fear an uncontrolled inflation that causes an increase in interest rates in the country, so the stock markets could consider this possible scenario with declines in stock prices. Increases in interest rates ends up affecting the consumer demand by reducing consumption when the price of consumer financing increases . Rising interest rates also impact on the increased cost of companies financiation, reducing their profits.

When the CPI is growing and it denotes an inflation scenario, the predictable result is a depreciation of bond prices in the market and an increase in the profitability of the new bonds issued, because the interest rates will rise as inflation is manifested more strongly.

In the Forex market, when PPI data show an increase in prices, the markets can anticipate an increase in interest rates to control inflation, due to economic overheating, which could translate into a revaluation of the currency. The finding of a strong economy and rising interest rates are likely to attract investors to buy the domestic currency to benefit from from the probable increase in its value. In this scenario, the currency of a country can raise its value against the other. For example, if the PPI of United States shows an increase compared with the previous data, it is quite likely that the market will react with an increase in the price of the U.S. dollar against other currencies like the euro because investors are buying more dollars.