In this article we’re going to explain to you what NFTs (Non Fungible Tokens) are and how they work, so you can understand one of the technological innovations aimed at art emerging from the blockchain, the same protocol behind cryptocurrencies.

Therefore, we’re going to try to steer away from technical jargon to make the explanation as simple as possible. We’ll first tell you what non-fungible assets are, as it’s a vital concept to understand NFTs. Then, we’ll move on to tell you what NFTs are, and we’ll also briefly delve into how they function.

First, what are non-fungible assets?

To begin grasping the concept of NFTs, we must first know and understand that in our legal system, there are fungible and non-fungible assets. Fungible assets are those that can be exchanged, having a value based on their number, measurement, or weight. And non-fungible assets are those that are not replaceable.

An example of fungible assets is money. If you have a 20 euro bill, it is a fungible asset because you can easily exchange it for another 20 euro bill without losing value, and they are exactly the same. Additionally, this bill is consumed when you use it.

On the other hand, an example of a non-fungible asset would be a piece of artwork. If you have a painting at home, it is not consumed when used, and it cannot be replaced by another painting. One piece of artwork is not equivalent to another, and therefore, they cannot simply be exchanged like a 20 euro bill.

What are NFTs?

The acronym NFT stands for Non-Fungible Token, a non-fungible token. Tokens are units of value assigned to a business model, such as cryptocurrencies. NFTs have a close relationship with cryptocurrencies, at least technologically, although they are opposites, as Bitcoin is a fungible asset, and an NFT is a non-fungible asset, but essentially, they are like the two sides of a technological coin. To understand it well, we can think of cryptocurrencies as a store of value, something similar to gold. You can buy and sell gold, and when the number of buyers increases, the price goes up, and it decreases when this number decreases. It behaves just like cryptocurrencies.

But gold is gold in the end, and you can exchange one nugget for another without any problem. However, there are other goods made of gold that also have value, but they are unique, and that fact makes the difference and gives them another type of value. Just like the value of something made with gold or a piece of artwork, NFTs are unique assets that cannot be modified or exchanged for another with the same value, as there are no two NFTs that are equivalent just as there are no two paintings that are.

Therefore, you can think of an NFT like a great work of art, such as Da Vinci’s Mona Lisa. There is only one, and it’s in a specific art gallery. If you want it, you can only buy the original if it were for sale. You could also get a copy, but it would have a different value since it wouldn’t be the original. That’s exactly what an NFT does, but in a digital form.

To understand it better, an NFT would be like a unique work of art, for example, Michelangelo’s David, there is only one, and it’s in the Gallery of the Academy of Florence; if someone wanted to have that specific David, they would need to buy it (if it were for sale) or get a copy, in which case, we wouldn’t be talking about the original anymore, which is what gives value to the sculpture.

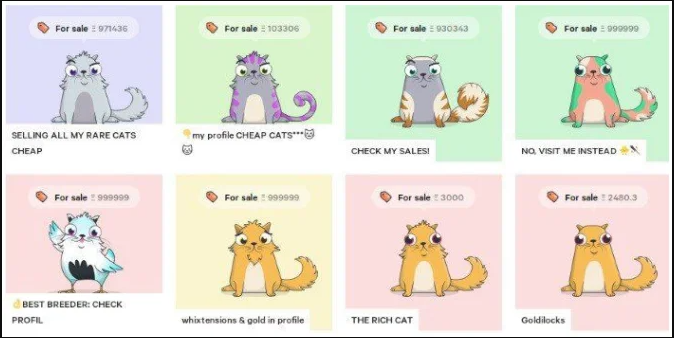

That’s why NFTs are often attached to some digital artworks or illustrations. Their price is really what people are willing to give them, and now that they are at a peak of popularity, we might find people paying 260,000 euros for a drawing of a rock attached to an NFT.

How do NFTs work?

NFTs operate through blockchain technology. It’s the same technology as cryptocurrencies, which function through a decentralized network of computers, with linked and secured blocks or nodes using cryptography. Each block links to a previous block, along with a timestamp and transaction data, and by design, they are resistant to data modification.

NFTs are assigned a kind of digital certificate of authenticity, a set of metadata that cannot be modified. These metadata ensure their authenticity, record the starting value, all acquisitions or transactions made, and also their author.

This means that if you purchase a digital content tokenized with an NFT, there will always be a record of its initial value and how much you bought it for. It’s like when you buy a painting and there’s a record of its movements.

Generally, most tokens or NFTs are based on the standards of the Ethereum network and its blockchain. Thanks to using a well-known and popular technology, it’s straightforward to operate with them to buy and sell using certain wallets that also work with Ethereum. However, we are talking about unique works, so there isn’t an active trading market like with digital coins.

Why do people buy NFTs?

If NFTs cannot be bought and sold as easily as Bitcoins, then why do people purchase them and spend so much money on them? Well, it’s simple, because they believe their value will increase over time, and then they can sell them for more money. Nobody spends 260,000 euros on a drawing of a rock because they like rock drawings since they can have them for free, but rather for the value this specific drawing has as an NFT.

The idea, therefore, is that if I buy an NFT for 100,000 euros, in the future, I may be able to resell it for more money. It’s a unique asset, which theoretically should give it a higher value since there is no other one like it.

However, the reality has ended up being a bit different, and over time, this has been a bubble that has deflated. NFTs have been used for scams against clients and artists, and right now, they are not as “trendy” as before. However, it’s still a technology that remains present and in use.