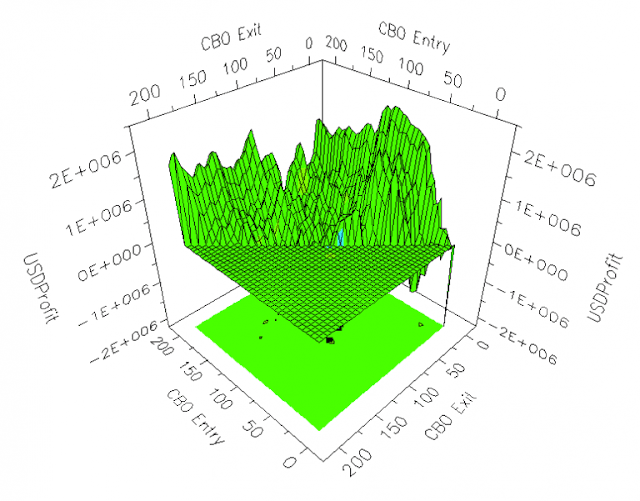

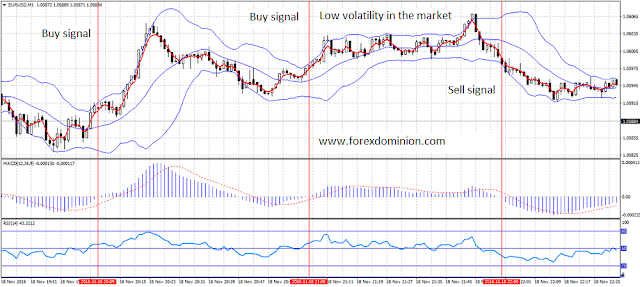

Tell me one thing: how do you validate your trading system? How can you be sure that by following these entry and exit signals from the market you will have profitable results? Just because you have executed a backtest and it has given you good results?

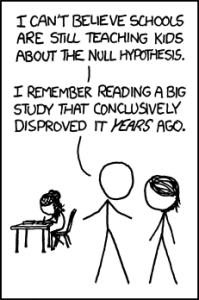

In today’s article I propose to rethink your way of working and begin to apply the scientific method as a procedure of development and validation of trading systems.